Can a small business in Moscow take Bitcoin for coffee? Can a Siberian manufacturer get paid in Ethereum for exporting metal? The short answer is: no - not legally, not without jumping through some of the most restrictive hoops in the world.

Russia doesn’t ban cryptocurrency outright. It recognizes it as property. But it refuses to let businesses use it like money. The Central Bank of Russia has made this crystal clear: crypto is not legal tender. You can’t pay your rent, your suppliers, or your employees in Bitcoin. If you try, your bank account will freeze. In June 2025, a Moscow electronics store called TechnoPoint lost access to its accounts for 45 days after letting customers pay with Bitcoin. No warning. No fine. Just locked out.

So why does crypto even exist in Russia’s economy? Because the government quietly created a backdoor - for the very few.

The Only Legal Way: The Experimental Legal Regime (ELR)

There’s one path where crypto payments are allowed: the Experimental Legal Regime, or ELR. But this isn’t a loophole for small businesses. It’s a VIP lane reserved for giants.

To qualify, a company must be classified as a “qualified investor.” That means:

- At least ₽100 million (about $1.24 million) in securities or bank deposits

- At least ₽50 million ($620,000) in annual income

- Registration with Rosfinmonitoring as a virtual asset service provider

That’s not a suggestion. It’s a hard wall. According to the Russian Union of Industrialists and Entrepreneurs, 89% of small and medium businesses say they can’t even dream of meeting these numbers. Only 247 companies out of over 4 million active businesses in Russia are currently in the ELR program.

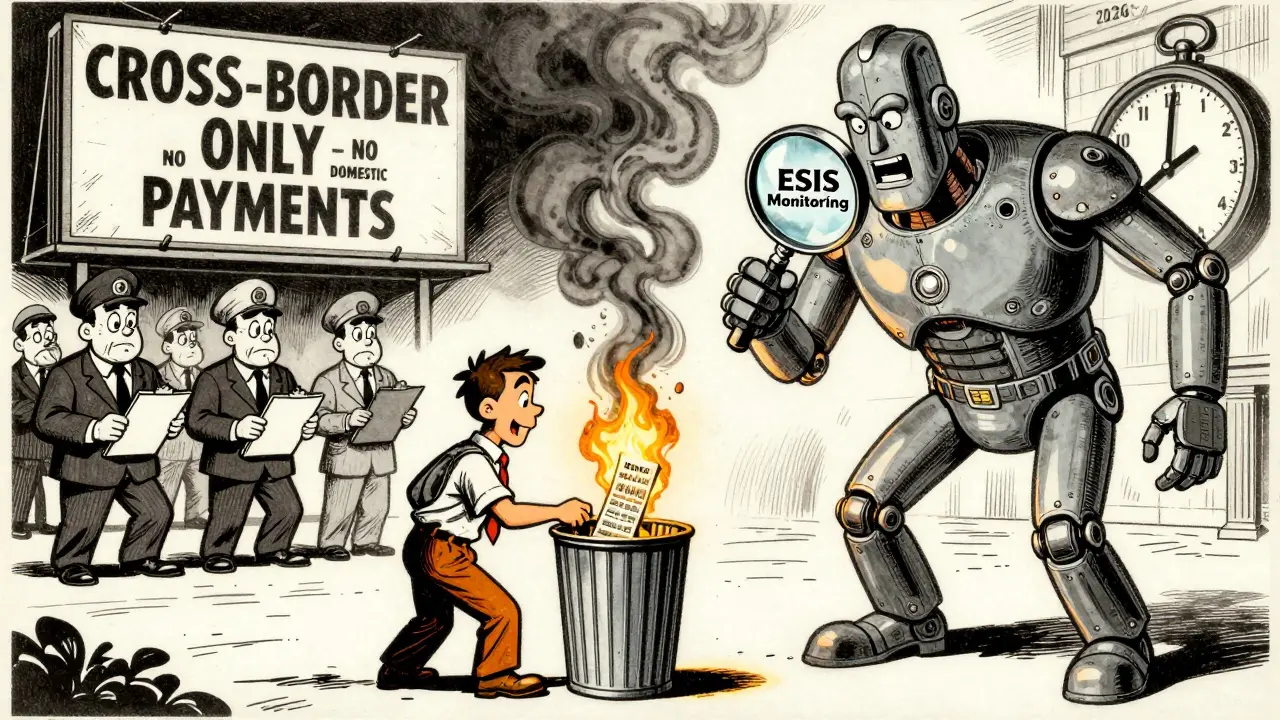

And even if you qualify, you can’t use crypto for anything domestic. The ELR only works for cross-border trade. Think oil exports to India, metal sales to China, or gas deals with Turkey. That’s it.

What Cryptocurrencies Are Allowed?

Not all crypto is treated the same. The Bank of Russia has approved only three blockchain networks for ELR transactions:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

Any other coin - Dogecoin, Solana, Tether, even stablecoins like USDC - is off-limits. If you try to settle a payment in anything else, the system will flag it as illegal. And the Central Bank’s blockchain monitoring system, which processes over 1.2 million crypto transactions daily, will catch it.

How Does It Actually Work?

Setting up a legal crypto payment channel under ELR isn’t plug-and-play. It’s a six-month project with serious costs.

Here’s the 7-step process businesses must follow:

- Apply for qualified investor status - takes 30 to 45 days

- Register with Rosfinmonitoring

- Buy and install approved blockchain analytics software - minimum cost: ₽1.2 million ($14,800) per year

- Integrate with one of the 17 Central Bank-approved wallet providers (like Finversity or BitRiver)

- Install dual-factor authentication systems that meet Russia’s GOST R 57580.1-2017 standard

- Train staff on mandatory reporting rules

- Conduct quarterly compliance audits - each costs around ₽350,000 ($4,300)

Total setup cost? Between ₽3.8 million and ₽7.2 million ($47,000-$89,000). Time? Around 112 days on average, according to the Central Bank’s Q3 2025 report.

And even after all that, you’re not done. Every crypto transaction over ₽600,000 ($7,400) must be reported to the Unified State Information System (ESIS) within five business days. Starting January 1, 2026, tax authorities will cross-check those reports with bank records. Miss one? You’re looking at a tax audit - and possibly criminal charges.

Who’s Actually Using It?

The companies using ELR aren’t startups or mom-and-pop shops. They’re state-linked giants in oil, gas, and mining.

According to the Ministry of Finance’s October 2025 report:

- 82% of all legal crypto transactions come from extractive industries

- 63% of ELR participants have direct or indirect government ownership

- Rosneft reported that 12% of its Q3 2025 exports were settled in crypto

- Norilsk Nickel cut payment times from 14 days to 4 hours for 37% of its Asian contracts

Meanwhile, retail businesses? They’re getting shut down. A restaurant chain in Moscow called Sakhalin lost ₽18 million ($222,000) in July 2025 when its crypto payment processor was blocked for “insufficient documentation.” The bank froze its accounts. The tax office started an audit. The owner had to sell assets to stay afloat.

Why Does Russia Even Allow This?

It’s not about innovation. It’s about survival.

After Western sanctions blocked access to SWIFT and Visa/Mastercard, Russia needed a way to keep trading. Crypto became a lifeline. In September 2025, crypto transactions accounted for 4.7% of Russia’s total cross-border trade - that’s over $12.6 billion monthly.

Finance Minister Anton Siluanov said it plainly: “Digital currencies are becoming an essential tool for maintaining our foreign economic activity.”

But the Central Bank isn’t interested in letting regular businesses use it. First Deputy Governor Vladimir Chistyukhin warned in October 2025 that letting crypto compete with the ruble would “threaten financial stability.” The goal isn’t to modernize payments - it’s to control them.

What Happens If You Try to Accept Crypto Domestically?

Don’t.

Even advertising that you accept crypto - like putting “Bitcoin Accepted” on your website or menu - is an administrative offense. Under Article 15.25 of Russia’s Administrative Offenses Code, amended in July 2025, you can be fined between ₽50,000 and ₽300,000 ($620-$3,700).

If you actually process a payment? Your bank account will freeze. Your payment processors will be shut down. Your business could be flagged for money laundering. In 2025, 12 small businesses that tried domestic crypto payments all had their accounts frozen. None got them back without paying fines and proving they’d “stopped the violation.”

There’s no gray area. No warning. No second chance.

Is There Any Hope for Change?

Maybe - but not soon.

In November 2025, Deputy Finance Minister Ivan Chebeskov hinted that the “superqual” investor threshold might be scrapped. The idea of a tiered system with lower entry requirements is being discussed. But nothing is official yet.

The Central Bank is also considering adding more blockchains to the approved list - possibly Litecoin or Polygon. But again, no timeline.

Experts at the Higher School of Economics give a 40% chance that domestic crypto payments will be allowed by 2027 - but only if the cross-border system proves stable and doesn’t cause capital flight.

For now, the message is clear: crypto is a tool for sanctioned state enterprises to bypass Western controls. Not a payment method for Russian consumers or small businesses.

What Should Businesses Do?

If you’re a small business: don’t even think about accepting crypto. The risks far outweigh any benefits. Use ruble payments, bank transfers, or digital wallets like Sberbank Online or Tinkoff.

If you’re a large exporter in oil, gas, or metals, and you have the capital: explore the ELR. But do it right. Hire a compliance specialist. Use only approved wallet providers. Report everything. One mistake can cost you millions.

And if you’re just curious? Watch the news. The rules could change - but not because of public demand. They’ll change only if the government decides it needs crypto more than it fears it.

Allen Dometita

January 10, 2026 AT 11:04Rahul Sharma

January 10, 2026 AT 18:09greg greg

January 12, 2026 AT 06:10Sherry Giles

January 13, 2026 AT 16:49Jordan Leon

January 13, 2026 AT 17:21Sarbjit Nahl

January 14, 2026 AT 09:21Gideon Kavali

January 15, 2026 AT 06:17Meenakshi Singh

January 15, 2026 AT 20:17Michael Richardson

January 16, 2026 AT 08:12Emily Hipps

January 16, 2026 AT 14:44Paul Johnson

January 17, 2026 AT 08:12Brittany Slick

January 17, 2026 AT 13:35Krista Hoefle

January 18, 2026 AT 09:39Kip Metcalf

January 19, 2026 AT 13:56Natalie Kershaw

January 20, 2026 AT 09:10Kelley Ramsey

January 21, 2026 AT 20:25Sabbra Ziro

January 22, 2026 AT 02:13Jessie X

January 22, 2026 AT 23:47Jacob Clark

January 23, 2026 AT 02:29