USDC: The Stablecoin You Need to Know

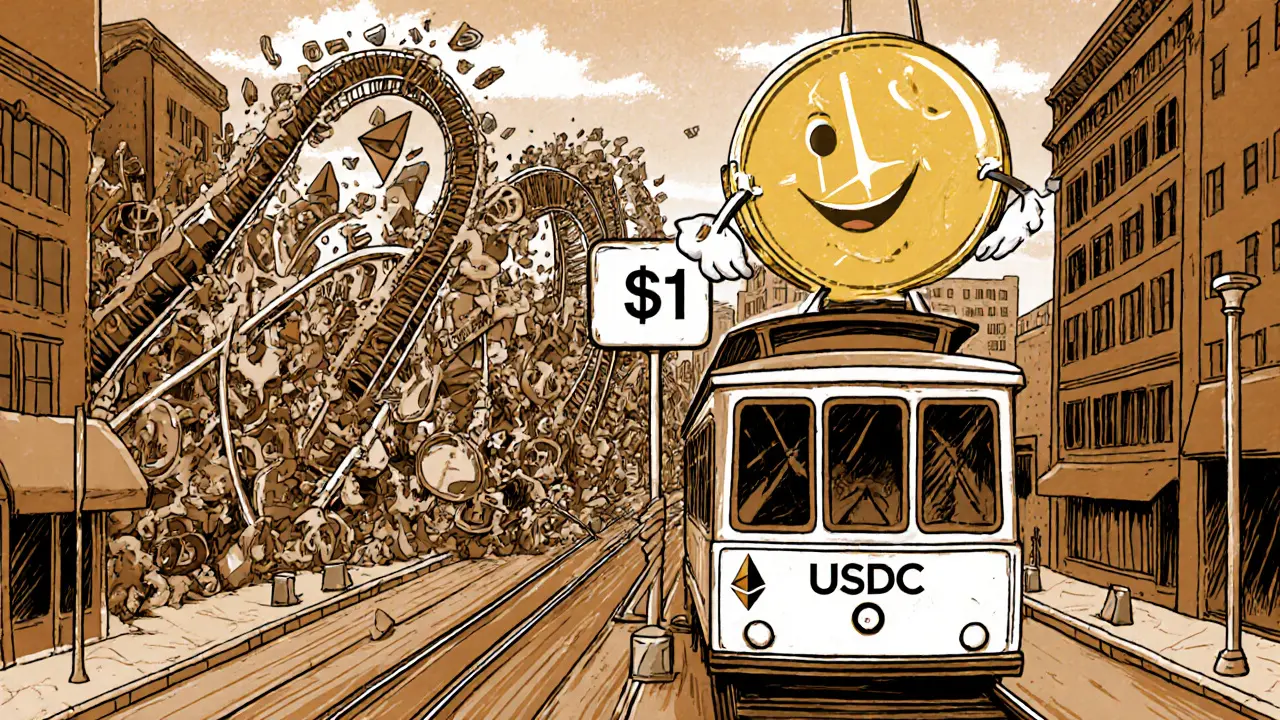

When working with USDC, a dollar‑backed digital token that maintains a 1:1 peg with the US dollar. Also known as USD Coin, it is issued by Circle, a fintech company that guarantees the reserves behind each token. Stablecoin is a class of cryptocurrencies designed to minimize price volatility by linking to stable assets like fiat currencies and Ethereum, the blockchain where USDC first launched and where most smart contracts run today. Because it offers predictable value, USDC has become a core building block for DeFi decentralized finance applications that let users earn, borrow, and trade without banks. This mix of stability, regulatory backing, and blockchain compatibility creates a unique tool that powers everything from simple payments to complex liquidity‑staking strategies.

Why USDC Matters Across the Crypto ecosystem

USDC’s stability lets traders move money in and out of volatile assets without losing buying power, which is why it sits at the heart of cross‑chain bridges, token swaps, and liquid staking platforms. When you stake a proof‑of‑stake token, you often receive a wrapped version of USDC as a reward because its price stays steady, letting you reinvest or withdraw safely. The token’s presence on multiple chains – Ethereum, Solana, Avalanche, and others – means developers can build interoperable services that rely on a trusted, low‑slippage asset. In DeFi protocols, USDC serves as collateral for loans, a base pair for stable‑swap pools, and a safe harbor during market turbulence. Its tokenomics are simple: each USDC is backed 1:1 by cash or short‑term government securities, and the supply expands or contracts automatically as users mint or redeem tokens, keeping the peg intact.

Regulators keep an eye on USDC because its fiat backing makes it a bridge between traditional finance and crypto. Circle publishes regular attestation reports, showing that every USDC in circulation is fully reserved. This transparency builds trust for institutional investors, who can use USDC to move large sums quickly across borders, settle trades, or park funds in high‑yield DeFi farms without worrying about sudden price swings. For everyday users, the ease of converting fiat to USDC on major exchanges means you can start earning yield on assets that would otherwise sit idle in a bank account. Whether you’re a trader looking for a stable base, a developer building a new DApp, or a holder seeking low‑risk exposure, USDC offers a reliable, liquid gateway into the broader crypto world.

Below you’ll find a curated collection of articles that dive deeper into USDC’s role in crypto. From detailed guides on liquid staking with USDC to analyses of cross‑chain bridges that move the token around, the pieces cover practical how‑tos, risk considerations, and the latest market trends. Explore the posts to see how USDC can fit into your strategy, boost your DeFi earnings, and simplify your crypto experience.

Stablecoins: Tackling Crypto Volatility in 2025

by Johnathan DeCovic Oct 12 2025 22 CryptocurrencyExplore how stablecoins tame crypto volatility, the mechanisms behind their peg, major players, benefits, risks, and 2025 market trends in clear, practical terms.

READ MORE