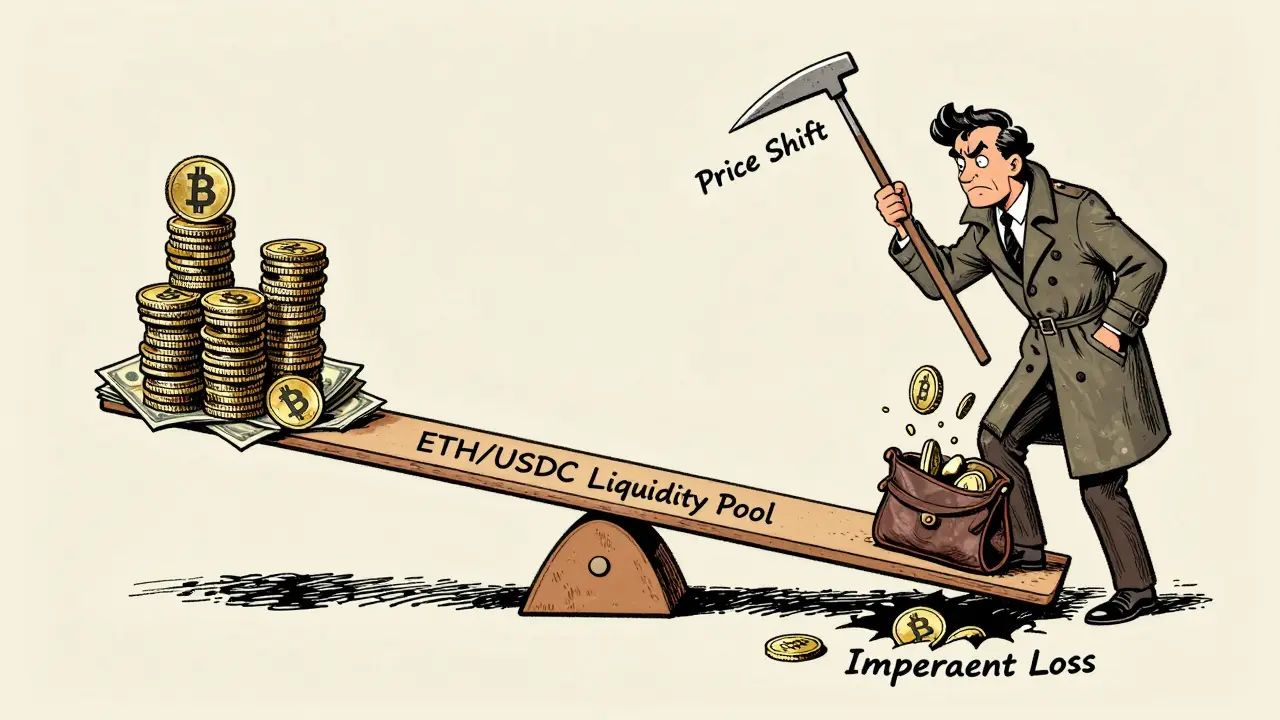

Impermanent loss isn’t something you can avoid if you’re providing liquidity in DeFi. It’s built into the math of automated market makers like Uniswap and Curve. But you can control how much of it hurts you. The key isn’t to eliminate it - that’s impossible - but to make sure your trading fees earn more than you lose. Here’s how real liquidity providers are doing it in 2026.

What Impermanent Loss Actually Does to Your Money

Imagine you put $1,000 into a liquidity pool with 50% ETH and 50% USDC. The price of ETH is $2,000. A week later, ETH hits $4,000. You might think you’ve doubled your money. But when you withdraw, you only have $1,800 worth of assets instead of $2,000 you’d have if you just held ETH. That $200 gap? That’s impermanent loss. It happens because AMMs rebalance your pool automatically. When ETH rises, arbitrage traders buy cheap ETH from your pool and sell it on centralized exchanges, slowly draining your ETH balance and filling your pool with more USDC. You end up with less of the asset that went up, and more of the one that didn’t. The math is simple: if the price of one token moves 2x, you lose about 5.7%. At 3x, it’s 13.4%. At 4x? You’re down 40%. The word “impermanent” is misleading. If ETH stays at $4,000, your loss is permanent. It only becomes “impermanent” if the price snaps back - which is rare with major assets. Most LPs who don’t understand this end up surprised when they withdraw and see less than they deposited.Stablecoin Pools Are Your Safest Bet

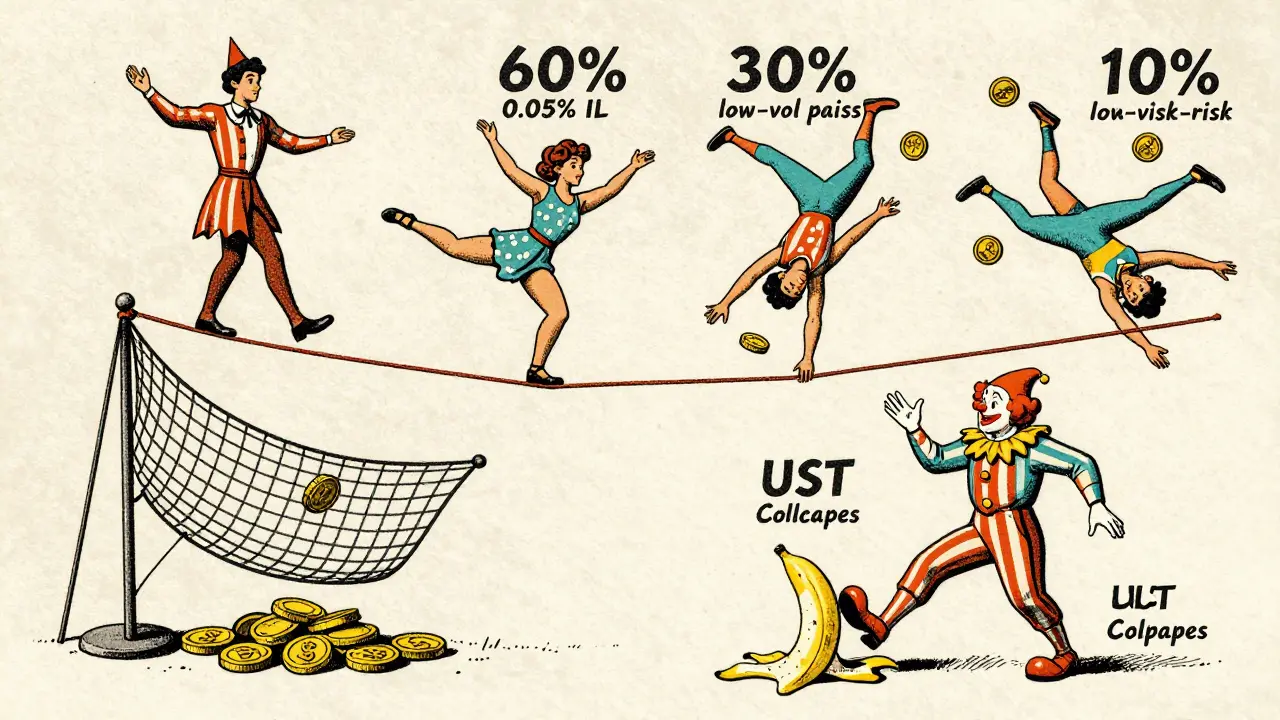

The single most effective strategy to reduce impermanent loss is to stick to stablecoin pairs: USDC/USDT, DAI/USDC, or even BUSD/USDT. These tokens are designed to stay pegged at $1.00. Their price rarely moves more than 0.1% in a week. Ston.fi’s 2024 data shows stablecoin pools have less than 0.05% impermanent loss over 90% of the time. That’s almost nothing. Meanwhile, you still earn trading fees - often between 2% and 5% APY. Compare that to ETH/UNI, where a 15% price swing can wipe out 18% of your capital. You’re trading higher returns for near-zero risk. Professional LPs like APY_Hunter allocate 60% of their capital to stablecoin pools. Why? Because during the March 2023 banking crisis, volatile pairs lost 20%+ in impermanent loss. Stablecoin LPs barely blinked. Reddit user DeFi_Diver earned 12.3% APY over six months in a USDC/DAI pool - fees covered 8.7% of his tiny impermanent loss. That’s the model.Use Concentrated Liquidity (Uniswap v3) - But Don’t Set It and Forget It

Uniswap v3 changed everything by letting you choose a price range for your liquidity. Instead of spreading $1,000 across $1,000 to $5,000 for ETH/USDC, you can lock it all between $1,900 and $2,100. That means 90%+ of your capital is working when the price is near $2,000. This boosts capital efficiency by up to 4,000x. You earn way more fees. But here’s the catch: if ETH moves outside your range, you earn zero fees. And if it crashes or surges, you’re stuck holding only one asset - and your impermanent loss skyrockets. The trick? Active management. LPs who check their positions weekly and adjust ranges when price moves 10%+ earn 2.3x more net returns than passive v3 users. Those who set a range and ignore it? They underperform v2 by 15%. Tools like Gamma.xyz automate this - but charge 0.3% monthly. For experienced users, it’s worth it. For beginners? Stick to stablecoins until you understand the math.

Choose Pools With Higher Fees and Lower Volatility

Not all volatile pairs are created equal. ETH/USDC has higher volatility than SOL/USDC. UNI/ETH has wild swings; AAVE/ETH is more stable. Check 30-day volatility metrics before depositing. Look for pools with 0.3% or higher fees. CryptoHopper’s 2024 analysis found that pools with fees above 0.3% can offset typical impermanent loss for moderate volatility pairs under normal conditions. That’s why many LPs prefer ETH/USDC (0.3%) over ETH/SHIB (0.01% - too risky). Balancer’s weighted pools (like 80% ETH / 20% DAI) also help. They reduce impermanent loss by 30-40% compared to 50/50 pools because you’re not equally exposed to both assets. If ETH crashes, you lose less because you held more DAI. DODO’s Proactive Market Maker (PMM) algorithm showed 22% better IL resistance during the 2022 crash. It’s not widely used yet, but it’s worth watching.Never Put Money in Pools With Unstable or New Tokens

The worst-case scenario? Liquidity pools tied to collapsed protocols. In May 2022, UST depegged from $1.00. Within 72 hours, LPs in UST/ETH pools lost up to 99% of their capital - not just from impermanent loss, but from the token itself becoming worthless. OSL Academy calls this “compound risk.” Impermanent loss + protocol failure = disaster. Avoid pools with:- Tokens under $100 million market cap

- Projects with no audits

- Highly speculative tokens (SHIB, PEPE, etc.)

- Any token tied to a lending or yield protocol with unclear reserves

Diversify Like a Pro

The most successful LPs don’t put all their money in one place. APY_Hunter’s strategy is simple:- 60% in stablecoin pairs (0.05% IL, 4% APY)

- 30% in low-volatility volatile pairs (ETH/USDC, 5-7% IL, 12% APY)

- 10% in high-risk, high-reward pools (new tokens, 15-25% IL, 30-50% APY)

Use Tools to Predict and Track Loss

You don’t need to be a mathematician, but you need tools. impermanentloss.io lets you plug in your pair, deposit amount, and price change - and it shows you exactly how much you’d lose. SushiSwap added a built-in IL simulator in Q4 2023. DeFi Education Protocol’s free calculator has been used by over 187,000 people. Set up price alerts for 5%+ moves. If ETH jumps 5% in a day, check your pool. You might want to rebalance or move to a new range. Most beginners don’t do this - and that’s why they lose money.Future Fixes Are Coming - But Don’t Wait

Uniswap v4 (expected Q3 2024) will introduce auto-adjusting liquidity ranges based on volatility. Ethereum’s ERC-7702 standard (Q2 2025) will let you manage positions with one transaction, cutting gas fees by 60-80%. Gauntlet predicts options-based IL hedging markets will hit $500 million by 2026. But here’s the truth: these tools won’t save you if you don’t understand the basics. You still need to pick the right pools, manage your ranges, and avoid toxic tokens. The tech is getting better - but your strategy still matters most.Final Rule: Fees Must Beat Loss

The only way to win at liquidity provision is to earn more in fees than you lose to impermanent loss. Tarun Chitra of Gauntlet says: target fee revenues that exceed 1.5x your expected IL. Calculate it:- Expected IL over 3 months? 8%

- Expected fees? 15%

- Net gain? 7% - you’re ahead.

Can you completely avoid impermanent loss?

No, you cannot completely avoid impermanent loss if you’re providing liquidity in an automated market maker (AMM). It’s built into the math of how AMMs like Uniswap and Curve work. When token prices change, the protocol automatically rebalances your pool, which leads to a mismatch between your holdings and what you’d have if you just held the tokens. The only way to avoid it entirely is to not provide liquidity - but then you also miss out on trading fees. The goal isn’t to eliminate it, but to minimize it so your fees cover the loss.

Are stablecoin pools really safer?

Yes, stablecoin pools like USDC/USDT or DAI/USDC are by far the safest option. Because stablecoins are designed to stay at $1.00, their price rarely moves more than 0.1% in normal conditions. This means impermanent loss is typically under 0.05% over months. You still earn 2-5% APY in fees, which is better than most savings accounts. While returns are lower than volatile pairs, the risk is minimal. For beginners and risk-averse LPs, this is the only strategy that makes sense.

What’s the biggest mistake new LPs make?

The biggest mistake is setting a liquidity range in Uniswap v3 and forgetting about it. Many new users think “concentrated liquidity” means they can lock their funds and earn more forever. But if the price moves outside their range - even by 10% - they stop earning fees and get stuck holding only one asset. This often leads to bigger impermanent loss than if they’d used Uniswap v2. Active management - checking ranges weekly and adjusting when price moves - is non-negotiable for v3.

Should I use automated tools like Gamma.xyz?

Only if you’re serious about liquidity provision and understand the risks. Tools like Gamma.xyz automate range rebalancing based on price movement and volatility. They’re great for saving time and reducing human error. But they charge 0.3% of your position value per month. If your position is $10,000, that’s $30/month. You need to be earning at least $100/month in fees to make it worth it. For casual users or small positions, manual management or stablecoin pools are better.

Is impermanent loss worse during market crashes?

Yes - and it’s worse when paired with protocol failure. During the 2022 Terra/Luna collapse, UST depegged from $1.00. LPs in UST/ETH pools didn’t just face impermanent loss - they lost almost everything because UST became nearly worthless. Even strong assets like ETH dropped 40% in days. This created a double hit: price volatility + token collapse. That’s why avoiding new, unproven tokens is critical. Stick to assets with deep liquidity, strong community backing, and real use cases.

How do I calculate my expected impermanent loss?

You don’t need to memorize formulas. Use free tools like impermanentloss.io or SushiSwap’s built-in calculator. Just enter your token pair, deposit amount, and the price change you expect. The tool will show you the loss percentage. For example: if ETH moves from $2,000 to $3,000 (a 1.5x change), your loss is about 2.5%. Compare that to your projected fees - if you’re earning 8% APY over 3 months, you’re still ahead. Always do this math before depositing.

Jackson Storm

January 3, 2026 AT 13:50Vernon Hughes

January 5, 2026 AT 01:56Phil McGinnis

January 6, 2026 AT 03:53Ian Koerich Maciel

January 7, 2026 AT 00:27Andy Reynolds

January 7, 2026 AT 22:48Rick Hengehold

January 8, 2026 AT 21:54Brandon Woodard

January 9, 2026 AT 05:33Ryan Husain

January 10, 2026 AT 19:09Rajappa Manohar

January 10, 2026 AT 19:42surendra meena

January 11, 2026 AT 02:21Mike Pontillo

January 12, 2026 AT 01:39Joydeep Malati Das

January 12, 2026 AT 19:45rachael deal

January 13, 2026 AT 07:19Adam Hull

January 14, 2026 AT 23:23Bruce Morrison

January 15, 2026 AT 22:32Jordan Fowles

January 16, 2026 AT 00:36nayan keshari

January 17, 2026 AT 11:26Johnny Delirious

January 19, 2026 AT 07:59Bianca Martins

January 19, 2026 AT 12:21alvin mislang

January 21, 2026 AT 09:11Monty Burn

January 23, 2026 AT 01:29Kenneth Mclaren

January 23, 2026 AT 02:59