DeFi – Decentralized Finance Explained

When working with DeFi, a system of financial services built on blockchain that operates without traditional intermediaries. Also known as Decentralized Finance, it lets anyone lend, borrow, trade, or earn yield directly from their wallet. The ecosystem runs on open‑source protocols, so anyone can read the code, contribute improvements, or launch a competing product. From savings accounts that pay higher interest than banks to global token swaps that happen in seconds, DeFi aims to democratize access to financial tools. Understanding how DeFi works is the first step toward smarter crypto decisions.

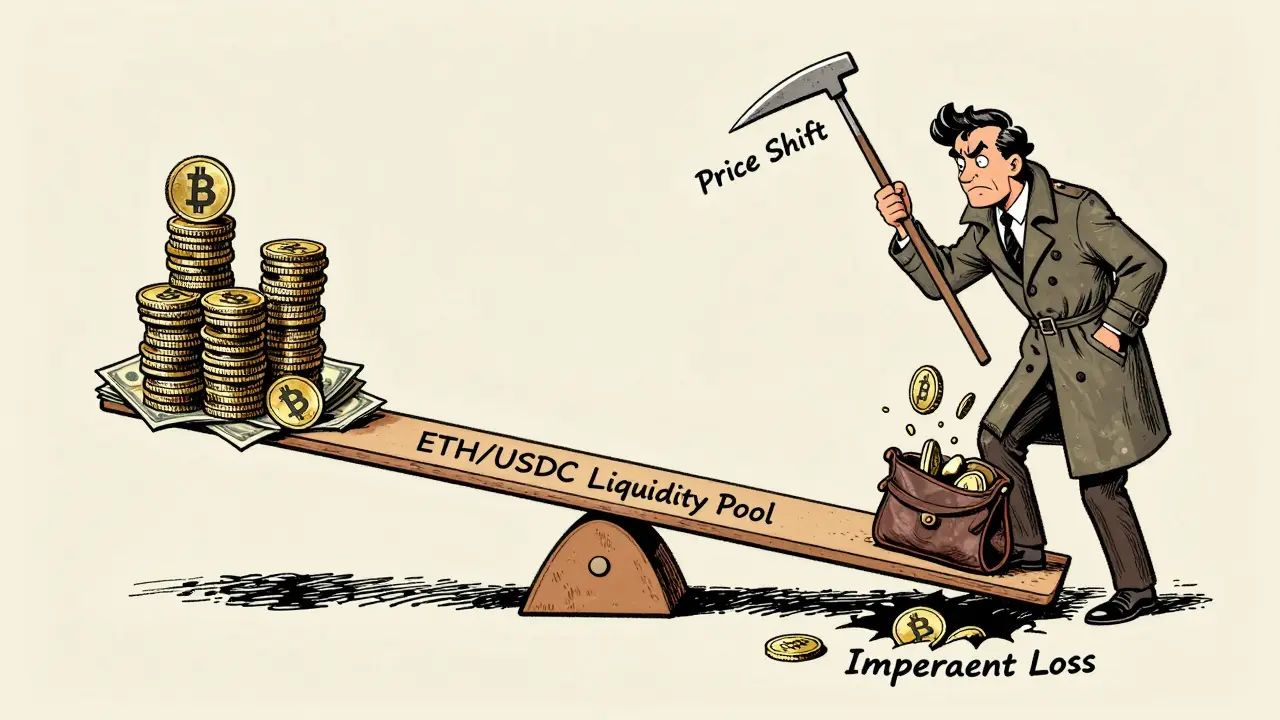

Stablecoins, cryptocurrencies pegged to a stable asset like the US dollar, designed to reduce price swings act as the cash layer of the ecosystem, letting users move in and out of volatile markets without exiting to fiat. They come in three flavors: fiat‑collateralized (e.g., USDC), crypto‑collateralized (e.g., DAI) and algorithmic designs that maintain the peg through supply adjustments. Cross‑chain bridges, protocols that lock assets on one chain and mint wrapped versions on another give DeFi the ability to talk across Bitcoin, Ethereum, Solana and dozens of other networks, expanding the pool of users and liquidity. Bridges can be trustless, using smart contracts and fraud proofs, or federated, relying on a set of validators—each model has trade‑offs in speed, cost, and security. And Liquidity pool token ratios, the math that determines how assets are priced inside automated market makers shape the yields you earn when you provide capital to a pool. Constant‑product formulas like Uniswap’s x·y=k, weighted pools that favor certain assets, and stable‑swap curves for low‑slippage trades all influence impermanent loss and profit potential. Together these pieces create a toolkit where DeFi can offer lending, swapping, and yield farming all in one place.

Because every action runs on code, smart contract audits become the safety net that catches bugs before they cost users money. A solid audit reviews the contract’s logic, checks for re‑entrancy, overflow, and access‑control flaws, and often includes formal verification. Reputable firms publish detailed reports, and many projects adopt bug‑bounty programs for continuous monitoring. Skipping this step can lead to exploits that wipe out liquidity in minutes—think of the infamous bridge hacks that drained millions. Ongoing post‑deployment monitoring, upgradeable proxy patterns, and transparent governance further reduce risk, making the DeFi stack more resilient for everyday users.

Explore Our DeFi Resources

Below you’ll find guides that break down each component in plain language – from how stablecoins tame crypto volatility in 2025, to a step‑by‑step look at cross‑chain bridges, to a deep dive on liquidity pool token ratios and their risk profile. We also cover smart contract audit best practices, the latest trends in DeFi regulation, and practical tips for earning safe yields. Whether you’re just curious about earning interest, planning to build a DeFi app, or want to stay ahead of security pitfalls, the articles here give actionable insight without the jargon. Let’s jump into the collection and see what each topic offers.

How to Minimize Impermanent Loss in DeFi Liquidity Pools

by Johnathan DeCovic Jan 2 2026 22 CryptocurrencyLearn how to minimize impermanent loss in DeFi by choosing stablecoin pools, using concentrated liquidity wisely, and ensuring your fees beat your losses. Real strategies for 2026.

READ MOREHow Flash Loans Work Without Collateral in DeFi

by Johnathan DeCovic Dec 4 2025 18 CryptocurrencyFlash loans let you borrow crypto without collateral, but only if you repay it within one blockchain transaction. Learn how they work, what they're used for, and why they're both powerful and dangerous.

READ MOREMDX Airdrop Details: How to Spot and Claim Mdex’s MDX Token Giveaway

by Johnathan DeCovic Oct 7 2025 13 CryptocurrencyLearn how to spot a real MDX airdrop, avoid scams, and prepare your wallet for Mdex's native token giveaway with step‑by‑step tips and reliable news sources.

READ MORE