Order Flow Analysis in Crypto Markets

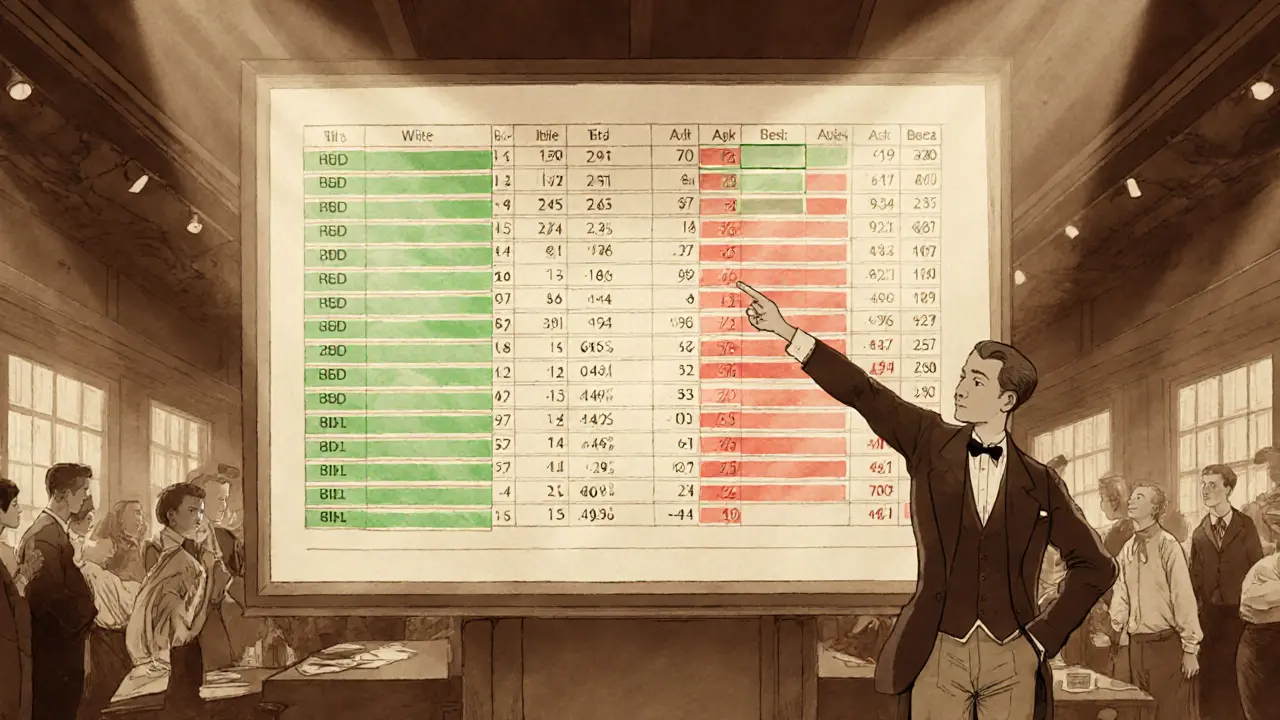

When working with order flow analysis, the practice of tracking buy and sell transactions to gauge market direction and pressure. Also known as trade flow examination, it helps traders spot real‑time supply‑demand shifts. The core data source is the order book, a live list of pending buy and sell orders at each price level. By watching how orders stack up, you get a clear picture of market depth, the amount of liquidity behind price points. Liquidity pools, where traders supply assets to automated market makers, also shape order flow because pool imbalances create price pressure. All this information funnels through a crypto exchange, the platform that aggregates order books, depth charts, and pool data for users. Understanding order flow analysis is essential for anyone who wants to read the market instead of reacting to it.

Why Order Flow Matters for Risk Management and Tokenomics

Order flow analysis isn’t just a fancy chart—it directly feeds into risk management, helping traders size positions, set stop‑losses, and avoid sudden squeezes. When a token’s tokenomics the design of supply, utility and distribution mechanisms change, you’ll often see a shift in order flow as buyers and sellers react to new incentives. Stablecoins, for example, generate a unique order flow pattern because their pegged nature draws large, predictable inflows and outflows; tracking that flow can reveal early signs of de‑pegging risk. Cross‑chain bridges also influence order flow: when a bridge opens new routes between Bitcoin, Ethereum, or Solana, traders flood the order books with arbitrage orders, creating spikes that signal market opportunities. By linking order flow data to these broader concepts, you get a holistic view that’s far more actionable than isolated price charts.

Practical tools are readily available on platforms like OKX, Virtuse, or any major exchange that offers depth charts and real‑time order book visualizers. These interfaces let you filter by token, view cumulative volume, and even spot large hidden orders that can move markets once they hit. Combining order flow analysis with insights from airdrop announcements or regulatory news—like a new crypto ban or a MiCA license—helps you anticipate sudden demand surges or drops before they happen. The articles below dive deeper into each of these angles, from stablecoin behavior and liquidity pool ratios to exchange reviews and risk‑management strategies. Browse the collection to see how seasoned traders turn raw order flow into clear, profitable decisions.

Understanding Order Book Data for Effective Trading Analysis

by Johnathan DeCovic Feb 5 2025 17 TechnologyLearn how order book data works, why it matters for trading, and practical steps to use market depth, bid‑ask spread, and order flow for better strategies.

READ MORE