$250

When working with $250, a reference amount that shows up in token pricing, airdrop thresholds, and risk calculations across the crypto space. Also known as a quarter‑dollar benchmark, it helps traders gauge entry points, investors assess value, and developers set reward levels. Stablecoins, digital assets pegged to a fiat value, often use $250 as a liquidity buffer or a minimum holding requirement to keep their peg stable. Meanwhile, Crypto airdrops, free token distributions that reward community members frequently set $250 worth of token value as the eligibility floor, making the amount a practical trigger for participation. Finally, solid risk management, the process of limiting losses and protecting capital strategies often allocate $250 as a “stop‑loss” unit or as a base for position sizing, ensuring that exposure stays within comfortable limits.

Why $250 Matters Across Different Crypto Activities

The $250 figure isn’t just a random number; it ties directly into how the market operates. For stablecoins, having a $250 reserve can absorb sudden price shocks, which is why many issuers keep that amount in reserve per 10,000 tokens. In the world of airdrops, projects use $250 as a benchmark to filter serious participants from bots, so you’ll see eligibility rules like “hold at least $250 worth of XYZ token.” When it comes to risk management, traders often set a $250 stop‑loss on a single trade, which creates a clear rule: if the market moves against you by that amount, you exit the position. These three connections – stablecoins, airdrops, and risk management – illustrate how $250 functions as a bridge between valuation, reward distribution, and safety nets.

Understanding these links can sharpen your crypto decisions. If you notice a new airdrop promising $250 in free tokens, ask yourself whether the project also offers a stablecoin‑backed reserve or a clear risk‑management plan; that combination usually signals a more trustworthy offering. Conversely, if a token’s price hovers around $250 and the team highlights strong liquidity pools, it often means the market sees that level as a psychological support zone. By keeping an eye on how $250 shows up in stablecoin reserves, airdrop thresholds, and risk‑management rules, you can spot patterns that many casual traders miss. Below you’ll find a curated list of articles that break down each of these aspects, from deep dives into stablecoin mechanics to step‑by‑step airdrop guides and practical risk‑management tips.

Ready to see how $250 shapes real‑world crypto scenarios? Below is a collection of posts that explore the amount from every angle – stablecoin stability, airdrop eligibility, liquidity pool ratios, and disciplined trading practices. Dive in to get actionable insights and see how this simple $250 benchmark can become a powerful tool in your crypto toolbox.

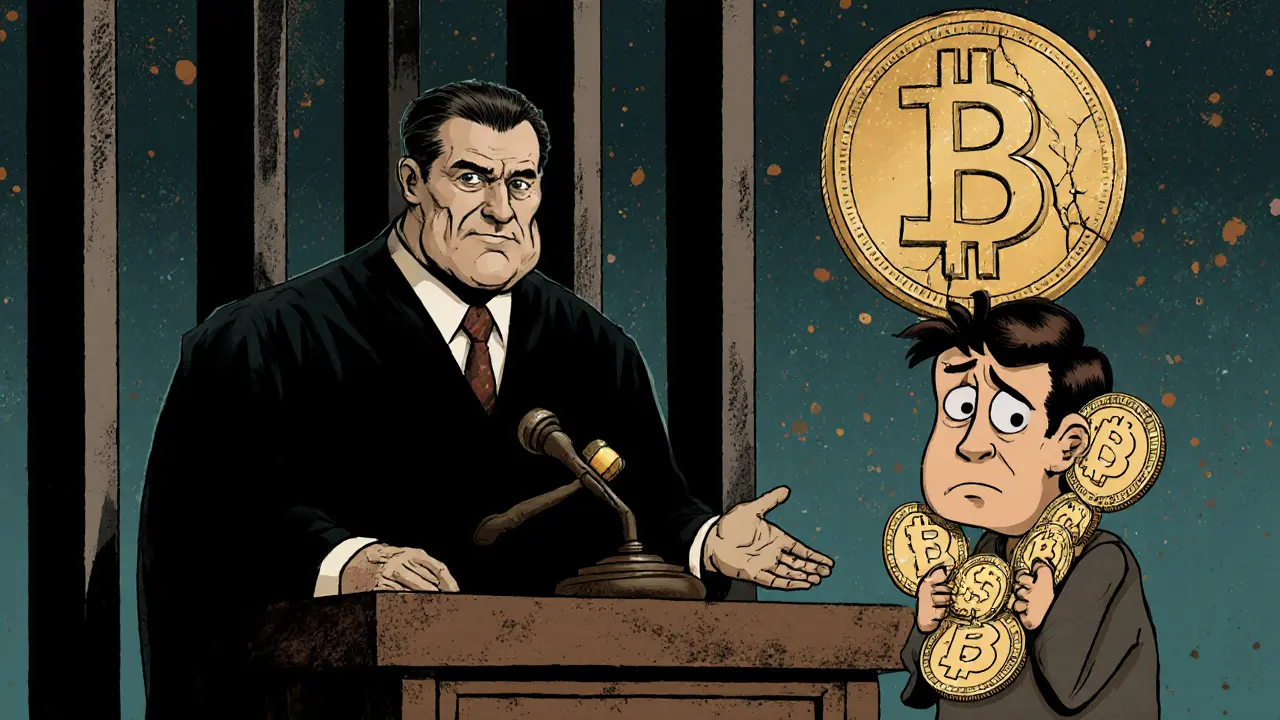

Crypto Tax Evasion: 5‑Year Prison, $250K Fine & How to Stay Safe

by Johnathan DeCovic Nov 20 2024 17 CryptocurrencyLearn how cryptocurrency tax evasion can lead to 5 years in prison and $250,000 fines, understand IRS enforcement tools, and get a step‑by‑step compliance guide.

READ MORE