MCONTENT token

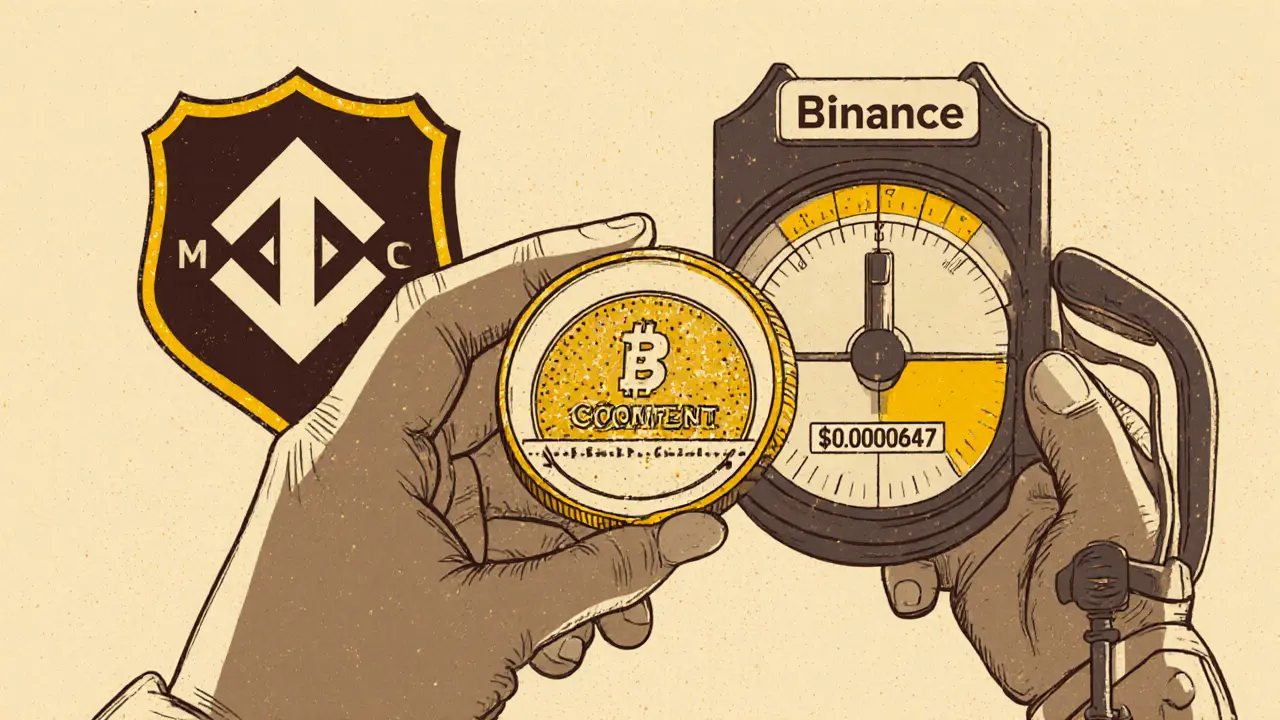

When talking about MCONTENT token, a digital asset that powers the MCONTENT ecosystem, enabling content creators to monetize and reward their audiences. Also known as MCT, it combines a utility function with a governance role. The token’s value hinges on its tokenomics, which define supply limits, distribution methods, and incentive structures. To move MCONTENT token across different blockchains, users rely on cross‑chain bridges, trustless protocols that wrap the token for use on other networks. Finally, when MCONTENT is deposited into a liquidity pool, it creates liquidity pool tokens that represent a share of the pool’s assets.

Why does tokenomics matter? Because it tells you how many MCONTENT tokens exist, how many are reserved for the team, and what portion rewards creators. The supply is capped at 1 billion, with 40% allocated to community incentives, 20% to the development fund, and the rest split between early investors and a reserve. This allocation influences price stability and the token’s ability to fund new features. When you add MCONTENT to a DeFi pool, the pool’s token ratios determine impermanent loss risk and the potential yield you earn. Understanding those ratios helps you decide whether to stake MCONTENT for rewards or keep it liquid for trades.

Moving MCONTENT between networks isn’t a hassle thanks to cross‑chain bridges like Wormhole or LayerZero. These bridges lock the original token on its home chain and mint a wrapped version on the destination chain, preserving the total supply. Wrapped MCONTENT can then be used on platforms that only support Ethereum or Binance Smart Chain, expanding its reach to NFT marketplaces, gaming dApps, and other DeFi services. The bridge process also adds a security layer: auditors regularly check bridge contracts to prevent hacks that could burn or steal tokens. If you’re interested in earning extra MCONTENT, many airdrop campaigns target users who have previously bridged or staked the token, rewarding them for early adoption.

What you’ll find in the MCONTENT token collection

Below you’ll see articles that break down stablecoin mechanics, risk management tips, smart contract audits, and real‑world token use cases—all of which intersect with MCONTENT token’s ecosystem. Whether you’re looking for a quick tokenomics cheat sheet, a guide on using bridges safely, or insights into earning rewards through liquidity pools, the list covers the full spectrum. Dive in to get practical steps, avoid common pitfalls, and stay ahead of the latest trends shaping the MCONTENT token and its community.

Understanding MContent (MCONTENT) Crypto Coin - Basics, Market Data & Risks

by Johnathan DeCovic Sep 17 2025 24 CryptocurrencyA detailed look at MContent (MCONTENT) crypto coin, covering its purpose, market data, Watch2Earn model, risks, and how it stacks up against similar creator‑focused tokens.

READ MORE