Stablecoin Safety Checker

Assess Stablecoin Safety

Learn how to evaluate the safety of stablecoins based on key risk factors. This tool helps you understand the security and stability of your digital assets.

Enter Stablecoin Details

Safety Assessment

Recommendation:

When you hear the term Stablecoins are digital assets designed to keep a steady value by linking to a stable reference like a fiat currency or commodity, the idea of a less‑jumpy crypto world becomes clearer. In short, stablecoins aim to curb the wild price swings that keep many investors on edge.

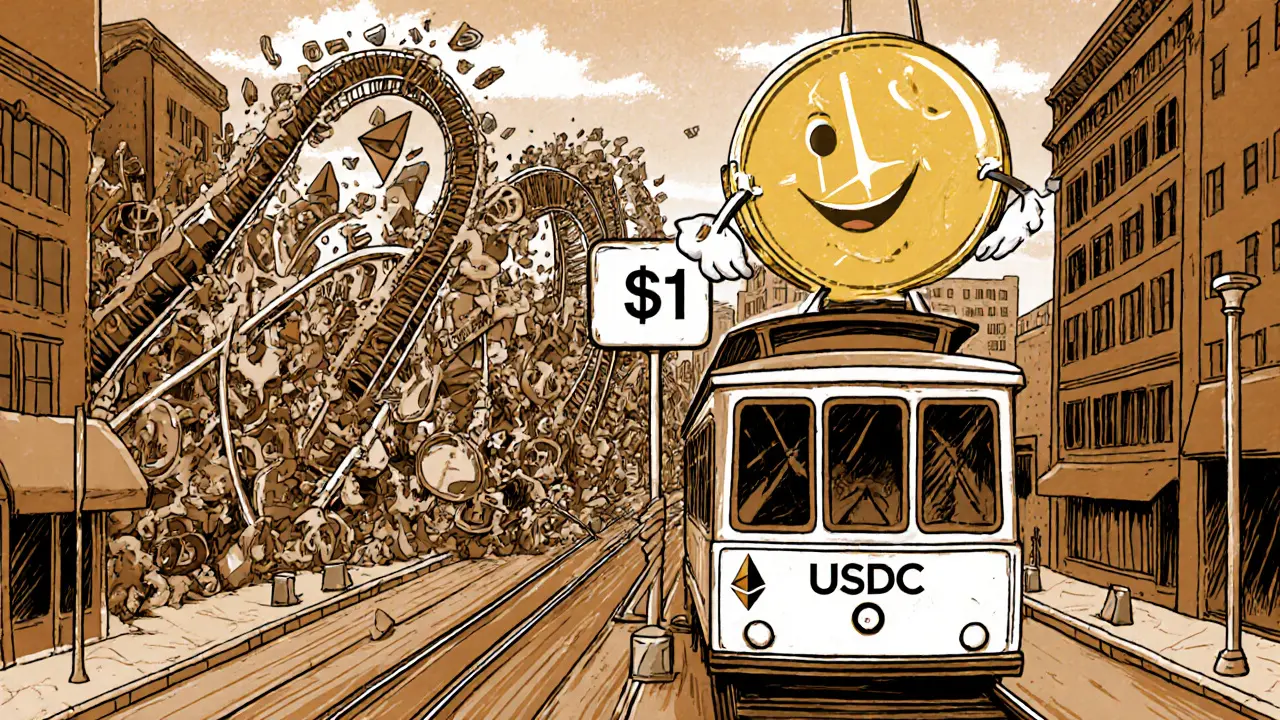

Why Crypto Volatility Matters

Bitcoin, Ethereum and countless altcoins can double or halve their price in a single day. That kind of roller‑coaster deters merchants, makes payroll in crypto risky, and forces traditional traders to keep a large cash buffer. If you’ve ever tried to use a half‑dollar‑worth Bitcoin to buy a coffee, you know the headache. Stablecoins promise a solution: a crypto‑friendly token that behaves more like cash.

How Stablecoins Keep Their Value

At a high level, a stablecoin stays level by holding something of equal worth in reserve. The reserve can be:

- Cash or short‑term U.S. Treasury bills (the most common backing for fiat‑pegged coins).

- Other cryptocurrencies, but over‑collateralized to cushion price drops.

- Physical commodities like gold.

- Purely algorithmic rules that expand or contract supply.

Whenever the market price drifts away from the peg, smart contracts or custodians buy or sell the reserve assets to pull the price back in line. The process is invisible to most users, but the math and the audits are the foundation of trust.

Four Main Types of Stablecoins

| Type | Peg | Typical Collateral | Example | Risk Profile |

|---|---|---|---|---|

| Fiat‑pegged | 1:1 to a fiat currency (USD, EUR) | Cash & short‑term Treasury bills | USD Coin (USDC) | Low, depends on reserve transparency |

| Crypto‑collateralized | Soft peg to USD, over‑collateralized | Ethereum, other DeFi tokens | DAI | Medium, price of crypto backing can fluctuate |

| Commodity‑backed | 1:1 to a physical metal | Gold or silver stored in vaults | PAX Gold (PAXG) | Low‑to‑Medium, depends on custody of the metal |

| Algorithmic | Supply‑adjusted to maintain price | No collateral, code‑driven incentives | TerraUSD (UST) - collapsed 2022 | High, prone to rapid de‑peg |

Spotlight on the Big Players

The market is dominated by a handful of well‑known coins. Tether (USDT) was the first to claim a 1‑to‑1 USD peg and still boasts the highest circulation. USD Coin (USDC), issued by Circle and Coinbase, emphasizes regular audits and cash reserves held at The Bank of New York Mellon. DAI lives in the MakerDAO ecosystem, letting users lock up Ethereum and other DeFi tokens to mint a dollar‑stable token without a central custodian. Finally, gold‑backed tokens like PAX Gold (PAXG) let investors own a fraction of physical gold while moving it instantly on a blockchain.

Stability Factors: What Keeps the Peg Intact?

Three pillars hold the system together:

- Reserve Quality - Cash and short‑term Treasury bills are the gold standard. When a stablecoin’s reserve includes risky corporate paper or low‑quality crypto, confidence drops fast.

- Transparency - Public attestation reports, third‑party audits, or blockchain‑based proof‑of‑reserves let users verify that the backing really exists.

- Regulatory Clarity - Clear rules about redemption rights, reserve composition, and reporting keep issuers honest. Jurisdictions that demand regular disclosures tend to host more stablecoins that survive market stress.

When any of these pillars wobble, the token can drift from its peg, as we saw with TerraUSD’s abrupt collapse.

Benefits for Users and Businesses

Because stablecoins stay near a constant value, they solve several real‑world pain points:

- Low‑cost, fast cross‑border transfers - Moving USDC from a wallet in Toronto to one in Singapore can settle in minutes for pennies, bypassing SWIFT fees.

- Programmable money - Smart contracts can automatically release funds when conditions are met, enabling escrow, payroll, or DeFi lending without human intervention.

- Access to crypto markets without exposure to wild swings - Traders can park profits in USDT or USDC during a market dip, preserving value while staying on‑chain.

- Better liquidity for decentralized exchanges - Stablecoins act as a reliable base pair, allowing users to trade any token against a dollar‑stable asset.

For a small e‑commerce shop, accepting USDC means the owner doesn’t have to watch Bitcoin price charts to know tomorrow’s revenue. For an individual worker sending remittances, a stablecoin can cut the cost of sending money home by 80% compared with traditional banks.

Risks and Market Concerns

Stablecoins aren’t a magic bullet. The biggest red flags include:

- Run risk - If a large group of holders asks to redeem tokens at once, the issuer must sell reserves quickly, potentially affecting Treasury yields or asset prices.

- Regulatory crackdowns - Sudden legal restrictions on reserve holdings or redemption rights can cause a price drift, as warned by J.P. Morgan analysts.

- Smart‑contract bugs - Crypto‑backed coins rely on code; a flaw could let attackers drain collateral.

- Liquidity mismatches - Some stablecoins hold longer‑term assets for yield, which may not be liquid enough during a panic.

Understanding these risks helps you decide whether a stablecoin fits your risk tolerance.

Current Market Landscape (2025)

By October2025, stablecoins hold roughly $190billion in circulation, dwarfing all other crypto assets combined. The surge began in 2022 when higher Treasury yields made cash‑backed coins attractive for yield‑seeking investors. Today, over 60% of the total stablecoin supply is backed by short‑term U.S. Treasury bills, creating a feedback loop: higher yields draw capital into stablecoins, and stablecoin demand pushes Treasury issuers to offer more short‑term paper.

Regulators in the U.S., EU, and Asia are drafting frameworks that require monthly reserve attestations and clear redemption timelines. In Canada, the recent “Stablecoin Act” mandates that issuers hold reserves in a federally‑inspected custodian, a move that has boosted local confidence.

Institutional adoption is also climbing. Major banks now offer custodial services for USDC and USDT, allowing corporate clients to settle inter‑bank payments on a public ledger. Meanwhile, decentralized finance platforms continue to build lending markets where users earn 5‑8% APY by supplying stablecoins, feeding the cycle of demand.

Future Outlook: Where Do Stablecoins Go Next?

Looking ahead, three trends are likely to shape the space:

- Stronger regulatory harmonization - Global standards on reserve reporting could make stablecoins the preferred bridge between fiat banks and blockchain networks.

- Higher‑yield, low‑risk collateral - Some issuers are experimenting with short‑term municipal bonds or agency securities to boost yields without sacrificing safety.

- Deeper integration with payment rails - APIs that let merchants accept USDC directly into their bank accounts are already live in Europe; similar solutions are rolling out in North America by 2026.

If these developments materialize, stablecoins could become the default settlement layer for everything from grocery purchases to corporate payroll, effectively making crypto volatility a relic of the past.

Key Takeaways

- Stablecoins keep a steady price by holding high‑quality reserves, most often cash and short‑term U.S. Treasury bills.

- Four main families exist - fiat‑pegged, crypto‑collateralized, commodity‑backed, and algorithmic - each with its own risk profile.

- Major players like USDT, USDC, DAI, and PAXG dominate the market, and their transparency levels drive user confidence.

- Benefits include cheap cross‑border transfers, programmable money, and reduced exposure to crypto swings.

- Risks such as run scenarios, regulatory changes, and smart‑contract bugs mean users should stay informed and choose reputable issuers.

Frequently Asked Questions

How does a fiat‑pegged stablecoin stay $1?

The issuer holds an equivalent amount of cash or short‑term U.S. Treasury bills in a bank. When demand pushes the price above $1, the issuer sells some of the reserve for the token, pulling the price down. If the price falls below $1, new tokens are minted and the reserve is bought back, pushing the price up.

Can I lose money if a stablecoin fails?

Yes, but the loss size depends on the coin’s backing. A well‑audited fiat‑backed coin like USDC typically returns the full amount, while algorithmic tokens without collateral can become worthless, as seen with TerraUSD.

Are stablecoins regulated?

Regulation is evolving. In the U.S., the Treasury and SEC are drafting rules that would require regular reserve attestations. The EU’s MiCA framework already enforces transparency, and Canada’s Stablecoin Act mandates custodial oversight.

How do stablecoins compare to traditional bank transfers?

Bank wires can take 1‑3days and cost $15‑$30 per transaction. Stablecoin transfers settle in minutes on a public blockchain and usually cost a few cents, making them far cheaper and faster for cross‑border payments.

What should I look for before using a stablecoin?

Check the reserve composition (cash vs. risky assets), verify audit frequency, see if the issuer is regulated in your jurisdiction, and assess the token’s market depth. A transparent, well‑regulated coin with daily attestations is typically the safest choice.

Brandon Salemi

October 12, 2025 AT 08:25Stablecoins are the unsung heroes keeping crypto from turning into a roller‑coaster; they give us a foothold in a wild market.

Leynda Jeane Erwin

October 18, 2025 AT 03:19When you examine the reserve structures behind fiat‑pegged tokens, the picture becomes surprisingly clear; most rely on daily audited cash balances that sit in tier‑one banks. Yet the fine print often reveals hidden exposure to short‑term Treasury fluctuations. In practice, this means your USDC may earn a few basis points while still maintaining the $1 peg. The regulatory environment in the U.S. is tightening, demanding more transparency, which should further solidify confidence. Ultimately, the blend of formal oversight and casual market adoption creates a robust, albeit imperfect, safety net.

Siddharth Murugesan

October 23, 2025 AT 22:12This whole stablecoin hype is just a casino on steroids. They promise safety but hide risky collaterals behind a veil of audit jargon. If the auditors slip up or the backing assets tank, you’re left holding dust. The market’s been ridden by ponzi‑style schemes for years, and stablecoins are no different. Wake up before your dollars disappear.

Daron Stenvold

October 29, 2025 AT 16:05It’s understandable that many newcomers feel jittery about crypto volatility; stablecoins provide a much‑needed bridge to confidence. By anchoring value to tangible reserves, they let users experience blockchain speed without the heart‑racing price swings. The industry’s move toward clearer attestations only strengthens that bridge. As long as custodians act responsibly, the drama of market turbulence can stay safely on the other side of the peg.

Nina Hall

November 4, 2025 AT 10:59What a vibrant evolution! Stablecoins are turning the crypto world into a rainbow of possibilities-instant cross‑border payments, programmable money, and a safety net for traders. The fact that big‑bank custodians are now on board adds a splash of legitimacy. Imagine buying coffee in Tokyo with USDC and never worrying about the price wobble. The future looks bright, and stablecoins are the brushstrokes painting it.

Mureil Stueber

November 10, 2025 AT 05:52Key things to check: reserve composition, audit frequency, regulatory jurisdiction. Cash‑backed coins like USDC hold most assets in short‑term Treasuries which are highly liquid. Crypto‑collateralized tokens such as DAI over‑collateralize with ETH, adding a buffer for price drops. Commodity‑backed tokens tie value to gold, but custody risk remains. Regular third‑party attestations are the gold standard for trust.

Emily Kondrk

November 16, 2025 AT 00:45Don’t be fooled by the “transparent” audits. Behind the glossy reports lies a network of shadow banks pulling strings, feeding the Fed’s secret agenda. The algorithmic stablecoins were deliberately allowed to fail to scare the market into buying the “real” ones. It’s all a massive data‑dollar manipulation scheme that the powers-that‑be don’t want you to see.

Leo McCloskey

November 21, 2025 AT 19:39Well, the article covers the basics, but it glosses over the systemic risk, the hidden leverage, and the inevitable regulatory crackdowns that are looming on the horizon; without these details, readers are left with a rosy picture that’s far from the harsh reality of the crypto ecosystem; in short, more depth is needed, not just a bullet‑point summary.

arnab nath

November 27, 2025 AT 14:32Exactly, the piece skips the heavy‑lifting analysis.

Nathan Van Myall

December 3, 2025 AT 09:25The rise of treasury‑backed stablecoins mirrors traditional money‑market funds, but with blockchain speed; this convergence raises interesting implications for monetary policy and liquidity management that regulators are only beginning to grapple with.

debby martha

December 9, 2025 AT 04:19i think theyre cool but dont trust all of them.

Ted Lucas

December 14, 2025 AT 23:12Totally get you! 🚀 Stablecoins can be a game‑changer, but you gotta watch the audit trail and keep your eyes peeled for any red flags. 😉

ചഞ്ചൽ അനസൂയ

December 20, 2025 AT 18:05Think of stablecoins like a safety net in a gymnastics routine; they let you try daring moves without fearing a hard fall. When the net is made of verified reserves, you can focus on the performance, not the fear.

Orlando Lucas

December 26, 2025 AT 12:59Stablecoins have come a long way since the early days of Tether, evolving from a simple dollar‑linked token into a multifaceted financial instrument. The first generation relied mostly on undisclosed reserves, which sparked skepticism among regulators and investors alike. Over time, issuers like Circle introduced regular third‑party attestations, setting a new benchmark for transparency. This shift not only attracted institutional capital but also prompted lawmakers to draft clearer guidelines. In the United States, the forthcoming Stablecoin Act will require monthly reporting and independent custodians, thereby reducing information asymmetry. The European MiCA framework takes a similar approach, emphasizing consumer protection and reserve adequacy. Meanwhile, in Asia, countries such as Singapore are experimenting with sandbox environments to foster innovation while maintaining oversight. One of the most compelling developments is the integration of short‑term Treasury yields into reserve portfolios, which offers holders modest returns without sacrificing liquidity. However, this also introduces interest rate risk; a sudden spike in yields could affect the peg maintenance mechanisms. Crypto‑collateralized stablecoins like DAI mitigate this by over‑collateralizing with volatile assets, creating a buffer against market downturns. Commodity‑backed tokens, on the other hand, tie value to physical assets like gold, appealing to investors seeking a tangible hedge. Algorithmic stablecoins remain the outliers, prone to rapid de‑pegs, yet they continue to attract speculative capital due to their promise of higher yields. The market’s total stablecoin capitalization surpassing $190 billion signals both a growing trust and a heightened systemic importance. With more banks offering custodial services for USDC and USDT, the line between traditional finance and decentralized finance blurs further. As regulatory harmonization progresses, we can anticipate a future where stablecoins act as the universal settlement layer for global commerce, effectively relegating crypto volatility to history.

Philip Smart

January 1, 2026 AT 07:52All that optimism sounds nice, but it ignores the inevitable centralization pressures that will erode the decentralized ethos.

Jacob Moore

January 7, 2026 AT 02:45Great point about custodial services-banks providing USDC wallets is a huge step toward mainstream adoption, making crypto feel as familiar as checking a savings account.

Jon Asher

January 12, 2026 AT 21:39Stablecoins simplify cross‑border payments, cutting fees and delays, which is especially helpful for freelancers working with overseas clients.

Helen Fitzgerald

January 18, 2026 AT 16:32Hey everyone, just wanted to shout out to the community for sharing resources; learning about reserve audits together makes this space feel more welcoming.

Ben Parker

January 24, 2026 AT 11:25🙌 Absolutely! The more we demystify the tech, the faster we’ll see everyday folks hopping on board. 🎉

Anjali Govind

January 30, 2026 AT 06:19When evaluating a stablecoin, checking the redemption rights is crucial; a clear promise to exchange 1 token for $1 instantly builds user confidence.

Sanjay Lago

February 5, 2026 AT 01:12Redemption mechanisms are the lifeline-if the issuer can’t honor them, the whole peg collapses faster than a house of cards in a hurricane.

Annie McCullough

February 10, 2026 AT 20:05maybe the hype is overblown; not every stablecoin needs instant redemption as long as the market trusts the collateral