When you look at a crypto price chart, it’s easy to get overwhelmed. Prices jump up and down like a pinball-Bitcoin spikes 12% in a day, then drops 8% the next. If you’re trying to decide when to buy or sell, raw price data won’t help. That’s where moving averages come in. They smooth out the noise and show you the real direction of the market.

Think of a moving average like a slow-moving river. Even if there are ripples and small waves on the surface, the current underneath tells you which way things are really flowing. In crypto trading, moving averages do exactly that. They calculate the average price of a coin over a set number of days, giving you a clearer picture than looking at daily price swings alone.

What Are Moving Averages, Really?

A moving average (MA) is just the average price of a cryptocurrency over a specific time period. For example, a 50-day moving average adds up the closing prices of the last 50 days and divides by 50. That number becomes a single line on your chart. As new data comes in, the oldest data drops off, and the line keeps moving-hence the name.

It’s not magic. It’s math. But that math turns chaos into clarity. Traders use it to answer three simple questions:

- Is the market going up or down?

- Where might the price find support or resistance?

- When should I enter or exit a trade?

These questions matter because crypto moves fast. A 10-minute chart can show a fake breakout that vanishes in an hour. Moving averages filter out those false signals and show you what’s actually happening.

The Three Main Types: SMA, EMA, and Why It Matters

Not all moving averages are the same. There are three main types, and each one gives you a different view of the market.

Simple Moving Average (SMA)

The SMA treats every price in the period equally. If you’re looking at a 200-day SMA, today’s price counts the same as the price from 199 days ago. This makes it stable and slow to react. That’s good for spotting long-term trends but bad if you’re trying to catch quick moves.

Bitcoin has bounced off its 200-day SMA dozens of times since 2017. In early 2024, after a sharp drop, BTC held right above this line for over three weeks before rallying. Traders who saw that support level and bought there made solid gains. The SMA doesn’t guess-it just reports what happened. That’s why beginners often start with it.

Exponential Moving Average (EMA)

The EMA gives more weight to recent prices. So if Bitcoin surges 15% today, the EMA reacts faster than the SMA. This makes it better for short-term traders who need to act quickly.

On a 4-hour chart, a 20-day EMA can signal a trend reversal before the 50-day SMA even notices. Many crypto trading bots use the EMA because it’s more responsive. But there’s a catch: because it’s sensitive, it can also give false signals. A quick spike from a single large trade might look like a breakout, but it could just be noise.

Weighted Moving Average (WMA)

The WMA is similar to the EMA but uses a different formula to assign weights. It’s rarely used in crypto trading. Most platforms don’t even offer it by default. Stick with SMA and EMA-they’re what the pros use.

Why the 50-Day and 200-Day MAs Are the Gold Standard

While you can use any timeframe, two moving averages dominate crypto charts: the 50-day and the 200-day.

The 50-day MA shows the medium-term trend. If price is above it, the market is generally bullish. If it’s below, sellers are in control. The 200-day MA? That’s the long-term heartbeat of the market. It’s the line institutions watch. When Bitcoin breaks above its 200-day MA after a long downtrend, it often signals the start of a major bull run.

Here’s what happened in late 2023: Bitcoin had been trading sideways for months. Then, on December 12, it closed above its 200-day MA for the first time in 11 months. Within 30 days, it rallied over 40%. That wasn’t luck. That was a classic institutional signal.

These two lines aren’t just tools-they’re psychological barriers. Thousands of traders watch them. When price hits the 200-day MA, buyers step in. When it falls below, sellers flood the market. That’s why they work.

How Traders Use Crossovers to Time Entries

The most powerful move in moving average trading is the crossover.

It happens when a short-term MA crosses over a long-term one. The two most common signals:

- Golden Cross: The 50-day MA crosses above the 200-day MA. This is a strong bullish signal. It means short-term momentum is finally outpacing long-term trends.

- Death Cross: The 50-day MA crosses below the 200-day MA. This suggests the trend is turning bearish.

These aren’t perfect. In 2022, Bitcoin had a golden cross in March that turned into a trap-price dropped 60% over the next four months. But the signal still mattered. Why? Because it showed a shift in sentiment. The problem isn’t the crossover-it’s using it alone.

Smart traders combine crossovers with other tools. Volume spikes, RSI confirmation, or a break of a key resistance level. A golden cross with high volume? That’s a signal worth acting on. A golden cross with low volume? Probably a false alarm.

Real-World Strategy: The Triple Moving Average Setup

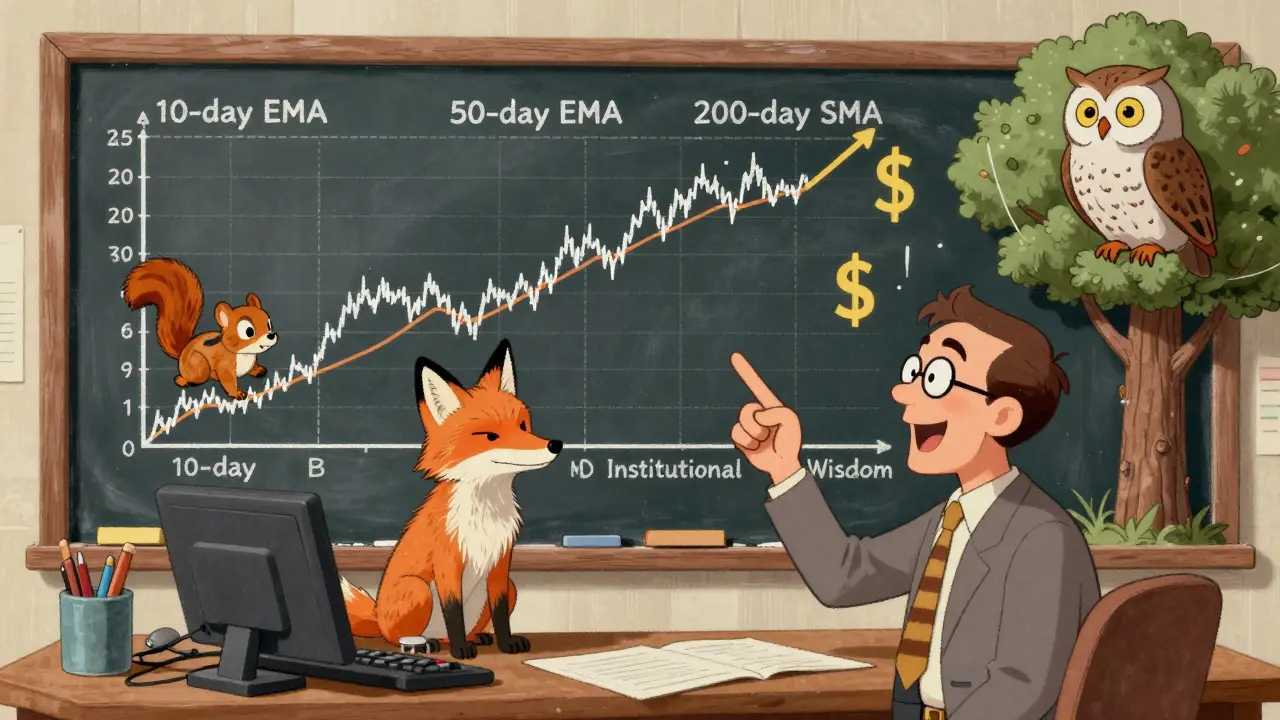

Many experienced crypto traders don’t use just one or two MAs. They stack three:

- 10-day EMA (fast)

- 50-day EMA (medium)

- 200-day SMA (slow)

Here’s how it works:

- If the 10-day EMA is above the 50-day EMA, and both are above the 200-day SMA, you’re in a strong uptrend.

- If the 10-day EMA crosses below the 50-day EMA, it’s a warning sign-maybe it’s time to take profits.

- If price pulls back to the 50-day EMA and bounces off it while still above the 200-day SMA, that’s a low-risk buy zone.

This setup filters out false signals. You’re not just chasing price-you’re waiting for confirmation from multiple timeframes. Reddit crypto traders call this the "triple MA strategy," and it’s one of the most consistent methods for swing trading altcoins.

What Moving Averages Can’t Do

Let’s be clear: moving averages are not crystal balls.

They’re lagging indicators. By definition, they react to price after it’s already happened. If you wait for a 200-day crossover to signal a breakout, you might miss the first 20% of the move.

They also fail in sideways markets. When Bitcoin trades in a tight range for weeks, MAs flatten out and cross back and forth. You’ll get whipsawed-buying, then selling, then buying again. That’s why traders use them with other tools like Bollinger Bands or MACD.

And don’t forget: crypto markets are driven by news, regulation, and sentiment. A moving average won’t tell you if Elon Musk tweets about Dogecoin or if the SEC files a lawsuit. Always combine technical analysis with fundamental awareness.

How to Start Using Moving Averages Today

You don’t need a degree to use moving averages. Here’s how to begin:

- Open a chart on TradingView (it’s free).

- Add a 50-day and 200-day SMA to Bitcoin or Ethereum.

- Watch how price interacts with those lines over the next month.

- Notice when price bounces off the 200-day line. When it breaks through it.

- Try adding a 20-day EMA and watch how it reacts faster than the SMA.

Don’t trade with real money yet. Just observe. Spend a week or two learning how the lines move. Then, when you see a clear crossover with rising volume, try a small trade. You’ll learn more in two weeks of watching than two months of reading theory.

Final Thought: The Foundation of Crypto Trading

Moving averages have been around for over a century. They worked on Wall Street. They work on crypto exchanges. They’ll keep working as long as people trade based on price action.

They’re not flashy. They don’t predict the future. But they reveal what’s already happening. And in crypto, where noise drowns out truth, that’s priceless.

Start simple. Use the 50-day and 200-day. Watch how price behaves around them. Add the EMA when you’re ready. Combine them with volume and context. That’s how the pros do it.

What’s the best moving average for crypto trading?

There’s no single "best" moving average-it depends on your style. Beginners should start with the 50-day and 200-day Simple Moving Averages (SMA) because they’re easy to understand and filter out noise. Short-term traders often prefer the 20-day or 50-day Exponential Moving Average (EMA) because it reacts faster to price changes. Most professionals use both: the 200-day SMA for long-term trend direction and the 50-day EMA for entry signals.

Why do moving averages lag behind price?

Moving averages are calculated using past prices. A 50-day SMA, for example, needs 50 days of data to update. That means it always reflects what happened, not what’s happening right now. This lag is intentional-it helps smooth out short-term spikes and fake breakouts. But it also means you’ll often enter trades after the biggest move has already happened. That’s why traders use volume, RSI, or candlestick patterns to confirm signals.

Can moving averages predict a crypto bull run?

They don’t predict-they reveal. A bull run often starts when price breaks above the 200-day moving average after a long consolidation. That breakout signals that long-term buyers are stepping in. But it doesn’t guarantee the run will continue. You need to see rising volume, strong follow-through, and no major resistance levels ahead. The MA is a flag, not a forecast.

Is the 200-day moving average still reliable for Bitcoin?

Yes, absolutely. Since 2017, Bitcoin has respected its 200-day MA as a key support level over 15 times. In 2023, it held at that level for 11 days before rallying 45%. Institutional investors still use it as a benchmark. While it’s not perfect, it’s one of the most consistent technical levels in crypto history. If price falls below it during a rally, it’s a red flag. If it bounces off it during a dip, it’s a green light.

Should I use SMA or EMA for crypto?

Use SMA for long-term trends and EMA for short-term signals. The SMA is better for spotting major support and resistance levels (like the 200-day line). The EMA is better for catching quick moves in volatile markets-like altcoin pumps. Many traders use both: the 200-day SMA for the big picture and the 20-day EMA for entry timing. Don’t pick one over the other-use them together.