Market Depth: The Hidden Engine Behind Crypto Prices

Ever wondered why a single large trade can push Bitcoin’s price up or down so fast? When you dig into that mystery, you hit market depth, the amount of buy and sell orders waiting at each price level in a market. Also known as order‑book depth, it tells you how much liquidity sits just beyond the current price. In simple terms, deeper markets can absorb bigger trades with less slippage, while shallow markets amplify price swings.

Why Market Depth Matters for Every Trader

One of the core pieces feeding market depth is liquidity, the ease with which an asset can be bought or sold without causing a significant price change. Liquidity is the lifeblood that keeps order books full and price impact low. When liquidity pools are robust, you’ll see tighter spreads and smoother price curves. Conversely, low liquidity means the same trade size can cause a big jump, which novice traders often mistake for market manipulation.

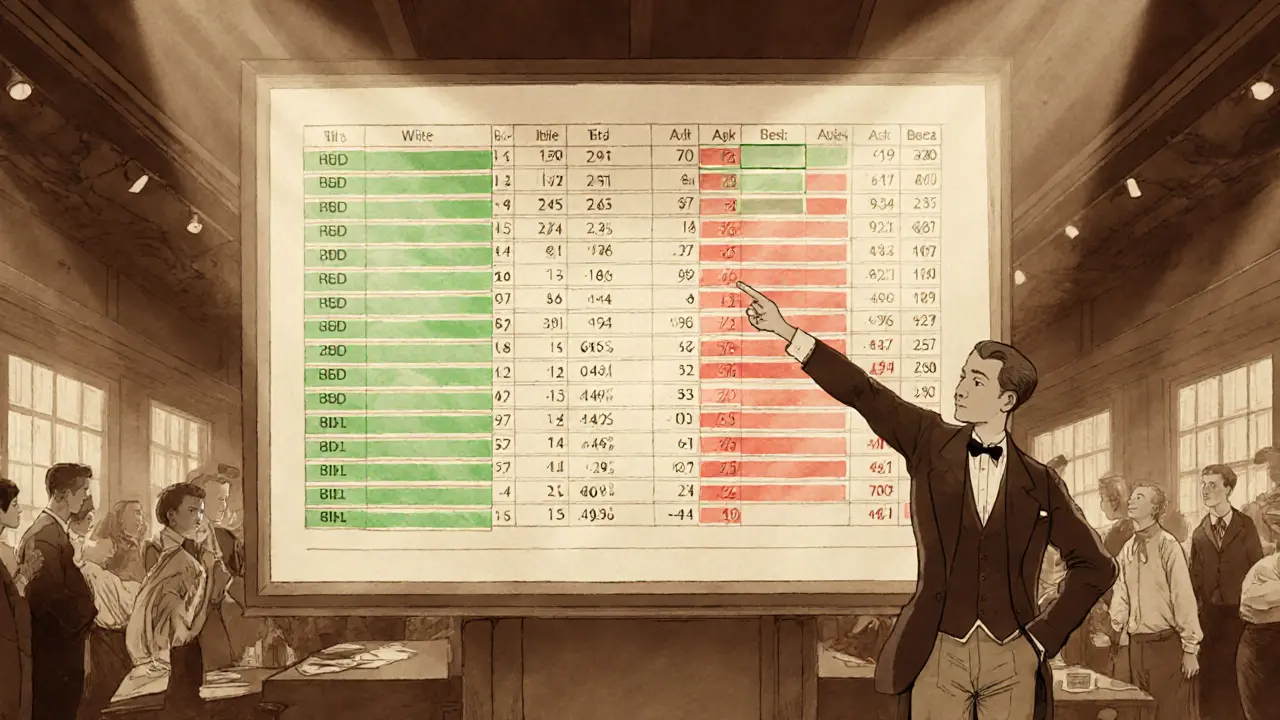

Another essential ingredient is the order book, a real‑time list of all pending buy and sell orders at different price points. The order book visualizes market depth: each price level stacks orders, forming walls that act as support or resistance. Traders watch these walls to gauge where the market might pause or reverse. A thick wall of buy orders right below the current price suggests strong demand, while a towering sell wall hints at upcoming pressure. Understanding how the order book and liquidity interact gives you a clear picture of market depth. For example, a market with a deep order book but thin liquidity will still suffer noticeable slippage on large trades because there aren’t enough assets ready to move. The reverse—a shallow order book but high liquidity from multiple exchanges—can also dampen price impact, as traders spread orders across venues.

Price impact is the third player in this trio. It measures how much the market price moves when you execute a trade of a given size. High price impact usually signals low market depth: there aren’t enough orders to fill your trade at the current price, so the market has to shift. By tracking price impact alongside order‑book depth, you can estimate the real cost of entering or exiting a position. Professional traders use this insight to split large orders into smaller slices, minimizing the footprint on the market. Trading volume rounds out the picture. Volume reflects how much of an asset changes hands over a period, and it directly feeds liquidity and order‑book health. A coin with high daily volume typically enjoys deeper order books because many participants are constantly placing and canceling orders. Low‑volume tokens, on the other hand, often have thin books and wild price swings, making them risky for sizable positions. Putting it all together, market depth encompasses liquidity, the order book, price impact, and trading volume. It requires real‑time data from multiple exchanges to paint an accurate picture, especially in fragmented crypto markets. Whether you’re a day trader looking for scalp opportunities, a swing trader managing risk, or a long‑term holder assessing market stability, a solid grasp of market depth helps you decide when to trade, how big your order should be, and what price you can realistically expect.

Below you’ll find a curated set of articles that break down each of these concepts further. From deep dives into stablecoin liquidity to practical guides on reading order books, the collection gives you actionable insights to navigate crypto markets with confidence.

Understanding Order Book Data for Effective Trading Analysis

by Johnathan DeCovic Feb 5 2025 17 TechnologyLearn how order book data works, why it matters for trading, and practical steps to use market depth, bid‑ask spread, and order flow for better strategies.

READ MORE