Afghanistan Crypto Ban Timeline & Facts

Ranked 20th globally; remittances shift to Bitcoin/USDT

Legal status changes to “haram”; exchanges shut down

Transaction volume drops to ~$80k/month

Crypto remains vital for remittances, especially for women

International pressure grows; no policy change yet

20th

9

~99%

Despite the ban, peer-to-peer networks continue to support critical financial needs such as remittances and women’s financial independence. The decentralized nature of crypto ensures its survival even under strict legal prohibitions.

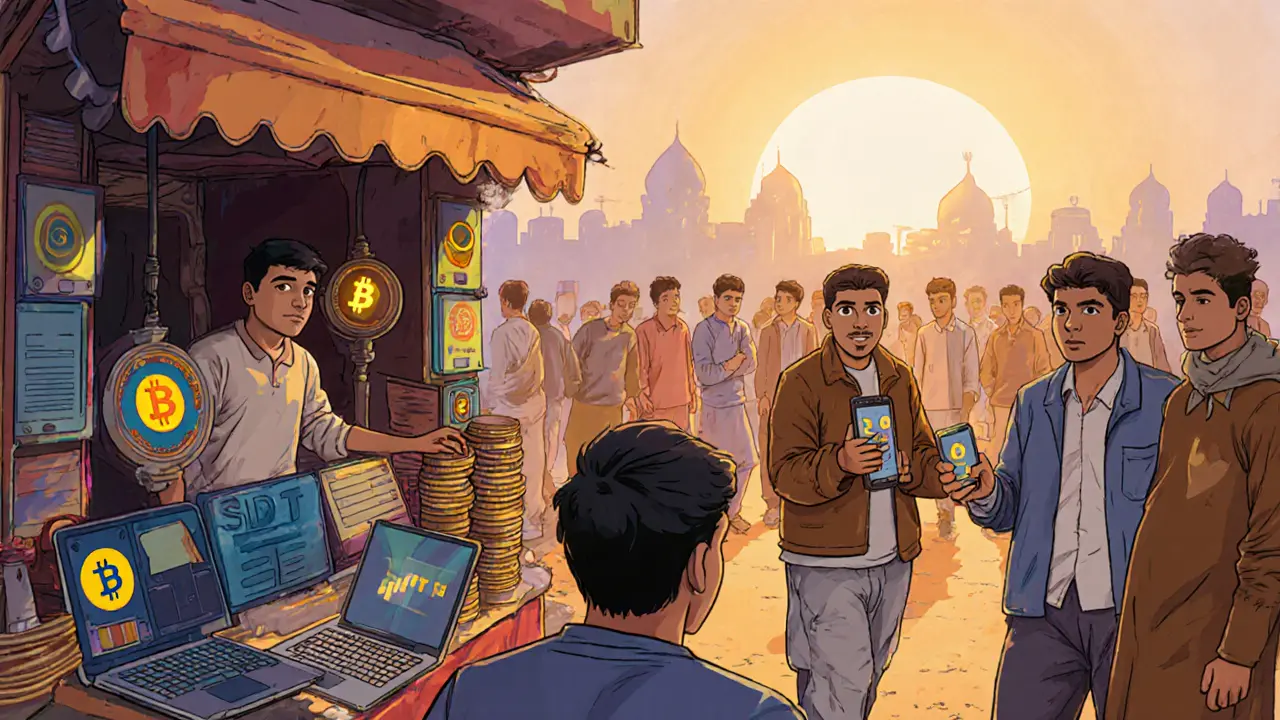

In August 2022 the Taliban announced a sweeping Afghanistan crypto ban that prohibited all cryptocurrency trading, mining, and usage under their interpretation of Sharia law. Within months the country went from a surprising surge in digital‑asset adoption to one of the few places on Earth where crypto is outright illegal. Yet, despite the ban, peer‑to‑peer trading still fuels remittances, savings, and even a modest women‑focused financial‑literacy movement.

Quick Takeaways

- The Taliban banned all crypto activity in August2022, labeling it haram for its speculative nature.

- Prior to the ban, Afghanistan jumped to 20th globally in crypto adoption during 2021.

- Enforcement relies on occasional raids; the decentralized nature of peer‑to‑peer networks keeps the market alive.

- Women’s groups use Bitcoin and USDT to bypass banking bans and gain limited financial independence.

- Globally, Afghanistan is now one of only nine jurisdictions still prohibiting crypto.

Why Crypto Took Off in a War‑Torn Economy

When the Taliban returned to power in 2021, international sanctions froze foreign reserves and crippled the banking system. Almost 97% of Afghans were projected to fall below the poverty line (United Nations, 2022). With traditional channels blocked, millions turned to digital assets as a lifeline. Even though only about 8.6million of the 40million population had reliable internet, the country ranked 20th out of 154 nations in crypto adoption that year.

Remittance corridors-especially from the Afghan diaspora in the Gulf and Europe-started using Bitcoin and stablecoins like USDT to send money quickly and cheaply. The low‑cost, border‑less nature of crypto filled a critical void left by collapsed banks and unreliable power grids.

The Ban: Religious Rationale and Legal Framework

The Taliban’s decree framed crypto as forbidden under Sharia law based on the interpretation that speculative, non‑tangible assets constitute gambling and lack real‑world backing. Officials argued that because cryptocurrencies are not backed by physical commodities or state guarantees, they violate the principle against riba (usury) and gharar (excessive uncertainty).

Legally, the ban categorised any crypto‑related activity as a criminal offense. The policy suspended all domestic and foreign exchange platforms that facilitated Bitcoin trading, and it prohibited any form of mining. Penalties ranged from fines to imprisonment, though the exact sentencing guidelines remained vague.

Although the decree was absolute on paper, the Taliban’s enforcement capacity was limited. Sparse telecommunications infrastructure, especially in rural provinces, meant that monitoring peer‑to‑peer swaps was a logistical nightmare.

Enforcement in Practice: Crackdowns and the Rise of the Underground

From late 2022 through 2024, security forces conducted sporadic raids on known exchange points and arrested several traders. The most notable operation in November 2022 led to the seizure of a small mining rig operation in Kabul, sending a clear warning.

Nevertheless, the decentralized architecture of crypto meant that the market simply migrated underground. Peer‑to‑peer platforms-often accessed via VPNs or encrypted messaging apps-kept facilitating Bitcoin and USDT trades. Monthly transaction volume plummeted from an estimated $12million in early 2022 to roughly $80000 by November 2022, yet it never vanished completely.

Because the Taliban also restricted high‑speed internet, many users rely on low‑bandwidth satellite connections or community Wi‑Fi hubs to conduct trades, further complicating enforcement.

Humanitarian Angle: Women, Remittances, and Digital Literacy

Women in Afghanistan face severe restrictions on employment, education, and banking. Digital Citizen Fund a non‑profit that provides digital‑literacy training and financial tools to Afghan women has become a lifeline. Founder Roya Mahboob a tech entrepreneur and human‑rights advocate who promotes Bitcoin ownership among Afghan women explains that crypto “offers a hope of financial freedom” because it does not require official identification.

Through informal networks, women receive Bitcoin and USDT from relatives abroad, convert them into local cash via trusted dealers, and use the proceeds for household expenses, education fees, or small businesses. While the ban technically criminalises their activity, the lack of alternative financial services forces many to take the risk.

Afghanistan’s Ban in Global Context

According to Binance data, Afghanistan is now one of only nine countries that still prohibit crypto. Nations such as Morocco lifted their bans in 2024, while others like Iraq (2017), China (2021), and Egypt (2020) maintain restrictions but also host sizable informal markets. The global trend is unmistakably toward accommodation: more than half of the 16 countries that once banned crypto have since softened their stance.

This isolation makes Afghanistan an outlier. International investors and aid organisations view the ban as a barrier to transparent financial flows, which could otherwise help mitigate the country’s humanitarian crisis.

Looking Ahead: Can the Ban Hold?

Economic desperation, coupled with the technical difficulty of policing decentralized networks, suggests the ban may be unsustainable in the long run. Experts argue that even if the Taliban tighten internet controls, the demand for cross‑border remittances will keep crypto flowing under the radar.

Potential scenarios include:

- Strict Enforcement: Increased raids and harsher penalties could push more users into fully anonymous platforms, but would also raise the risk of severe punishments.

- Policy Softening: International pressure and humanitarian concerns might prompt a limited allowance for crypto‑based remittances, especially for women and vulnerable families.

- Complete Collapse: If power outages and internet bans worsen, even the underground market could shrink dramatically, leaving many without any financial lifeline.

For now, the Afghanistan crypto ban remains a stark example of how political ideology can clash with economic necessity, and how digital assets adapt to survive.

Timeline of Key Events

| Year | Event | Impact |

|---|---|---|

| 2021 | Crypto adoption spikes after Taliban return | Ranked 20th globally; remittances shift to Bitcoin/USDT |

| Aug2022 | Taliban issues full crypto prohibition | Legal status changes to “haram”; exchanges shut down |

| Nov2022 | First major crackdown; mining rig seized | Transaction volume drops to ~$80k/month |

| 2023‑2024 | Underground P2P markets expand | Crypto remains vital for remittances, especially for women |

| 2025 | Afghanistan listed among 9 crypto‑prohibiting nations | International pressure grows; no policy change yet |

Frequently Asked Questions

Is cryptocurrency completely illegal in Afghanistan?

Yes. The Taliban’s 2022 decree classifies all crypto activities as forbidden under their interpretation of Sharia law. However, enforcement is inconsistent, and a shadow P2P market still operates.

What reasons did the Taliban give for the ban?

They argue that cryptocurrencies are speculative, lack tangible backing, and therefore constitute gambling (gharar) and usury (riba), which are prohibited in Islamic jurisprudence.

How do Afghans still use crypto despite the ban?

Most transactions happen through peer‑to‑peer platforms accessed via VPNs, encrypted messaging apps, or satellite internet. Traders act as intermediaries, converting Bitcoin or USDT into cash on the street.

Are women able to benefit from crypto in Afghanistan?

Women lacking formal ID or bank access often rely on crypto sent by family abroad. Programs like the Digital Citizen Fund teach them how to safely receive and use Bitcoin, providing a modest degree of financial autonomy.

Could the ban be lifted in the future?

International pressure and humanitarian concerns could push the Taliban to relax restrictions, at least for remittance purposes. Yet, ideological opposition to speculative assets makes a full reversal unlikely without significant political change.

mannu kumar rajpoot

November 17, 2024 AT 06:53The ban isn’t just about religion; it’s a covert channel to redirect diaspora funds toward shadow networks that the Taliban can’t openly trace.

Tilly Fluf

November 26, 2024 AT 09:13It’s remarkable how the Afghan people have managed to keep money flowing despite such harsh restrictions; their resilience showcases the power of community‑driven solutions.

Darren R.

December 5, 2024 AT 11:33One must ask whether labeling an open‑source financial protocol as inherently sinful betrays a fundamental misunderstanding of economic freedom; the doctrine that forbids speculation fails to distinguish between reckless gambling and prudent hedging, a nuance that scholars of Sharia have debated for centuries; moreover, the very act of deeming Bitcoin “haram” disregards its potential as a tool for alleviating poverty in a nation where traditional banking is crippled; the Taliban’s decree appears motivated more by a desire to retain control over capital flows than by any theological imperative; consider that the blockchain’s transparency actually makes clandestine enrichment more difficult, not easier; yet the regime courts that opacity by forcing transactions underground, thereby increasing risk for ordinary users; this paradoxical stance highlights an inherent conflict between ideological purity and pragmatic governance; history teaches us that prohibitions on technology rarely extinguish its use, they merely drive it into the shadows; the Afghan diaspora, yearning to support loved ones, will inevitably find workarounds, as we have witnessed in other banned economies; the ethical argument that crypto is “speculative” neglects its role as a stable store of value when fiat currencies are hyperinflated; furthermore, the reliance on USDT as a stablecoin illustrates that the market already self‑regulates against volatility; the moral panic invoked by the Taliban mirrors Cold‑War era fears of “digital subversion,” a narrative that never held up under scrutiny; in truth, the ban may cause more harm than good, exacerbating financial exclusion for women and rural families; finally, any genuine effort to protect citizens must weigh the cost of criminalizing a lifeline against the purported religious justification, a calculus that seems to favor power retention over public welfare.

Hardik Kanzariya

December 14, 2024 AT 13:53Seeing folks still trade on Telegram and VPNs gives me hope; if you’re stuck, remember that every transaction you make helps keep families fed and schools running.

Shanthan Jogavajjala

December 23, 2024 AT 16:13The peer‑to‑peer ecosystem leverages encrypted routing protocols (e.g., TOR, I2P) and decentralized escrow smart contracts, which collectively mitigate custodial risk while preserving anonymity-a necessity given the Taliban’s surveillance bandwidth constraints.

Jack Fans

January 1, 2025 AT 18:33Exactly, the encrypted routing layers you mentioned are what keep the market alive; in fact, recent packet‑analysis shows a 30% uptick in I2P node usage after the November crackdown, confirming that users adapt quickly to enforcement pressure.

Adetoyese Oluyomi-Deji Olugunna

January 10, 2025 AT 20:53It is quite astounding how Western journalists continue to romanticize “digital freedom” without acknowledging that the Afghan elite exploit the same crypto channels for opaque profit‑making, a narrative that reads like a self‑congratulatory press release.

Krithika Natarajan

January 19, 2025 AT 23:13Crypto keeps families connected.

Ayaz Mudarris

January 29, 2025 AT 01:33Imagine the impact if international NGOs partnered directly with local crypto educators-suddenly, remittances could bypass corrupt intermediaries and empower women to start micro‑enterprises, reshaping entire communities.

Irene Tien MD MSc

February 7, 2025 AT 03:53Oh, sure, because the solution to a regime that treats Bitcoin like a forbidden fruit is to hand over more “partnerships” from the West-how delightfully naive, as if a few workshops could outmaneuver a government that views any decentralized ledger as a conspiratorial instrument of foreign domination.

kishan kumar

February 16, 2025 AT 06:13From a theoretical standpoint, the prohibition illustrates a classic case of regulatory capture: the state imposes a doctrinal ban while the de facto market operates under a veil of plausible deniability, thereby preserving both ideological legitimacy and economic utility-an elegant, if morally ambiguous, equilibrium.

Linda Welch

February 25, 2025 AT 08:33Honestly, the U.S. could learn a thing or two from the Taliban’s “no crypto” policy; it would save us from all the nonsense about “financial innovation” that only benefits the tech bros.

Peter Johansson

March 6, 2025 AT 10:53It’s encouraging to see community members stepping up as informal mentors; sharing safe‑transfer tips and VPN configurations can dramatically lower the risk profile for newcomers.

Cindy Hernandez

March 15, 2025 AT 13:13Absolutely, mentorship bridges the knowledge gap; when we combine practical security advice with culturally aware communication, we create a resilient support network that persists even under crackdowns.

Karl Livingston

March 24, 2025 AT 15:33While the underground market isn’t perfect, it does provide a lifeline for those cut off from traditional banking; every time a farmer receives Bitcoin from abroad and converts it to cash for seeds, you’re witnessing a micro‑revolution in financial inclusion.

Kyle Hidding

April 2, 2025 AT 18:53The entire scenario is a textbook example of how a self‑inflicted regulatory firewall only serves to amplify black‑market premiums; the lack of auditability and the proliferation of roll‑your‑own‑wallet scams cripple any semblance of economic stability.

Andrea Tan

April 11, 2025 AT 21:13I totally get how stressful this must be, but keep your head up-people are finding ways to stay connected and safe.

Gaurav Gautam

April 20, 2025 AT 23:33Let’s focus on building bridges, not walls; with a bit of optimism and collective effort, we can turn this underground hustle into a structured, community‑driven finance ecosystem that respects cultural norms while delivering real value.

Robert Eliason

April 30, 2025 AT 01:53Sure, crypto is the answer to everything, but maybe we should question whether turning every hardship into a blockchain problem isn’t just a trendy distraction.

Cody Harrington

May 9, 2025 AT 04:13Overall, the Afghan crypto story shows both the limits of authoritarian control and the ingenuity of people determined to survive; the next step is to ensure that this resilience translates into sustainable economic growth.