Crypto Compliance: What It Means and Why It Matters for Every Trader

When you trade or hold crypto, you're already part of a system governed by crypto compliance, the set of legal and operational rules that crypto businesses and users must follow to prevent fraud, money laundering, and sanctions violations. Also known as crypto regulation, it's not optional—it's the backbone of any platform you use, whether you realize it or not.

It’s not just about KYC forms or identity checks. AML compliance, anti-money laundering rules that require crypto firms to track transactions and report suspicious activity is now enforced globally. In the EU, MiCA licensing, the comprehensive framework that requires crypto exchanges to meet capital, security, and transparency standards to operate legally forces platforms to prove they’re not just tech startups but serious financial entities. Meanwhile, OFAC sanctions, U.S. government restrictions that block transactions involving certain countries, individuals, or wallets mean even a simple swap could get your account frozen if you’re unknowingly interacting with a blacklisted address.

These rules aren’t just for exchanges—they ripple down to you. If you’re using a platform in Thailand, you’re dealing with a $2.1 million licensing requirement for operators. If you’re in Indonesia, crypto is now treated as a financial asset, not a commodity. If you’re in Iran, you’re pushed toward risky P2P trades because major exchanges are legally blocked. Even meme coins like DOGE or Shinobi can carry compliance risks because their volatility attracts money launderers, which draws regulator attention to the whole space.

And it’s not just about avoiding fines. Non-compliance can mean losing access to your funds forever. Platforms that ignore these rules—like fake exchanges such as Unielon or Spin—are shut down overnight, and users get nothing back. Real platforms, like Orion Protocol or Elk Finance, may still be risky, but at least they’re trying to follow the rules. That’s the difference between a gamble and a legal operation.

What you’ll find below isn’t just a list of articles. It’s a map of the real world where crypto meets law. You’ll see how North Korea’s crypto theft triggers global blockchain forensics, how Cambodia’s banking ban crushes P2P traders, and why a simple airdrop like ART Campaign might be a trap designed to bypass AML checks. You’ll learn what happens when a country shifts crypto from commodities to financial assets—and why that change affects your taxes, your wallet, and your next trade.

Syria Crypto Ban Complications from US Sanctions in 2025

by Johnathan DeCovic Dec 8 2025 21 CryptocurrencyDespite U.S. sanctions relief in 2025, Syria's crypto scene remains locked down by residual designations, banking restrictions, and zero local regulations. Users face frozen accounts, $500 limits, and risky workarounds.

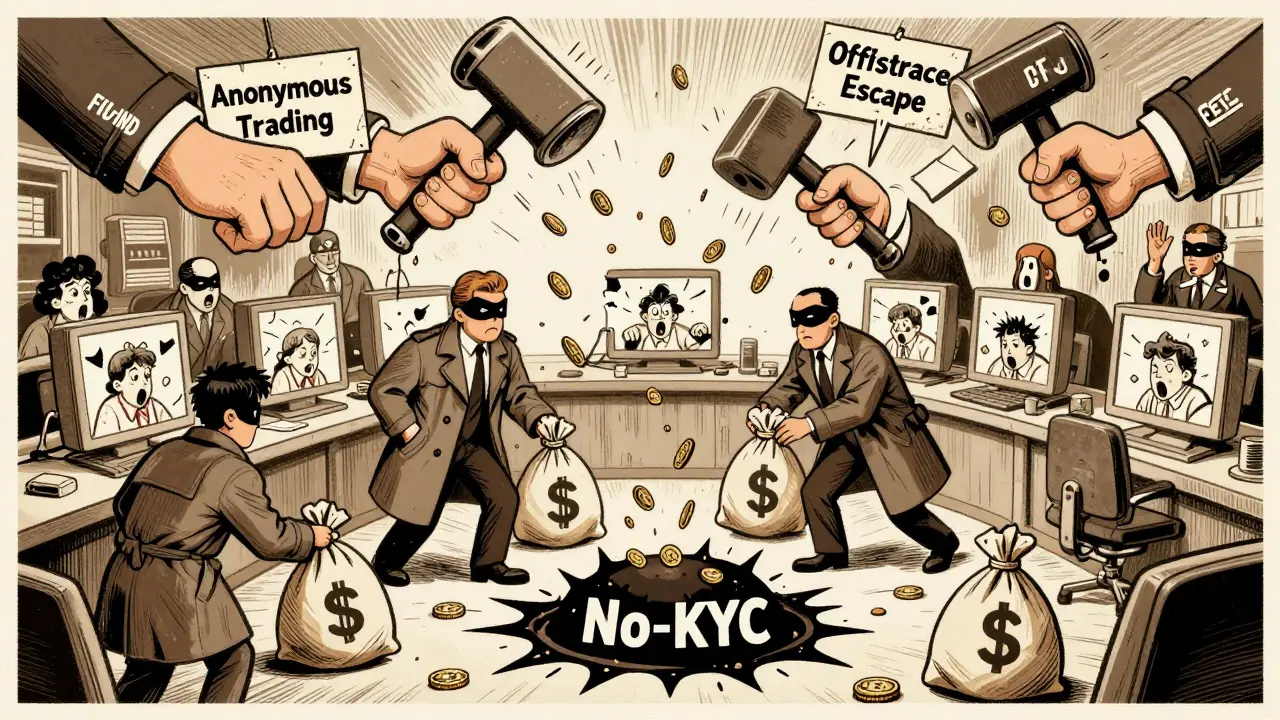

READ MORENo-KYC Crypto Exchange Shutdowns by Authorities: What Happened and Why It Matters

by Johnathan DeCovic Dec 6 2025 25 CryptocurrencyNo-KYC crypto exchanges faced global shutdowns in 2024-2025 as regulators cracked down on money laundering and sanctions evasion. Platforms like KuCoin and BitMex were forced to relocate or face criminal charges. Compliance is now mandatory for survival.

READ MOREEU Crypto Travel Rule Compliance: What Zero Threshold Means for Your Transactions

by Johnathan DeCovic Dec 4 2025 23 CryptocurrencyThe EU's zero-threshold Travel Rule now requires full identity data for every crypto transaction, no matter how small. Here's how it works, who it affects, and what you need to know as a user or business.

READ MORE