EU Crypto Travel Rule Compliance Checker

Check if your crypto transaction would be accepted under EU's zero-threshold Travel Rule requirements. Enter transaction details below to see if your transfer would be accepted or rejected by EU platforms.

Transaction Details

On December 30, 2024, something quietly changed for everyone using cryptocurrency in the European Union. If you sent even €1 from one exchange to another, that transaction now carries a legal footprint - and you didn’t even get a notice. The EU’s new Travel Rule enforcement, with a €0 threshold, means every single crypto transfer between regulated platforms must include full sender and receiver details. No exceptions. No minimums. Not even for small payments or tips.

What Exactly Is the Travel Rule?

The Travel Rule isn’t new. It started in traditional banking decades ago, requiring financial institutions to share sender and receiver info for wire transfers over $3,000. But when the Financial Action Task Force (FATF) updated its guidelines in 2019 to include cryptocurrency, most countries kept that $3,000 cutoff. The U.S. still uses it. Japan, Singapore, and Australia all have thresholds above €1,000. The EU said no. They went all the way to zero. Under Regulation (EU) 2023/1113 and MiCA (Regulation (EU) 2023/1114), every crypto transaction between two registered crypto asset service providers (CASPs) - think exchanges, custodians, or wallet providers - must include:- Sender’s full name

- Sender’s account number or wallet address

- Sender’s physical address or national ID number

- Recipient’s full name

- Recipient’s account number or wallet address

Why Zero Threshold? The Logic Behind the Rule

The EU’s reasoning isn’t based on hard data - it’s based on control. While reports from Chainalysis and the European Central Bank show that illicit crypto activity is far lower than in traditional finance, regulators argue that crypto’s pseudonymity makes it a potential blind spot. If criminals can send small amounts without scrutiny, they might use it for layering - spreading money across many tiny transactions to hide its origin. But here’s the catch: the EU already had a head start. Countries like France and Germany had been enforcing zero-threshold rules for years before the EU-wide mandate. Many exchanges operating in those markets had already built systems to handle full data collection. So for them, the December 2024 deadline was more about paperwork than tech overhaul. For smaller platforms, though, it was a different story. Building infrastructure to capture, verify, store, and transmit personal data for every single transaction - even those under €5 - required major investment. Some had to hire compliance officers. Others had to rebuild their entire API layer. And many small wallets or peer-to-peer services simply shut down rather than comply.What Happens If Data Is Missing?

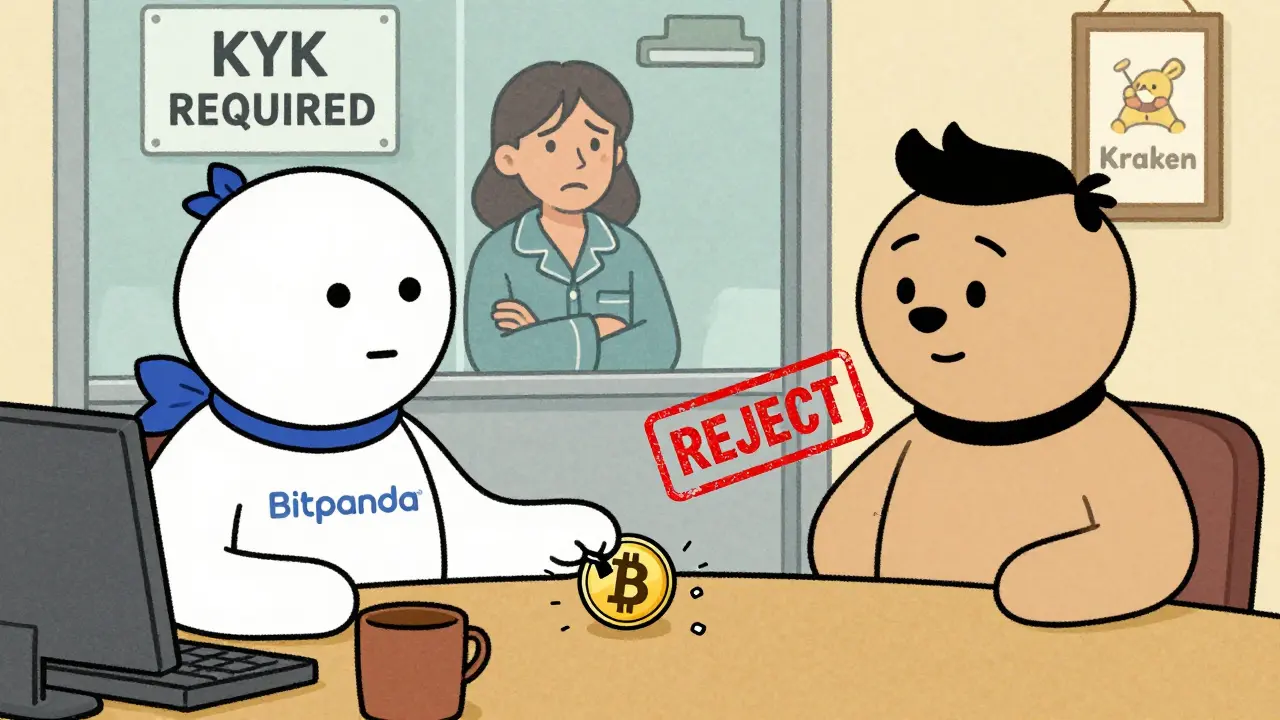

This is where things get tricky. The rule doesn’t just require sending data - it forces the receiving CASP to act on it. If you send crypto to a European exchange and your sender info is incomplete or missing, the receiving platform can’t just accept it. They have four choices:- Accept the transaction anyway (only if they classify it as low risk)

- Reject it outright

- Return the funds to the sender

- Suspend the transaction and investigate

How Do CASPs Actually Comply?

To meet the rule, exchanges and wallet providers had to build or buy compliance tech. Companies like KYCAID, Trulioo, and ComplyAdvantage now offer specialized platforms that handle:- Automated data exchange between CASPs using standardized protocols (like the Travel Rule Messaging Protocol)

- Real-time identity verification of users

- Sanctions and PEP screening

- Wallet address reputation checks (to block funds from mixers or darknet markets)

- Secure, encrypted data storage for 5+ years as required by law

The Global Ripple Effect

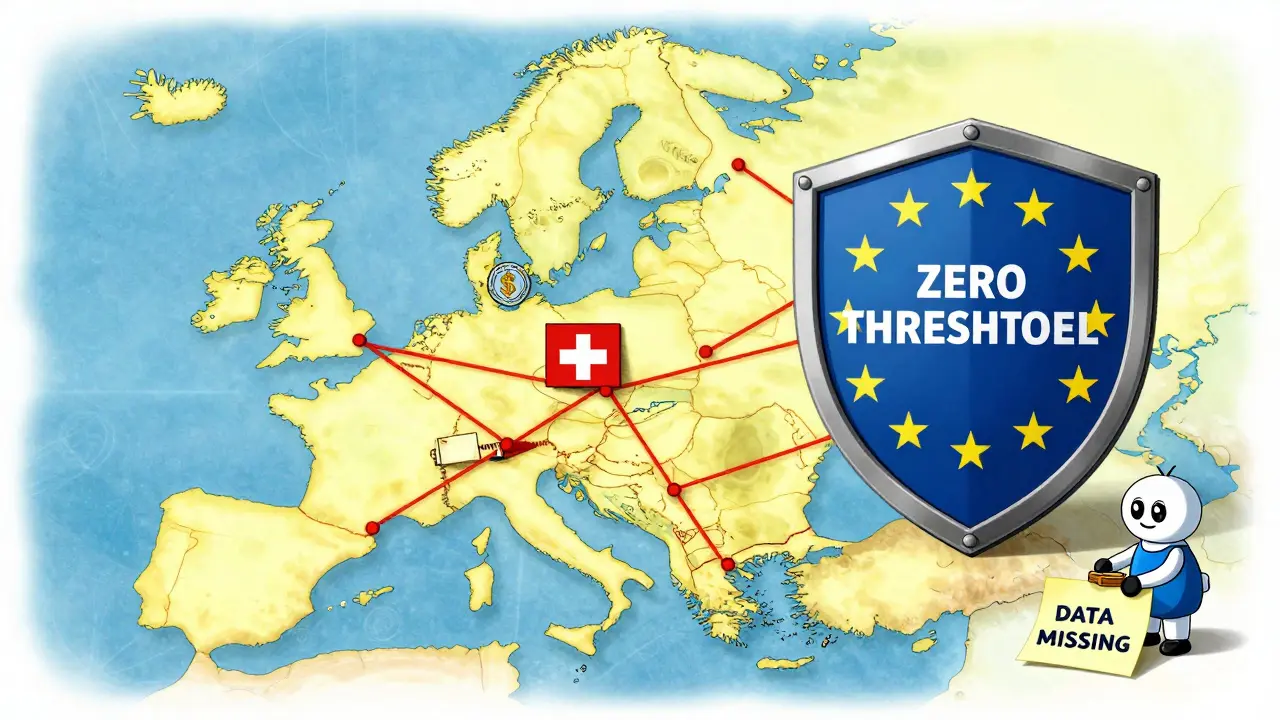

The EU’s zero-threshold rule doesn’t stop at its borders. If you’re a U.S.-based exchange and you send crypto to a French wallet, you have to comply - even if your own rules allow a $3,000 threshold. The EU doesn’t care what your local laws say. If your transaction enters the EU, you play by their rules. This has created a "Sunrise Issue" - a term used when one jurisdiction enforces a rule and others haven’t caught up. For example, if you send crypto from a non-EU exchange in Switzerland (which has a €1,000 threshold) to an EU exchange, the EU platform will treat it as high-risk. The transaction might be delayed, flagged, or blocked entirely - even if it’s perfectly legal in Switzerland. As a result, many global exchanges now operate two separate systems: one for EU-bound transactions (full data), and one for others (threshold-based). It’s inefficient. It’s costly. But it’s the only way to keep doing business in Europe.

What This Means for You

If you’re a regular user, you probably won’t notice much - unless you’re sending crypto between platforms. Here’s what to expect:- You’ll need to complete full KYC on every exchange you use, even if you only trade small amounts.

- Transfers between wallets on the same platform (like from your Coinbase spot wallet to your Coinbase Earn wallet) are fine - no Travel Rule applies.

- Transfers between different exchanges? Expect delays. You might get an email asking you to re-verify your identity.

- Using non-regulated wallets (like MetaMask) to send to an EU exchange? The exchange may reject the deposit unless you can prove the source is clean.

What’s Next?

The EU is already looking ahead. In 2025, regulators are expected to expand the rule to cover decentralized finance (DeFi) protocols that act as intermediaries - even if they’re not traditional exchanges. They’re also testing new ways to link wallet addresses to real identities without violating GDPR. Some proposals suggest mandatory on-chain identity tags, similar to how bank accounts work. Meanwhile, other regions are watching. The UK is considering a zero-threshold rule. Canada is reviewing its options. Even the U.S. Congress has held hearings on whether to lower its $3,000 threshold. The EU didn’t just change a rule. They set a new global standard. And whether you agree with it or not, the rest of the world is now playing catch-up.Frequently Asked Questions

Does the EU Travel Rule apply to personal wallets like MetaMask?

No, the Travel Rule only applies when a transaction moves between two regulated crypto asset service providers (CASPs), like exchanges or custodial wallets. If you send crypto from your MetaMask wallet to another MetaMask wallet, no data is required. But if you send from MetaMask to Binance or Kraken, the receiving exchange may block the deposit unless you can prove the funds aren’t from a high-risk source. They’ll treat it like an unverified transfer and may ask for additional proof of origin.

What happens if I send crypto to an EU exchange without providing my details?

The receiving exchange will likely reject the deposit. Most EU platforms now auto-block any incoming transaction that lacks full sender information - even if it’s from a well-known exchange. You’ll get a notification asking you to complete KYC or contact support. If you don’t respond, the funds may be returned to the sender after 30 days. There’s no way around it - the system is designed to block incomplete transfers.

Can I avoid the Travel Rule by using a non-EU exchange?

Not if you’re sending to or from the EU. If your transaction crosses into the EU - whether you’re in Germany, Spain, or Poland - the EU’s rules apply. Even if you use a U.S. or Asian exchange, once the funds enter an EU-regulated platform, they must comply with the zero-threshold rule. The only way to avoid it is to never interact with any EU-based CASP.

Is my personal data safe under this rule?

Yes, but only if the CASP follows GDPR. The Travel Rule requires data collection, but EU law also mandates that this data be encrypted, stored securely, and only kept for five years. CASPs must use secure messaging protocols (like the Travel Rule Messaging Protocol) to transmit data - not email or unencrypted channels. If a platform mishandles your data, you can file a complaint with your national data protection authority. The system isn’t perfect, but it’s legally bound to protect your privacy.

Do I need to pay extra fees because of the Travel Rule?

Some exchanges have added small compliance fees - usually between €0.50 and €2 - to cover the cost of data verification and reporting. But most absorb the cost into their regular trading fees. You won’t see a separate "Travel Rule fee" on your receipt, but it’s likely built into the price. The bigger cost is time - delays in transfers can happen while systems verify your data.

Bhoomika Agarwal

December 5, 2025 AT 17:16Nelia Mcquiston

December 7, 2025 AT 14:40Mark Stoehr

December 8, 2025 AT 17:03Shari Heglin

December 10, 2025 AT 15:05Reggie Herbert

December 12, 2025 AT 04:02Murray Dejarnette

December 12, 2025 AT 21:39Sarah Locke

December 13, 2025 AT 18:17Mani Kumar

December 15, 2025 AT 17:20Philip Mirchin

December 17, 2025 AT 14:14Britney Power

December 18, 2025 AT 09:10Maggie Harrison

December 20, 2025 AT 04:47Lawal Ayomide

December 21, 2025 AT 04:18justin allen

December 22, 2025 AT 07:20ashi chopra

December 22, 2025 AT 14:31Darlene Johnson

December 23, 2025 AT 05:50Ivanna Faith

December 23, 2025 AT 12:49Akash Kumar Yadav

December 25, 2025 AT 00:13samuel goodge

December 25, 2025 AT 21:05alex bolduin

December 27, 2025 AT 02:50Vidyut Arcot

December 29, 2025 AT 00:46Jay Weldy

December 29, 2025 AT 15:59Melinda Kiss

December 30, 2025 AT 06:10Christy Whitaker

December 31, 2025 AT 01:59