No-KYC Risk Calculator

Risk Assessment

This calculator estimates your risk level when using a no-KYC exchange based on key factors mentioned in the article.

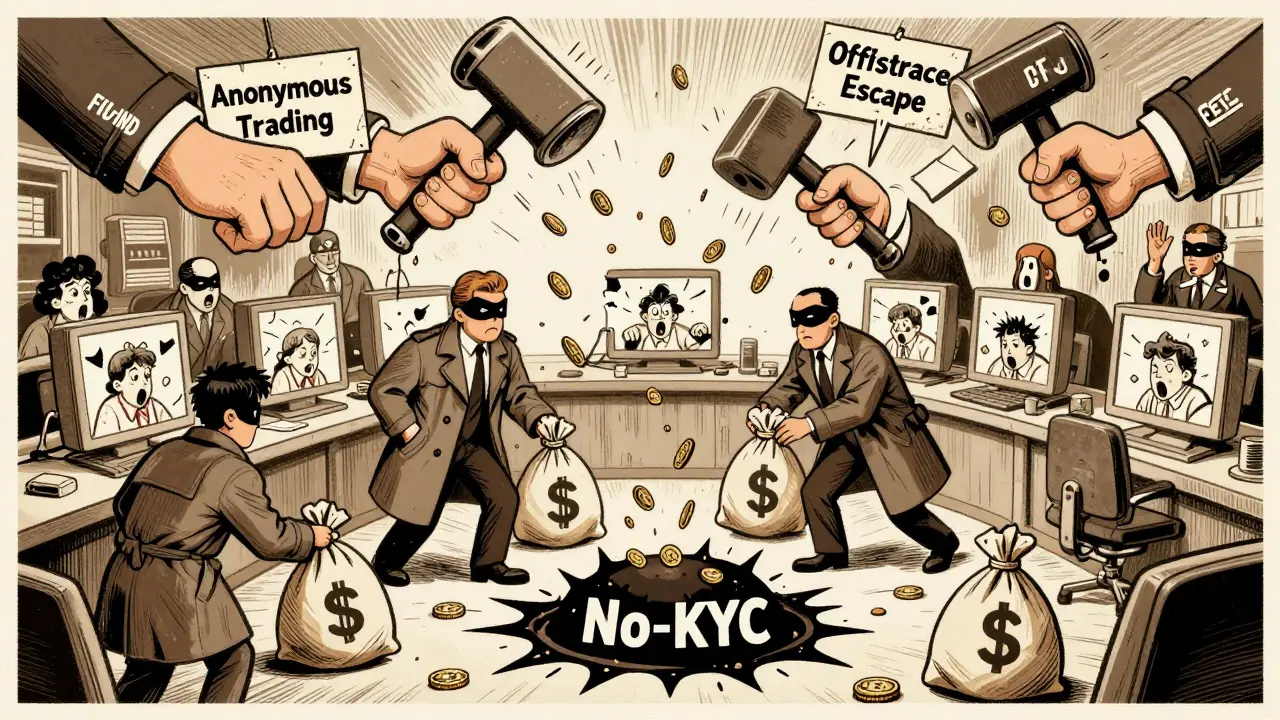

By 2025, if you were still using a no-KYC crypto exchange, you were taking a serious risk. Authorities didn’t just warn these platforms-they shut them down. Hard. From India to the U.S. to the Seychelles, governments stopped turning a blind eye. No more fines. No more warnings. Just takedowns, criminal charges, and frozen bank accounts.

Why No-KYC Exchanges Became Targets

No-KYC means no identity checks. No government ID. No proof of address. Just deposit crypto and trade. Sounds simple, right? That’s exactly why regulators saw it as a danger zone. Money launderers loved these platforms. So did sanctions evaders, scam artists, and ransomware operators. A 2025 CipherTrace report showed that platforms without KYC were 3.2 times more likely to be used in criminal activity. The numbers didn’t lie. In 2021 and 2022, fraudsters pulled over $1 billion from crypto users-mostly through unverified exchanges. By 2024, regulators had had enough. The turning point? When major platforms started handling billions in transactions while ignoring basic rules. The U.S. Department of Justice found that KuCoin received over $5 billion in suspicious funds. BitMex and Huione were still letting Indian users trade without any verification, even though Indian law required it. These weren’t small-time operations. They were global, high-volume platforms. And that made them prime targets.India’s Crackdown: A Turning Point

In early 2025, India’s Financial Intelligence Unit (FIU-IND) sent notices to 25 offshore crypto exchanges. Names like Paxful, Changelly, and BitMex were on the list. The message was clear: if you serve Indian users, you register with us-or get blocked. The enforcement was brutal. Apps were pulled from Indian app stores. Websites were blocked nationwide. No appeals. No grace period. The FIU-IND didn’t care if the exchange was based in the Cayman Islands or Estonia. If Indian users were trading on it, it violated the Prevention of Money Laundering Act. The law doesn’t require a physical office-it requires activity. And activity meant compliance. Thousands of Indian traders woke up one morning to find their favorite exchange gone. No warning. No refund. Just a dead link. That’s when it hit home: no-KYC wasn’t a feature. It was a liability.KuCoin and BTSE: The Big Relocations

KuCoin used to be one of the largest no-KYC exchanges. By 2024, it was processing over $2 billion in daily volume. But in March 2024, the U.S. Department of Justice filed criminal charges against KuCoin and its founders. The charge? Operating an unlicensed money transmission business. The CFTC added a civil suit. The New York Attorney General slapped on a $22 million fine. By September 2025, the Seychelles government passed new rules requiring all crypto platforms to get licensed. KuCoin didn’t apply. So they were shut down there. They didn’t fix their compliance-they moved. First to Turks and Caicos. Then to Costa Rica. BTSE did the same. But relocation isn’t a solution. It’s a delay. Banks in those new locations won’t touch them. Payment processors refuse to work with them. Advertisers won’t spend money on them. Affiliates dropped them. KuCoin’s user growth flatlined. Revenue dropped 40% in six months.

Compliance Isn’t Optional Anymore

The market shifted fast. By 2025, 92% of centralized crypto exchanges had full KYC in place. That’s up from 85% in 2024. The reason? Institutional investors won’t touch anything else. 67% of funds now say KYC is non-negotiable. Retail users noticed too. In the U.S., 58% of crypto users said they prefer exchanges that verify identities. Not because they like paperwork-because they trust them more. The tech improved too. KYC verification used to take 7 minutes in 2023. By 2025, top platforms like Coinbase and Kraken reduced it to 3.5 minutes. AI checks your ID, cross-references it with government databases, and confirms your face in real time. It’s faster than signing up for a streaming service. Even Binance, which paid over $4 billion in penalties, now runs one of the most advanced compliance systems in the industry. Coinbase got hit with a $100 million fine in 2023-but they fixed it. They hired former FBI agents. They built real-time transaction monitoring. They became the model for what compliance looks like.The Cost of Ignoring Rules

The real penalty isn’t the fine. It’s what happens after. Banks cut off access. Card networks like Visa and Mastercard stop processing crypto payments. Stablecoin issuers like Circle and Tether refuse to work with unverified platforms. Payment gateways like Stripe and Adyen won’t integrate with them. Even advertising platforms like Google and Meta ban ads from no-KYC exchanges. Without banking access, you can’t pay your developers. You can’t pay your cloud bills. You can’t pay your lawyers. You can’t pay your rent. And then there’s the human cost. Users lose funds. Support teams get flooded with angry messages. Scammers use these platforms to run phishing scams-then disappear. Legitimate users are left holding the bag.

Doreen Ochodo

December 8, 2025 AT 04:03Just moved my funds off KuCoin last week. Best decision ever. No more sleepless nights worrying about a shutdown.

Adam Bosworth

December 9, 2025 AT 09:34lol imagine being so naive you thought crypto was ever gonna be free. you people are the reason we need regulation.

Tisha Berg

December 9, 2025 AT 10:49I get why people liked no-KYC. It felt like freedom. But now? It’s like driving without a seatbelt. You think you’re cool until the crash.

Nicole Parker

December 10, 2025 AT 23:36It’s weird how we romanticized anonymity in crypto, like it was some kind of digital rebellion. But the truth is, most people using no-KYC weren’t libertarians-they were just trying to avoid taxes or launder cash. And now the innocent users are the ones getting burned. Feels like the whole movement got hijacked by bad actors, and we all paid the price.

Kenneth Ljungström

December 12, 2025 AT 01:26Yup. KYC took 7 minutes in 2023 and now it’s 3.5? That’s faster than ordering coffee. 😎 I used to hate it, now I’m like ‘just verify me already’.

Chloe Hayslett

December 13, 2025 AT 01:53Oh wow, so now we’re supposed to be grateful regulators ruined crypto? Next they’ll be forcing us to wear ID bracelets when we trade.

Uzoma Jenfrancis

December 13, 2025 AT 09:17India’s move was right. We lost billions to fake exchanges. No more excuses. If you trade here, you follow our rules. Simple.

Renelle Wilson

December 14, 2025 AT 10:41The institutional shift is undeniable. Over two-thirds of funds now require KYC-not because they distrust decentralization, but because fiduciary duty demands accountability. This isn’t censorship; it’s the maturation of a financial ecosystem.

Elizabeth Miranda

December 14, 2025 AT 17:47I used to think KYC was surveillance. Now I see it as a filter. It doesn’t track your trades-it stops criminals from using your wallet as a front. That’s not invasive. That’s responsible.

Jerry Perisho

December 15, 2025 AT 08:12Biggest mistake people made was thinking no-KYC meant no risk. It just meant the risk was hidden. Now it’s visible. And the cost is way higher.

Manish Yadav

December 17, 2025 AT 01:46My uncle lost 20 lakhs on a no-KYC site. He cried for days. India did the right thing. No more scams.

ronald dayrit

December 18, 2025 AT 03:43There’s a philosophical tension here between autonomy and safety. We built crypto as a tool to escape centralized control, but then we used it to enable centralized crime. The irony is thick enough to spread on toast. The system didn’t fail-it evolved. And evolution demands adaptation, not nostalgia.

Yzak victor

December 18, 2025 AT 11:49Been using Kraken since the crackdown. Took me 4 minutes to verify. Now I sleep like a baby. No drama. Just crypto.

Holly Cute

December 20, 2025 AT 06:33Oh please. ‘Compliance is the future’? That’s just corporate propaganda dressed up as wisdom. They’re not protecting us-they’re controlling us. And don’t even get me started on how Coinbase and Binance are now the new banks with better PR.

Josh Rivera

December 20, 2025 AT 18:55Of course KuCoin moved to Costa Rica. Because nothing says ‘legit’ like a company that relocates every time a country says ‘show your ID.’ Pathetic.

Neal Schechter

December 21, 2025 AT 17:19People forget: banks won’t touch unverified exchanges. That’s not regulation-that’s market reality. No bank, no business. Simple as that.

Madison Agado

December 22, 2025 AT 03:19It’s not about privacy. It’s about whether you want to be part of a system that lets criminals operate openly. If you’re not doing anything wrong, why fear verification?

Chris Mitchell

December 23, 2025 AT 01:54KYC isn’t the enemy. The enemy is pretending you can run a global financial platform without accountability.

nicholas forbes

December 23, 2025 AT 03:28They shut down KuCoin? Good. Now maybe people will stop acting like crypto is some anarchist playground.

Regina Jestrow

December 23, 2025 AT 03:31I’m terrified. What if my favorite exchange gets taken down tomorrow? I don’t even know where my coins are anymore…

Scott Sơn

December 23, 2025 AT 09:56They didn’t just shut down exchanges-they buried the wild west with a bulldozer and poured concrete over it. And honestly? I kinda respect it.

Frank Cronin

December 23, 2025 AT 15:05Oh wow, so now we’re supposed to applaud the corporate state for forcing us into compliance? How quaint. You’re not safe-you’re just obedient.

Annette LeRoux

December 24, 2025 AT 04:39It’s funny how we used to call KYC ‘Big Brother.’ Now we’re begging for it because the chaos was worse. We didn’t lose freedom-we just realized we didn’t want to live in a lawless dumpster fire. 🤷♀️

Jonathan Sundqvist

December 24, 2025 AT 11:24Just deleted my apps. Too many fake sites. If it’s not on Coinbase or Kraken, I don’t touch it. No more drama.

Jerry Perisho

December 25, 2025 AT 22:15Replying to myself: Also, the AI verification is actually kind of cool. It flagged my expired license and told me to upload a new one. Didn’t even need to call support.