Crypto Volatility: Understanding the Swings that Shape Digital Markets

When dealing with Crypto Volatility, the rapid and often unpredictable price swings seen in digital assets, traders feel the heat of sudden rallies and sharp drops. This turbulence isn’t random; it’s the result of supply‑demand imbalances, macro‑economic news, and network events. Think of it as a roller coaster that reacts to every tweet, regulation, or protocol upgrade. Below you’ll see why crypto volatility matters for anyone holding or swapping coins.

Key Factors Behind Crypto Volatility

One of the biggest buffers against wild price swings is Risk Management, a set of tools and habits designed to limit losses in uncertain markets. Simple moves like position sizing, stop‑loss orders, and diversification turn chaos into a manageable risk profile. At the same time, Tokenomics, the economic design of a cryptocurrency, including supply rules and incentive structures can amplify or dampen volatility. A token with a fixed max supply may experience sharper spikes when demand surges, whereas a project that mints new coins regularly can see a steadier price curve. Another driver is the rise of Cross‑Chain Bridges, protocols that let assets move between blockchains, creating arbitrage opportunities and liquidity shifts. When a bridge opens, sudden inflows or outflows can cause price shockwaves across multiple chains.

Regulatory shifts also tip the volatility balance. The Regulatory Environment, government policies, legal rulings, and compliance frameworks that shape how crypto businesses operate can trigger market rallies or sell‑offs overnight. For example, a new ban in a major economy often triggers a sharp dip, while a friendly licensing announcement can spark a rapid upturn. These three forces—risk management practices, tokenomics design, and regulatory news—interact constantly, forming a feedback loop where each influences the other. In other words, good risk management helps you ride the volatility caused by tokenomics and regulation, while understanding tokenomics lets you anticipate how new rules might move prices.

Below you’ll find a curated collection of articles that dig deeper into each of these aspects. From detailed risk‑management guides to breakdowns of token supply models, and from bridge technology explanations to the latest regulatory updates, the posts will give you the tools to read and react to market swings with confidence.

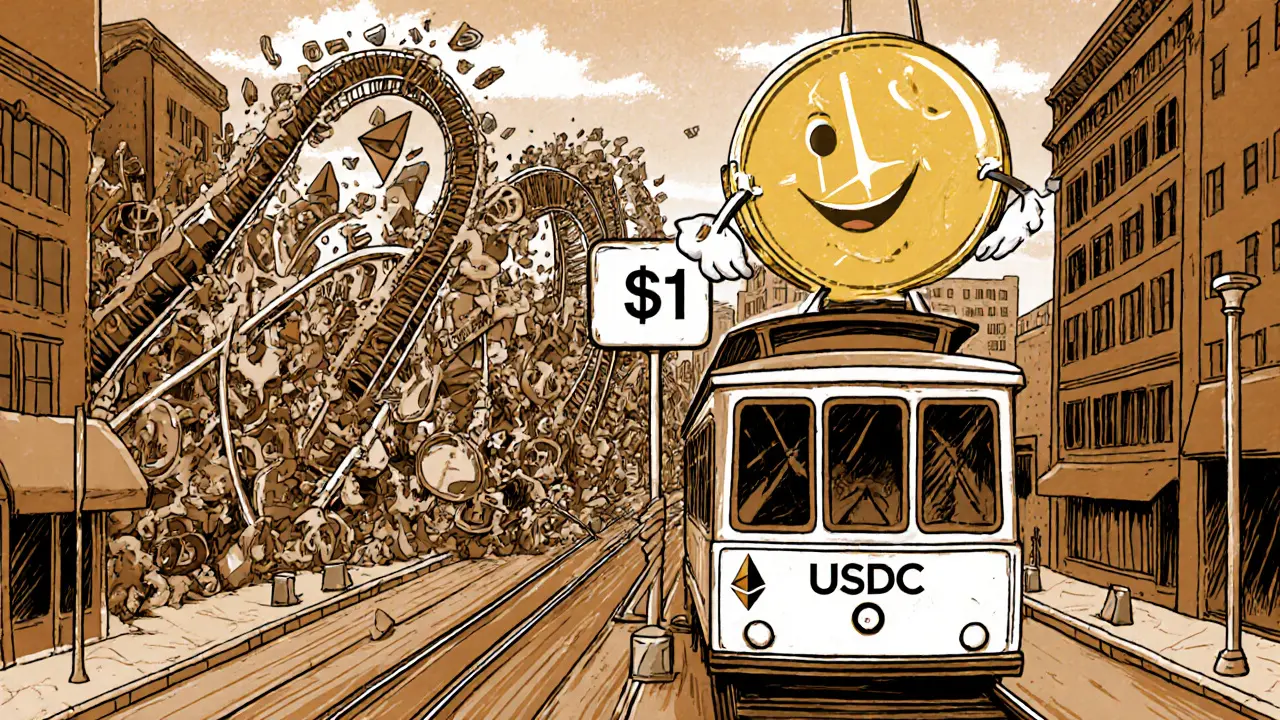

Stablecoins: Tackling Crypto Volatility in 2025

by Johnathan DeCovic Oct 12 2025 22 CryptocurrencyExplore how stablecoins tame crypto volatility, the mechanisms behind their peg, major players, benefits, risks, and 2025 market trends in clear, practical terms.

READ MORE