Tunisia Crypto Policy Checker

Current Regulatory Status Overview

Full Ban Status

All cryptocurrency transactions require explicit state permission, which is rarely granted.

ActiveRegulatory Sandbox

Limited blockchain experiments allowed under strict supervision for fintech firms.

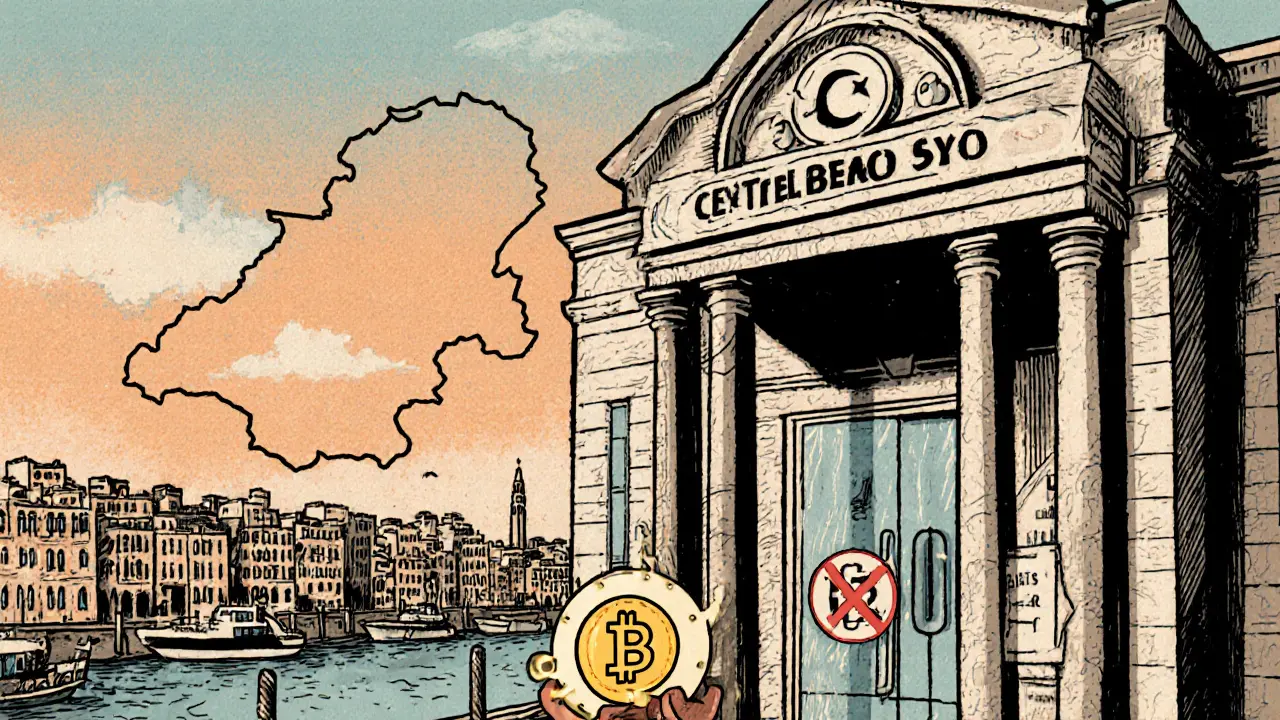

OperationalWhen the Central Bank of Tunisia (BCT) issued a sweeping directive in May 2018, it effectively shut the door on all crypto activity inside the country. The ban covers everything from buying Bitcoin to running a mining farm, and it sticks to the point that any crypto transaction needs explicit state permission - which, so far, simply doesn’t happen. If you’re wondering why the ban matters, how it’s enforced, and whether it could melt away, this guide walks you through the whole picture in plain language.

Quick Takeaways

- Since 2018, Tunisia forbids all cryptocurrency transactions without a state licence.

- Violations can lead to fines or up to five years in prison.

- Three bodies enforce the ban: the Central Bank of Tunisia, the Ministry of ICT & Digital Economy, and the Financial Market Council.

- Mining rigs can be seized at the border, and banks block crypto‑related card purchases.

- A regulatory sandbox launched in 2020 shows the government may be open to blockchain use, even while the crypto ban stays.

What the Ban Actually Says

Tunisia is a North African nation that introduced a blanket cryptocurrency prohibition in 2018. The BCT directive declares that any virtual‑currency transaction is illegal unless a specific licence is granted by the state. That means:

- Public exchanges cannot list or trade crypto assets.

- Merchants may not accept digital tokens for goods or services.

- Financial institutions must block any crypto‑related transfers.

- Mining equipment imported into the country can be confiscated.

Violating these rules can result in fines and imprisonment of up to five years, as stipulated under Tunisia’s currency‑control regulations.

Who Enforces the Ban?

The enforcement network is a trio of agencies:

- Central Bank of Tunisia (BCT) issues the ban and monitors compliance across the banking sector.

- The Ministry of ICT & Digital Economy handles the technical side, including the regulatory sandbox for blockchain pilots.

- The Financial Market Council (CMF) would oversee tokenised securities if the ban were lifted.

Customs officers also play a role by seizing ASIC miners at ports, and the Tunisian Financial Analysis Committee (CTAF) receives mandatory suspicious‑transaction reports within ten days.

How the Ban Affects Everyday Activities

Buying or selling crypto - Any exchange that operates inside Tunisia is forced to shut down. Even overseas platforms become inaccessible because banks block the card purchases needed to fund those accounts.

Paying with crypto - Retailers cannot display a crypto‑payment option, and the law classifies any such transaction as illegal.

Mining - Importers must declare mining rigs, and customs can confiscate them on the spot. Converting mined coins into Tunisian dinars violates the 2018 directive.

KYC/AML compliance - Companies must keep customer identification records for at least ten years and report any suspicious activity to CTAF. The requirements cover standard KYC (photo ID, utility bill) and enhanced due diligence for high‑risk clients such as Politically Exposed Persons (PEPs).

Why Tunisia Chose a Total Ban

The BCT cited two main worries: capital flight and money‑laundering risk. Tunisia’s balance‑of‑payments challenges make the government nervous about anything that could drain foreign reserves. Crypto’s pseudo‑anonymous nature also clashes with traditional central‑banking goals of controlling the money supply.

Compared with neighbours, Tunisia’s stance is among the most restrictive. Only eight countries worldwide, including China and Qatar, have adopted similarly sweeping bans. Meanwhile, nearby Morocco and Algeria also block crypto, but a few regional players-like Egypt-allow limited trading under strict supervision.

Underground Activity and Public Sentiment

Even with the ban, a modest underground scene survives. From 2013‑2017, Bitcoin was traded in informal chat groups. In 2021, a teenager was sentenced for a small crypto exchange, sparking debate on decriminalisation. Today, peer‑to‑peer swaps still happen, but participants face legal uncertainty.

Public opinion is shifting. A 2024 poll of Tunisian university students showed 62% favour some form of regulated crypto use, while only 18% support the complete prohibition. The debate has reached cabinet level, and a draft bill in 2025 proposes decriminalising possession and introducing a licensing regime.

Sandbox Experiments: A Glimpse of Flexibility

In 2020, the Ministry of ICT launched a regulatory sandbox that lets fintech firms test blockchain‑based applications under tight oversight. Participants - such as VFunder (crowdfunding), Hydro E‑Blocks (carbon‑tracking), and No Phobos (AI‑generated NFTs) - operate most of their infrastructure outside Tunisia to stay clear of the ban.

These pilots focus on permissioned ledgers for land registries, subsidy distribution, and traceability, not on open‑ended cryptocurrencies. The sandbox shows the government is willing to explore blockchain’s benefits while still blocking crypto as a form of money.

Potential Paths Forward

Three scenarios could reshape Tunisia’s crypto landscape:

- Decriminalisation and licensing - The 2025 draft bill could legalise possession and set up a licensing authority for exchanges, similar to the EU’s MiCA framework.

- Selective permission for stablecoins - To curb capital flight while preserving digital payments, Tunisia might allow only government‑backed stablecoins.

- Maintain the status quo - Economic pressure could keep the ban in place, especially if currency stability remains a top priority.

International pressure from bodies like the FATF, which promotes AML‑compatible crypto regulations, may nudge policymakers toward a more nuanced approach.

Comparison: Countries With Full Bans vs. Permissive Regimes (2025)

| Country | Policy Type | Key Restrictions | Notable Exceptions |

|---|---|---|---|

| Tunisia | Full Ban | All trading, payments, mining illegal without licence | Sandbox for permissioned blockchain pilots |

| China | Full Ban | Crypto mining and trading prohibited | State‑backed digital yuan |

| ElSalvador | Legal Tender | None for Bitcoin | Government‑issued wallets |

| Germany | Permissive | Crypto treated as financial instrument | Bank licences for exchanges |

| Singapore | Permissive | AML/KYC compliance required | Crypto‑friendly licensing framework |

What This Means for Investors and Entrepreneurs

If you’re an investor eyeing North Africa, the ban forces you to look at neighbouring markets or use offshore structures. For local entrepreneurs, the sandbox offers a legal route to build blockchain‑based services - but you must keep any crypto‑token activities out of the country.

Compliance teams should audit KYC processes, retain records for a decade, and set up a rapid reporting channel to CTAF. Ignoring these steps can quickly turn a promising fintech startup into a criminal case.

Key Takeaways and Next Steps

- Understand that the ban is still law - no crypto‑related transaction is safe without a licence.

- Monitor the 2025 legislative draft; it could be the first sign of a shift.

- Leverage the sandbox if you need blockchain tech, but keep any token issuance outside Tunisian jurisdiction.

- Maintain rigorous AML/KYC documentation - the ten‑year retention rule is non‑negotiable.

- Watch international trends; FATF guidelines may provide a template for future regulation.

Frequently Asked Questions

Is it illegal to own Bitcoin in Tunisia?

Yes. Holding any cryptocurrency without a state licence violates the 2018 BCT directive and can lead to fines or imprisonment.

Can I mine crypto from my home in Tunisia?

No. Importing mining hardware is subject to seizure, and converting mined coins to dinars is prohibited.

What is the regulatory sandbox?

Launched in 2020, the sandbox lets fintech firms test permissioned‑blockchain solutions under close supervision. It does not allow public crypto trading.

Are there any plans to relax the ban?

A draft bill in 2025 proposes decriminalising possession and creating a licensing regime. The timeline is unclear, but the debate indicates possible softening.

How does the ban affect foreign investors?

Foreign investors must avoid any crypto‑related activity on Tunisian soil. They often set up offshore entities or choose neighbouring markets with clearer rules.

Taylor Gibbs

May 13, 2025 AT 13:08Hey folks, just wanted to point out that while Tunisia’s crypto ban looks harsh, there are a few practical takeaways. First off, if you’re thinking about any crypto activity there, you’ll need a state licence – which is practically never handed out. The sandbox is a tiny window where fintech can still experiment, so keep an eye on those pilot projects. Also, remember the ten‑year KYC record rule – it’s not just bureaucracy, it can actually land you in hot water if you slip. Bottom line: stay informed, avoid illegal swaps, and consider offshore routes if you really need exposure.

Cynthia Rice

May 13, 2025 AT 14:40The ban feels like a dark cloud hanging over every Tunisian’s digital dream.

Tyrone Tubero

May 13, 2025 AT 17:26The crypto ban in Tunisia is not just a law, it is a wall that separates hope from reality. It was written in 2018 and it still stands strong today. The Central Bank says any crypto move needs a licencse that never comes. Banks block card buys, and customs seize mining rigs at the dock. Even holding a bitcoin in a personal wallet is called illegal, according to the decree. The penalties can reach five years in prison, a fate that scares many young people. Yet a small underground market keeps trading in secret chat groups. Those traders risk everything for a few coins, because they believe in the technology. The government’s sandbox shows they want blockchain, but only the kind they can control. Fintech firms can test permissioned ledgers, but they cannot launch a public token. This split creates a paradox where innovation is allowed, but the core asset is banned. Investors watching from abroad must use offshore structures, or look at neighboring markets like Morocco. The strict AML rules force companies to keep records for ten years, a burden that many startups cannot bear. Public opinion is shifting, with university surveys showing a majority want some regulated use. Still, the law remains on the books, and enforcement agencies are ready to act at any time. So anyone thinking about crypto in Tunisia should tread carefully, or better yet, stay out altogether.

Alex Gatti

May 13, 2025 AT 20:13Great summary and i appreciate the practical tips let’s keep an eye on the sandbox developments

John Corey Turner

May 13, 2025 AT 23:00Indeed, the regulatory landscape reads like a labyrinth of red tape, yet within those twists we can glimpse opportunities for avant‑garde fintech innovators willing to dance on the edge of compliance.

Katherine Sparks

May 14, 2025 AT 01:46Dear community, I commend the thorough exploration of Tunisia’s regulatory framework; the detailed synthesis offers invaluable guidance for practitioners seeking compliance. Should you require further clarification, please feel free to reach out – I remain at your disposal. :)

Kimberly Kempken

May 14, 2025 AT 04:33Honestly the whole ban is a relic of outdated fear‑mongering; crushing innovation under the guise of “financial stability” only serves elite interests and should be torn down immediately.

Eva Lee

May 14, 2025 AT 07:20From a risk‑management perspective, the macro‑policy externalities induced by such prohibition generate systemic liquidity constraints, thereby amplifying counterparty exposure across the fintech value chain.

stephanie lauman

May 14, 2025 AT 10:06It is evident that international banking cartels are colluding with Tunisian regulators to keep crypto out of the region, preserving their monopoly over cross‑border payments. :)

Twinkle Shop

May 14, 2025 AT 12:53Tunisia’s current prohibition can be interpreted as a strategic fiscal maneuver aimed at preserving sovereign monetary autonomy while simultaneously mitigating exposure to volatile digital asset markets; this dichotomy reflects a broader regional trend wherein policymakers balance the imperative for technological advancement against the perceived risks of capital flight. The sandbox initiative, albeit limited to permissioned blockchain applications, exemplifies a controlled experimentation paradigm that aligns with regulatory prudence. Moreover, the ten‑year KYC retention requirement underscores a commitment to robust anti‑money‑laundering safeguards, albeit at the cost of heightened operational overhead for nascent enterprises. Stakeholders should therefore calibrate their compliance architectures to accommodate these stringent mandates while advocating for incremental liberalization through evidence‑based policy dialogues.

Jenise Williams-Green

May 14, 2025 AT 15:40It is a moral imperative for any society that claims to champion progress to reject draconian bans that imprison ideas; the Tunisian crypto prohibition stands as a stark testament to the perils of fearing the future.

Kortney Williams

May 14, 2025 AT 18:26I appreciate the depth of analysis presented here and will reflect on its implications.

Promise Usoh

May 14, 2025 AT 21:13In summation, the existing legal architecture imposes substantial barriers yet also reveals avenues for compliant innovation; future legislative revisions may well redefine the equilibrium between control and creativity.