Key Themes Shaping the Crypto Landscape

Regulation is the fourth pillar that frames every discussion. Recent moves in India, Tunisia, and the EU’s MiCA framework illustrate how cryptocurrency compliance shapes exchange behavior, token listings, and user safety. Understanding crypto regulation helps you avoid legal pitfalls and pick platforms that respect security standards. At the same time, airdrops remain a powerful marketing and distribution tool. By leveraging smart contracts, projects can automate eligibility checks and token distribution, making airdrop execution both scalable and auditable. The synergy between smart contracts and airdrops means participants get instant, verifiable rewards, while developers keep costs low.

All these pieces—stablecoins, smart contracts, cross‑chain bridges, regulation, and airdrops—create a mosaic of opportunities and risks. For instance, a stablecoin’s peg stability depends on robust smart contract code and transparent reserve audits; a bridge’s security hinges on rigorous contract reviews and bug bounty programs; airdrop campaigns must navigate tax rules and anti‑spam regulations. By grasping how each entity influences the others, you can make smarter decisions, whether you’re staking, trading, or building a new protocol. Below you’ll find a curated collection of articles that dive deeper into each of these topics, offering practical tips, risk assessments, and real‑world examples.

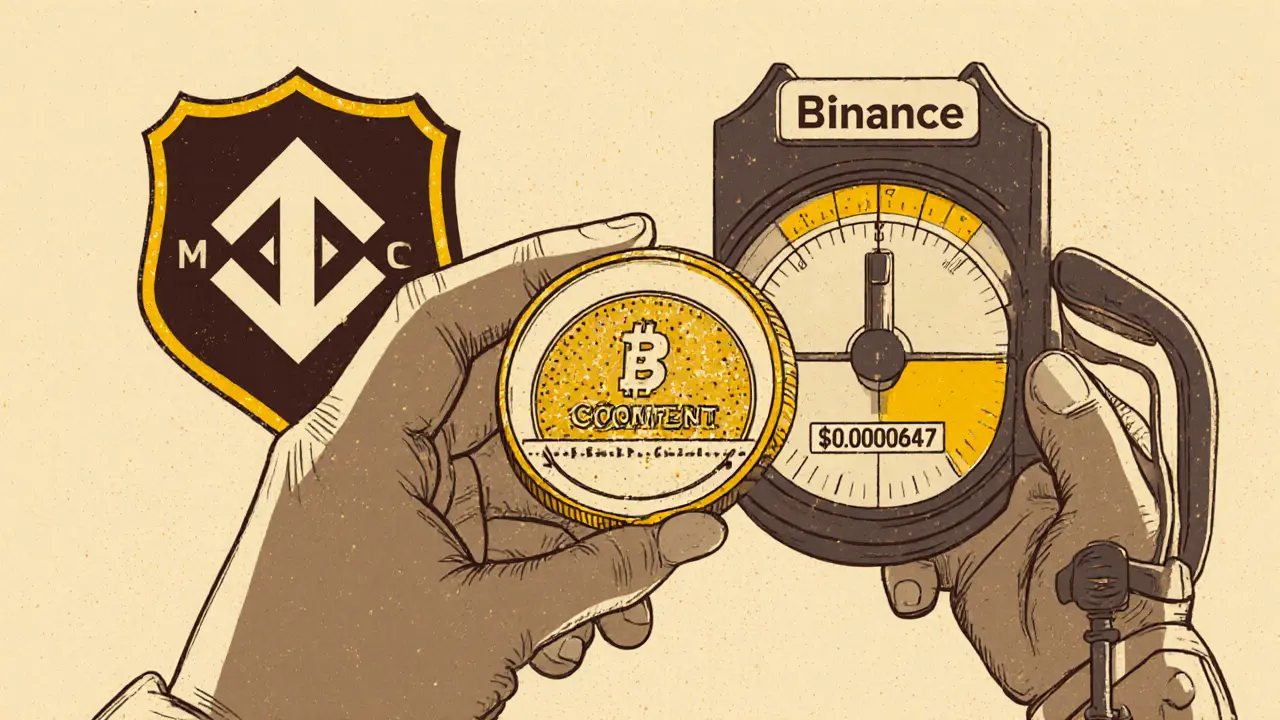

Understanding MContent (MCONTENT) Crypto Coin - Basics, Market Data & Risks

by Johnathan DeCovic Sep 17 2025 24 CryptocurrencyA detailed look at MContent (MCONTENT) crypto coin, covering its purpose, market data, Watch2Earn model, risks, and how it stacks up against similar creator‑focused tokens.

READ MORE