Concentrated Liquidity: The DeFi Game Changer

When working with concentrated liquidity, a method that lets liquidity providers allocate capital to specific price ranges instead of the whole curve. Also known as price range liquidity, it boosts capital efficiency and fee earnings for traders. This approach reshapes how automated markets price assets and how investors earn yields.

One of the core building blocks behind this shift is the Automated Market Maker (AMM), software that replaces order books with mathematical formulas to trade tokens instantly. AMMs require a pool of assets to function, and the pool’s shape determines trade slippage. By letting providers concentrate liquidity, AMMs reduce slippage at target prices while keeping overall pool depth low, which in turn lowers capital needs for the same trading volume.

Bitcoin’s most famous implementation of this idea lives in Uniswap V3, the third version of the leading AMM protocol. Uniswap V3 introduces customizable price ranges, multiple fee tiers, and non‑fungible LP positions. The protocol lets a provider allocate 1 % of their capital to a narrow band, earning up to ten times more fees than a uniform pool. This concrete example shows how concentrated liquidity turns theoretical capital efficiency into real profit for users.

Behind every successful pool is a Liquidity Provider (LP), someone who deposits two tokens into a pool and earns a share of transaction fees. LPs must decide how much capital to commit and where to set their range limits. With concentrated liquidity, they can target price zones they expect to trade most often, balancing risk and reward. This strategy creates a feedback loop where better range selection drives higher fees, which then attracts more capital.

Now that you’ve got the basics of concentrated liquidity, AMMs, Uniswap V3, and the role of liquidity providers, the articles below will dive deeper. You’ll see practical how‑tos, risk considerations, and real‑world examples that turn these concepts into actionable steps for your own DeFi portfolio.

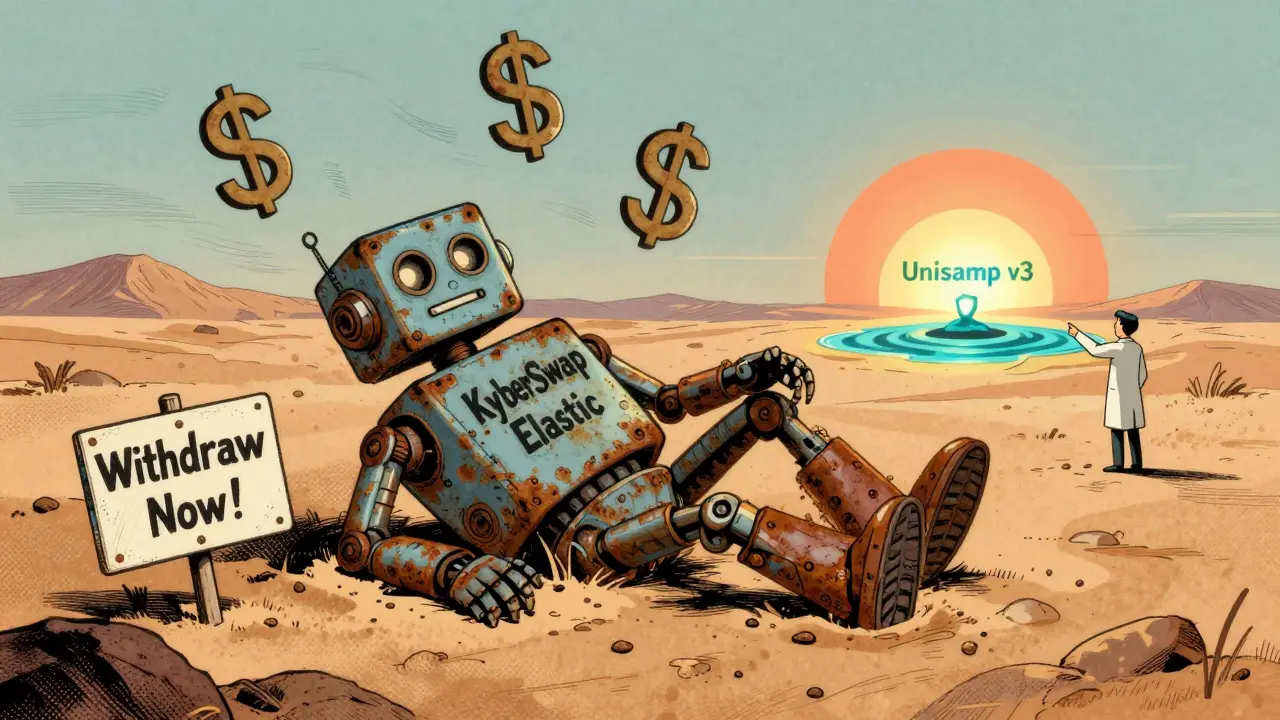

KyberSwap Elastic (Ethereum) Crypto Exchange Review: Is It Safe to Use in 2026?

by Johnathan DeCovic Jan 15 2026 18 CryptocurrencyKyberSwap Elastic on Ethereum was designed for advanced traders with auto-compounding liquidity, but a critical security breach has rendered it inactive as of 2026. No trades, no volume, and users are advised to withdraw funds immediately.

READ MOREAerodrome SlipStream Review: Concentrated Liquidity DEX on Base

by Johnathan DeCovic Oct 13 2025 20 CryptocurrencyA concise review of Aerodrome SlipStream, the concentrated liquidity DEX on Base. Covers features, performance, pros & cons, and how to start swapping or providing liquidity.

READ MORE