When you hear "Ainu Token" or "AINU," you might picture a revolutionary cryptocurrency with real-world use. But here’s the truth: Ainu Token is one of the most extreme examples of a high-supply, reward-based token built purely for speculation - not utility.

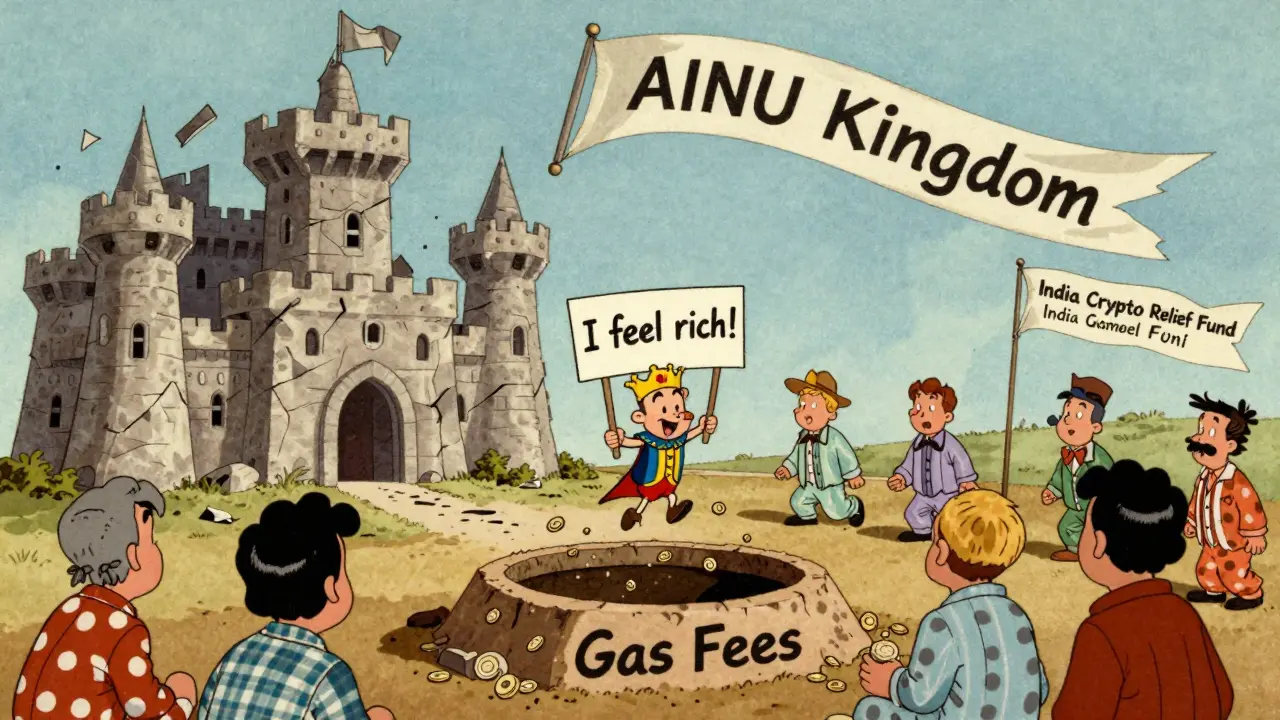

Launched in May 2021, AINU runs on the Binance Smart Chain as a BEP20 token. It has a total supply of exactly 1,000,000,000,000,000,000 tokens - one quadrillion. That’s not a typo. You can hold more than a million times more AINU than Bitcoin’s entire supply. But here’s the catch: each token is worth about $0.000000000011943. So even if you own 100 quadrillion AINU, your wallet shows roughly $1.19. It’s designed to make you feel rich, not actually be rich.

How Ainu Token Works (The Mechanics)

AINU doesn’t just sit there. Every time someone buys, sells, or transfers it, four automatic things happen:

- 5% goes to holders - Everyone who owns AINU gets a tiny reward just for holding it. No need to claim it. It happens automatically.

- 5% goes to liquidity - This part is supposed to keep the price stable by adding funds to trading pools on PancakeSwap.

- Tokens are burned - A portion of every transaction is sent to a dead wallet. No one can access it. This reduces the total supply over time.

- No mining or staking - You can’t earn more by locking up coins. You only gain from trading or holding.

This model is copied from tokens like SafeMoon. But AINU adds one twist: 20% of the total supply was donated to the India Crypto Relief Fund at launch. That sounds noble. But with a market cap under $550,000, that donation was worth about $110,000 - a one-time gesture that doesn’t change how the token functions today.

Why You Can’t Actually Use AINU

AINU’s biggest flaw isn’t its price - it’s how absurdly small that price makes everyday transactions.

On Binance Smart Chain, a normal transaction fee is around $0.05. To send 1 AINU, you’d pay 4,186,000% of its value in fees. That means if you try to sell 500 quadrillion AINU, you might get $6 back - but pay $0.05 in gas. You lose money just to cash out.

Binance’s own guide warns: "Transactions involving less than 10 quadrillion AINU tokens will likely result in net losses." So you can’t spend it. You can’t pay for coffee. You can’t tip someone. Even if you wanted to use it as a payment method - which the project claims it supports - it’s physically impossible.

Where It’s Traded (And Why It Matters)

Over 98% of AINU trading happens on PancakeSwap (v2). That’s it. No Coinbase, no Kraken, no Binance spot market. Just a decentralized exchange with a liquidity pool of about $12,345 as of late 2025.

Why does this matter? Because low liquidity means price swings are wild. A small buy order can spike the price 20% in minutes. A few large sellers can crash it just as fast. And with only 1,247 people in the official Telegram group and a Twitter account with 843 followers, there’s no real community to stabilize it.

Market data from CoinGecko shows AINU has traded as low as $0.0000000000004217 and as high as $0.000000000017. That’s a 300% swing in under 30 days. It’s not investing - it’s gambling with numbers.

Who Buys It? And Why?

Most buyers aren’t looking for value. They’re chasing the feeling.

On Reddit, users brag about holding "10 quadrillion AINU" and seeing their wallet say "$119." That’s not wealth - it’s a psychological trick. The number of zeros makes people feel like they’ve won the lottery. But when you check the actual USD value? It’s barely enough for a coffee.

One Trustpilot review says it best: "Tried to sell 500 quadrillion tokens and the gas fee was higher than the entire sale value - complete waste of time."

These aren’t investors. They’re speculators drawn in by memes, YouTube videos, and FOMO. There’s no real project behind it. No team updates. No roadmap since 2022. The "AINU swap" feature promised on Coinbase’s site? Never launched.

The Real Risks

AINU isn’t just low-value. It’s high-risk in ways most people don’t see:

- Gas fees eat your profits - Even if the price goes up, you might lose money just moving it.

- Liquidity is vanishing - The main trading pool has lost 47% of its funds in the last year. If it dries up, the token becomes worthless.

- No merchant adoption - Not one store accepts AINU. Not even online. Despite claims of helping "people who wish to invest," it’s useless as a currency.

- Regulatory gray zone - The SEC has flagged tokens like AINU that promise automatic rewards as potential securities. That could mean trouble down the line.

- High chance of abandonment - Analysts estimate a 92% probability AINU becomes completely illiquid within two years.

Is AINU Worth Buying?

If you’re asking this question, you’re probably already tempted by the low price and big numbers.

Here’s the honest answer: Only if you treat it like a lottery ticket.

Don’t buy AINU because you think it’s an investment. Don’t buy it because you believe in its mission. Don’t buy it because you want to use it.

Buy it only if:

- You understand you might lose 100% of your money

- You’re okay with paying more in fees than you earn

- You’re chasing the thrill of owning a quadrillion tokens

- You’re not using money you can’t afford to lose

If you’re looking for a crypto that does something real - pays dividends, powers apps, or gets used in daily life - AINU is not it. It’s a digital meme with a tokenomics gimmick. And like all memes, it could vanish tomorrow.

How to Buy or Check AINU (If You Still Want To)

If you’ve decided to try it anyway, here’s how:

- Get a BSC-compatible wallet: Trust Wallet, MetaMask, or Binance Chain Wallet.

- Buy BNB (Binance Coin) on an exchange like Binance or Coinbase.

- Send BNB to your wallet.

- Go to PancakeSwap and swap BNB for AINU.

- Store it. Don’t trade it unless you’re ready to pay high fees.

There’s no official app. No wallet integration. No easy way to track it. You’re on your own.

Is Ainu Token (AINU) a good investment?

No, Ainu Token is not a good investment in the traditional sense. It has no real utility, no merchant adoption, and its price is so low that transaction fees make trading unprofitable. The 5% reward system only works if you hold massive amounts - and even then, the value is negligible. It’s speculative gambling, not investing.

Can I use Ainu Token to pay for goods or services?

No. Despite claims on its website, no merchant accepts AINU. Even if they did, the transaction fee (around $0.05) would be over 4 million times the value of one token. Sending even a small amount of AINU costs more than it’s worth.

Why does AINU have such a high supply (1 quadrillion)?

A high supply like this is used to make the price look extremely low - creating the illusion that you’re getting "a lot" of tokens. It’s a psychological tactic. Owning 100 quadrillion AINU feels like winning, even though it’s worth less than $1. This is common in meme coins designed for speculation, not real value.

Is Ainu Token on Solana or another blockchain?

No. Ainu Token is only available on the Binance Smart Chain (BSC) as a BEP20 token. Any claim that it works on Solana, Ethereum, or other chains is false. Always verify the contract address before trading.

What happened to the India Crypto Relief Fund donation?

At launch, 20% of AINU’s supply (200 quadrillion tokens) was sent to the India Crypto Relief Fund. That donation was worth about $110,000 at the time. Since then, there have been no updates, audits, or reports on how the funds were used. The donation was a one-time marketing move - not an ongoing charity initiative.

Can I mine or stake AINU to earn more?

No. AINU has no mining or staking mechanism. The only way to earn more is by holding it - and even then, you only get a 5% reward on every transaction made by others. You don’t earn passive income from locking up coins. The rewards are automatic, but they’re tiny and tied to trading volume.

Is Ainu Token likely to increase in value?

Analysts predict the opposite. With declining liquidity, no development updates since 2022, and shrinking community engagement, AINU is on a path toward becoming completely illiquid. Experts estimate a 92% chance it will vanish from exchanges within two years. Its price is not driven by demand - it’s driven by hype, which is fading.