Afghanistan Crypto Ban: What It Means for Users and Markets

When working with Afghanistan crypto ban, a government directive that prohibits the buying, selling, and use of digital assets within Afghan borders. Also known as Afghanistan cryptocurrency prohibition, it aims to curb illicit finance while forcing local players to adapt to strict compliance rules. This ban directly restricts local crypto exchanges and forces investors to look for offshore solutions, shaking confidence in the region’s digital economy.

Why the Ban Matters in a Global Landscape

The crypto ban, a policy tool used by several countries to limit crypto activity isn’t unique to Afghanistan. China’s cryptocurrency ban, which shut down mining and exchange operations nationwide showed how a hardline approach can crush market liquidity overnight. Meanwhile, Tunisia’s crypto ban, a total prohibition enforced by the financial regulator demonstrates the legal ripple effects on cross‑border payments. Together these policies illustrate a semantic triple: Afghanistan crypto ban encompasses regulatory enforcement, regulatory enforcement shapes exchange compliance, and exchange compliance influences market stability. Understanding these connections helps you gauge how Afghan users might migrate to compliant platforms or face higher risk when dealing with unregulated services.

Beyond government orders, the ban forces crypto exchanges to revisit their compliance frameworks, the set of KYC/AML procedures required to operate legally. Exchanges that ignore the new rules risk being blacklisted, losing access to banking partners, or facing hefty fines. For DeFi participants, the restriction also raises questions about how consensus mechanisms—like Proof of Stake versus Proof of Work—behave under regulatory pressure. A PoS network, for example, can more easily enforce node bans than a PoW system that relies on hardware distribution. The practical upshot is that Afghan traders will see fewer local liquidity pools, higher transaction fees on offshore routes, and a sharper need to verify the legitimacy of airdrops or token launches. Below you’ll find articles that break down exchange reviews, consensus security, and case studies of other nation‑wide bans, giving you a toolbox to navigate this shifting landscape.

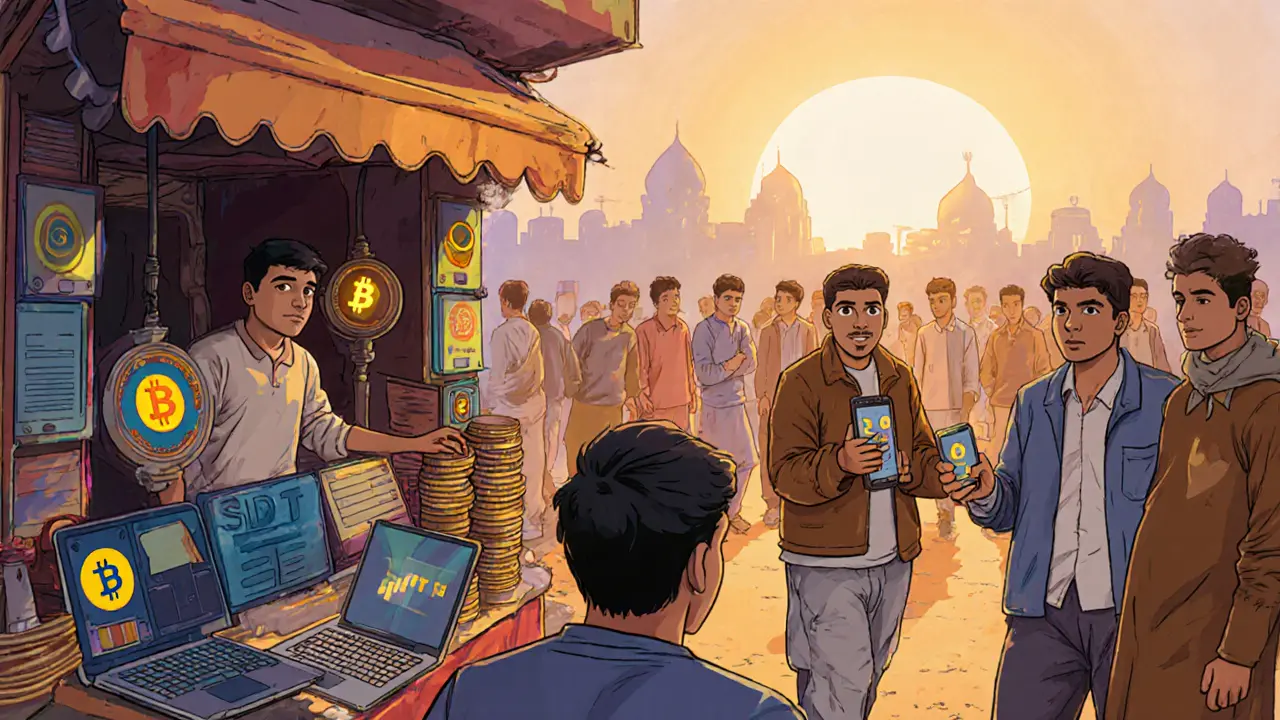

Afghanistan Crypto Ban: How the Taliban’s 2022 Prohibition Shaped the Underground Market

by Johnathan DeCovic Nov 17 2024 20 CryptocurrencyExplore how the Taliban's 2022 crypto ban reshaped Afghanistan's digital asset landscape, its underground market, and the impact on women and remittances.

READ MORE