CoinDCX vs WazirX Compliance Checker

Compare key regulatory and security aspects of India's top crypto exchanges to make informed trading decisions.

CoinDCX

- FIU-IND Registration Active since 2022

- FATF Travel Rule Full Automation

- Cybersecurity Audit Passed (Pi42)

- Recent Security Incident API Key Leak (2025)

- Regulatory Fine ₹8 Crore

- Compliance Partner Pi42 + Mudrex

- User Trust Score 78%

WazirX

- FIU-IND Registration Active since 2021

- FATF Travel Rule Manual Review (>₹1 Lac)

- Cybersecurity Audit Pending

- Recent Security Incident $230M Hack (2024)

- Regulatory Fine ₹15 Crore

- Compliance Partner Mudrex (AML) - Audit Pending

- User Trust Score 62%

Compliance Checklist

Essential requirements for Indian crypto exchanges under current regulations:

- Register with FIU-IND and obtain a VASP licence

- Implement KYC/AML systems capturing full sender-receiver data (FATF Travel Rule)

- Submit daily suspicious-transaction reports to FIU-IND

- Undergo a CERT-In-approved cybersecurity audit within 90 days of registration and annually

- Maintain an incident-response team that can lock down wallets within 24 hours of a breach

- Publish a compliance white-paper outlining security protocols, audit findings, and remediation steps

User Safety Tips

- Verify the exchange's FIU-IND registration number on the official portal

- Check the latest audit certificate displayed on the "Compliance" page

- Prefer exchanges integrating the FATF Travel Rule API (manual processes add delays)

- Keep a small portion of assets on an off-exchange wallet (hardware or Liminal-backed custodial service)

- Stay updated on FIU-IND notices with Google alerts for "FIU-IND crypto notice"

Indian traders trying to decide between CoinDCX is a domestic cryptocurrency exchange that became India’s first digital‑asset unicorn and WazirX is a one of the country’s earliest crypto platforms, known for its large user base need to untangle a web of rules that have tightened dramatically since 2023. Below we break down the current Indian crypto regulations, show how the two biggest exchanges have fared, and give you a roadmap for staying compliant.

Key Takeaways

- All crypto exchanges in India must register with the FIU‑IND, follow FATF’s Travel Rule, and undergo CERT‑In‑approved cybersecurity audits.

- WazirX’s 2024 $230million hack triggered the September2025 audit mandate and a series of fines.

- CoinDCX’s July2025 breach forced a rapid upgrade to its AML and KYC systems, putting it ahead of many smaller VASPs.

- Compliance firms like Pi42 and Mudrex are now essential partners for exchanges seeking audit approval.

- Users are shifting toward FIU‑registered platforms or offshore services that have met the 45‑day notice requirement.

The Regulatory Backbone: FIU‑IND, PMLA, and the VDA Shift

The Financial Intelligence Unit of India (FIU‑IND) is the central registry for all Virtual Digital Asset (VDA) service providers. Under the Prevention of Money Laundering Act (PMLA), the FIU‑IND now treats crypto exchanges like banks: mandatory KYC, continuous suspicious‑transaction reporting, and record‑keeping for at least five years.

In March2023 the government extended banking‑level obligations to VDA providers. The move eliminated the previous “crypto‑lite” regime and forced platforms to adopt the same verification standards used by traditional financial institutions.

Adding pressure, the Financial Action Task Force’s Travel Rule was adopted in India without any transaction‑size threshold. Every crypto transfer must include full sender and receiver details, making compliance one of the strictest globally.

Cybersecurity Audits: The September2025 Mandate

After a wave of high‑profile breaches, the FIU‑IND issued a new directive in September2025. All VASPs must undergo a third‑party security audit conducted by a CERT‑In-approved firm. The audit covers penetration testing, code review, and incident‑response readiness. Failure to secure a clearance within 90 days results in a suspension of trading services.

Compliance firms Pi42 and Mudrex quickly positioned themselves as the go‑to auditors. Their services now include a “pre‑audit checklist” that most exchanges run through before the official CERT‑In assessment.

Security Breaches that Shaped Policy

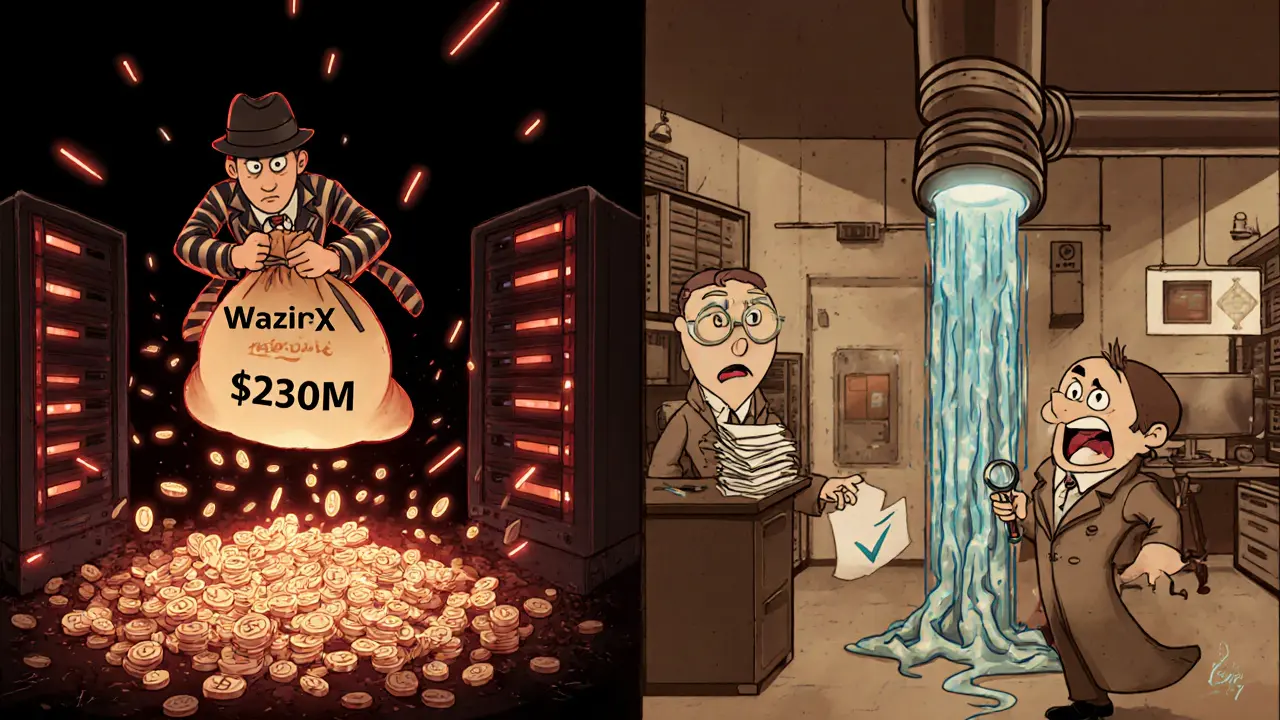

WazirX 2024 hack: In early 2024, a coordinated attack siphoned roughly $230million from user wallets. The breach exposed weak multi‑signature controls and a lack of real‑time monitoring. The fallout prompted the FIU‑IND to accelerate the audit mandate and imposed a ₹15crore fine on WazirX for inadequate safeguards.

CoinDCX July2025 breach: Just a year later, CoinDCX suffered a data leak that revealed internal API keys. Although the direct financial loss was lower than WazirX’s, the incident highlighted systemic gaps in key‑management practices. CoinDCX responded by partnering with Pi42 for a comprehensive audit and upgraded its AML engine to meet the newly refined FIU‑IND reporting guidelines.

Both incidents created a regulator‑industry feedback loop: breaches → tighter rules → forced investments in security.

Compliance Checklist for Indian Exchanges

- Register with FIU‑IND and obtain a VASP licence.

- Implement KYC/AML systems that capture full sender‑receiver data for every transaction (FATF Travel Rule).

- Submit daily suspicious‑transaction reports to FIU‑IND.

- Undergo a CERT‑In‑approved cybersecurity audit within 90days of registration and thereafter every 12months.

- Maintain an incident‑response team that can lock down wallets within 24hours of a breach.

- Publish a compliance white‑paper outlining security protocols, audit findings, and remediation steps.

Failure on any of these points can result in fines ranging from ₹5crore to ₹25crore, a temporary trading ban, or complete revocation of the VASP licence.

How CoinDCX and WazirX Stack Up

| Aspect | CoinDCX | WazirX |

|---|---|---|

| FIU‑IND Registration | Active since 2022 | Active since 2021 |

| FATF Travel Rule Implementation | Full automation (API‑to‑API) | Partial - manual review for > ₹1lac |

| Cybersecurity Audit (Sept2025) | Passed Pi42 audit - clearance granted | Pending - remediation after fine |

| Recent Security Incident | July2025 API key leak (no funds lost) | 2024 $230M hack |

| Regulatory Fine | ₹8crore (audit‑related) | ₹15crore (security breach) |

| Compliance Partner | Pi42 (audit) + Mudrex (AML) | Mudrex (AML) - audit pending |

| User Trust Score (2025 survey) | 78% | 62% |

Overall, CoinDCX has managed to convert its breach into a compliance upgrade, while WazirX is still scrambling to meet the audit deadline.

Impact on Users and the Broader Market

Indian crypto enthusiasts now face a clear choice: trade on a domestic platform that meets the FIU‑IND’s rigorous standards, or use an offshore exchange that may offer lower fees but risks a 45‑day compliance notice. The FIU‑IND recently sent notices to 25 offshore VASPs-including Huione, CEX.IO, and BingX-demanding proof of registration or face a ban.

Social‑media chatter reflects this tension. Traders on Twitter and Reddit frequently compare fee structures (“Binance is 0.1% vs CoinDCX’s 0.2%”) while also warning that unregistered platforms could be seized without warning.

Institutional players are adapting too. Singapore‑based Liminal Custody secured FIU‑IND registration in 2024, offering compliant custodial services for Indian hedge funds. Their model shows how foreign firms can legally operate in the Indian market by partnering with a local entity and obtaining the required licence.

Future Outlook: What’s Next for Indian Crypto Regulation?

Experts predict two major trends:

- More granular audit cycles. The FIU‑IND plans to move from an annual audit to a semi‑annual one for exchanges with daily volumes above $500million.

- Integration with traditional banking. By 2026, the RBI is expected to allow FIU‑registered exchanges to open linked bank accounts, further blurring the line between crypto and fiat services.

For exchanges, this means continued investment in security tooling, deeper data‑analytics for AML, and stronger relationships with audit firms like Pi42 and Mudrex. For users, it translates to higher confidence in domestic platforms but also higher fees and stricter KYC checks.

Practical Steps for Traders

- Verify the exchange’s FIU‑IND registration number on the official portal.

- Check the latest audit certificate-most platforms display a PDF badge on their “Compliance” page.

- Prefer exchanges that have already integrated the FATF Travel Rule API; manual processes add delays.

- Keep a small portion of assets on an off‑exchange wallet (hardware or Liminal‑backed custodial service) to mitigate exchange‑specific risks.

- Stay updated on FIU‑IND notices. A quick Google alert for “FIU‑IND crypto notice” can catch new enforcement actions.

Frequently Asked Questions

Do I need to register with FIU‑IND to trade crypto in India?

Yes. All platforms that facilitate buying, selling, or transferring virtual assets must hold a VASP licence issued by FIU‑IND. Trading on an unregistered exchange can lead to account freezes or loss of funds.

What is the FATF Travel Rule and how does it affect me?

The Travel Rule forces exchanges to share full sender and receiver details for every transaction, regardless of size. For users, this means providing government‑issued ID, PAN, and sometimes a residential address before you can move crypto off‑platform.

Are offshore exchanges like Binance safe for Indian users?

They can be, but they currently lack FIU‑IND registration. The regulator has issued 45‑day compliance notices to many offshore VASPs. If they fail to register, Indian authorities could block access or freeze accounts.

How often must an exchange pass a cybersecurity audit?

The baseline is once every 12months. Exchanges with daily volumes exceeding $500million will soon face a semi‑annual requirement, as announced by FIU‑IND for 2026.

What role do firms like Pi42 and Mudrex play?

They act as certified auditors and AML solution providers. A successful Pi42 audit earns the exchange the mandatory CERT‑In clearance, while Mudrex supplies the transaction monitoring software required for FATF compliance.

Rob Watts

October 5, 2025 AT 08:13Staying informed about the latest compliance rules helps you protect your assets.

CoinDCX’s recent audit shows how a proactive stance can pay off.

Bhagwat Sen

October 12, 2025 AT 06:53I’ve been tracking these exchanges for years and can tell you the ₹15 crore fine on WazirX is a massive wake‑up call for anyone still ignoring Indian crypto regulations.

Cathy Ruff

October 19, 2025 AT 05:33Honestly the whole situation is a circus and the users are the clowns, WazirX’s hack proved they can’t even keep their own servers safe and the regulator’s fine is just a slap on the wrist while they continue to bleed users dry with hidden fees and half‑baked security promises.

Amy Harrison

October 26, 2025 AT 03:13Great breakdown! 🎉 It really clarifies why CoinDCX feels safer right now.

Looking forward to seeing more exchanges step up their game. 🙌

Miranda Co

November 2, 2025 AT 01:53It’s simple – if a platform can’t stop an API leak, you shouldn’t trust it with your money.

Choose the exchange that actually protects you.

Marc Addington

November 9, 2025 AT 00:33Why bother with foreign crypto services when Indian platforms like CoinDCX are finally getting their act together?

Support homegrown solutions and keep our market strong.

Natalie Rawley

November 15, 2025 AT 23:13OMG the drama! WazirX got hacked and now they’re scrambling, while CoinDCX is pushing out audit reports like it’s a season finale cliffhanger – can you even handle the suspense?

Alex Gatti

November 22, 2025 AT 21:53Did you know that the semi‑annual audit rule coming in 2026 will push high‑volume exchanges to double their security investments?

That’s a positive sign for the overall health of the Indian crypto ecosystem.

John Corey Turner

November 29, 2025 AT 20:33The crypto landscape in India feels like a living organism, constantly adapting to regulatory pressures.

Each new rule acts as a mutation, forcing exchanges to evolve or risk extinction.

CoinDCX’s swift response to the API key leak demonstrates how agility can become a competitive advantage.

In contrast, WazirX’s slower remediation shows the dangers of complacency in a fast‑moving market.

The FIU‑IND’s mandate for regular cybersecurity audits will likely raise the baseline for all participants.

As auditors like Pi42 and Mudmud gain prominence, their methodologies will become industry standards.

Traders should view these developments not as hurdles but as safeguards that protect their assets.

The shift toward mandatory FATF Travel Rule compliance reduces anonymity but also curtails illicit activity.

Over the next few years, we can expect a convergence between crypto exchanges and traditional banking services.

This convergence will blur the lines between fiat and digital assets, fostering greater financial inclusion.

However, the increased scrutiny also means higher operational costs that may be passed on to users.

It’s a delicate balance: regulators want safety, while users desire low fees and ease of use.

The best strategy for an exchange is to invest in transparent processes and communicate openly with its community.

When users trust the platform’s security posture, they are more likely to stay loyal and increase volume.

Ultimately, the evolving regulatory framework is shaping a more resilient, albeit more regulated, crypto ecosystem in India.

Katherine Sparks

December 6, 2025 AT 19:13Dear readers, I would like to highlight the significance of the recent FIU‑IND audit requirements. Please ensure you review the latest compliance certificates on each exchange’s website 😊. Failure to do so could result in unnecessary risk for your portfolio.

Eva Lee

December 13, 2025 AT 17:53From a compliance architecture standpoint, the integration of real‑time AML transaction monitoring via Mudrex’s SDK constitutes a pivotal upgrade in the VASP risk matrix, aligning with the newly mandated CERT‑In audit framework.

Ciaran Byrne

December 20, 2025 AT 16:33Regulatory clarity benefits all market participants.

Brooklyn O'Neill

December 24, 2025 AT 03:53Exactly, a transparent rulebook lets traders focus on strategy rather than legal guesswork.

Lurline Wiese

December 27, 2025 AT 15:13The suspense is real – I can almost hear the ticking clock of the upcoming semi‑annual audit, and the drama of exchanges racing to meet it is like a high‑stakes thriller!

Jenise Williams-Green

December 31, 2025 AT 02:33While the theatrics capture attention, we must not forget that the underlying moral imperative is to protect investors from reckless practices, and any neglect is simply indefensible.

Adarsh Menon

January 3, 2026 AT 13:53Wow, you really called it a circus – the hack was a perfect example of why security should never be an after‑thought.