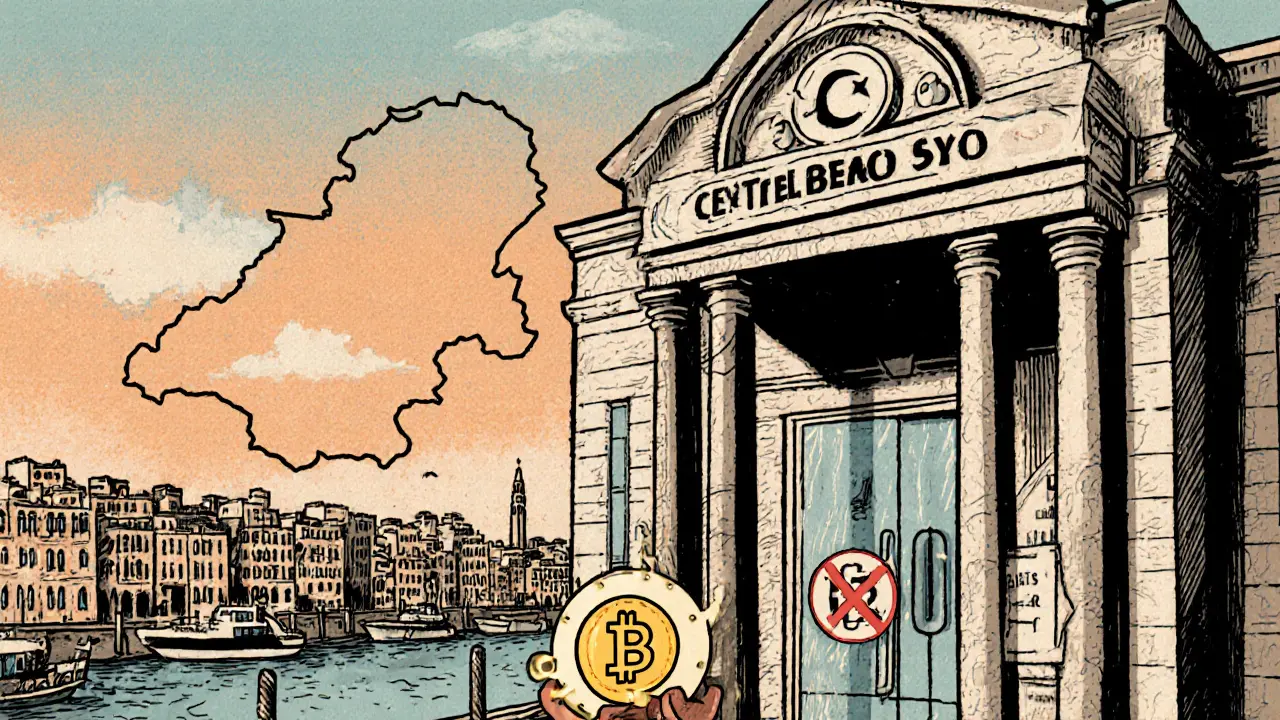

Tunisia Crypto Ban: What It Means for Investors and Exchanges

When talking about the Tunisia crypto ban, a sweeping prohibition that blocks all cryptocurrency trading, mining, and related services within the country, you’re dealing with a policy that reshapes the local market overnight. Also known as the Tunisia cryptocurrency prohibition, this move forces banks, exchanges, and users to rethink how they handle digital assets. The ban doesn’t just affect retail traders; it reaches institutional players, wallets, and even foreign platforms trying to serve Tunisian citizens.

At the heart of the ban sits the Central Bank of Tunisia, the authority that issued the decree and will enforce compliance through penalties and licensing revocations. This ties directly into broader cryptocurrency regulation, the set of laws, guidelines, and supervisory mechanisms that govern digital asset activities worldwide. Across the Gulf Cooperation Council, similar moves like the Kuwait crypto ban, a full prohibition enforced by the Central Bank of Kuwait show a regional pattern of strict oversight. Meanwhile, the European Union’s MiCA framework (EU MiCA, a comprehensive market regime that standardizes crypto rules across EU member states) offers a contrasting approach focused on licensing and consumer protection rather than outright bans.

How the Ban Shapes the Crypto Landscape

The Tunisia crypto ban encompasses all on‑chain transactions involving local residents, requires exchanges to halt onboarding Tunisian users, and influences nearby markets by pushing capital toward more permissive jurisdictions. For traders, the immediate effect is loss of access to local liquidity pools and higher friction when trying to move assets abroad. For businesses, compliance means shutting down Tunisian wallets, updating KYC procedures, and potentially facing fines if they ignore the decree. The ban also mirrors the Kuwait crypto ban’s legal scope, reinforcing a Gulf‑wide trend where central banks view digital assets as systemic risks. By contrast, EU MiCA’s licensing model shows that regulatory frameworks can coexist with active markets, offering a roadmap for countries that might soften their stance later.

If you’re running an exchange or DeFi platform, the first step is a rapid audit of user data to flag Tunisian IP addresses and account details. Next, strip out any services that directly facilitate buying, selling, or staking crypto for those users. Updating terms of service to explicitly mention the Tunisia ban helps demonstrate good faith to regulators. Finally, keep an eye on official communications from the Central Bank of Tunisia; they often release clarifications that can affect enforcement timelines. These practical moves mirror the compliance playbook used by Indian exchanges after the FIU‑IND guidelines and by Gulf platforms adapting to broader GCC directives.

Investors should also reconsider risk exposure. The ban raises the probability of asset freezes and hampers the ability to liquidate positions quickly. Diversifying into assets listed on exchanges that respect regional bans—such as those operating under EU MiCA or in jurisdictions with clear crypto‑friendly policies—can reduce this risk. Watching how other bans, like the one in Kuwait, impact market depth gives a useful benchmark. Historically, sudden prohibitions cause short‑term price dips in correlated tokens, but the long‑term effect depends on how quickly capital can flow to alternative hubs.

Looking ahead, the Tunisia crypto ban could evolve. If the Central Bank of Tunisia sees a surge in illicit activity or public pressure, it might introduce a licensing regime similar to EU MiCA, allowing vetted players to operate under strict oversight. Until then, the current prohibition remains the baseline rule for anyone dealing with crypto in the country. Keeping tabs on regional policy shifts—especially in the GCC and EU—will help you anticipate any regulatory tweaks before they hit the market.

Below you’ll find a curated set of articles that break down stablecoins, cross‑chain bridges, risk management, and more—topics that become even more relevant when you’re navigating a strict regulatory environment like the Tunisia crypto ban. Dive into the collection to see how these concepts intersect with the latest bans and what practical steps you can take right now.

Tunisia's Crypto Ban: How It Works, Who Enforces It, and What Might Change

by Johnathan DeCovic May 13 2025 13 CryptocurrencyA clear, up‑to‑date guide on Tunisia's total crypto ban, covering the law, enforcement, real‑world impact, sandbox pilots, and potential future reforms.

READ MORE