KYC Shutdown: What Happens When Crypto Exchanges Lose Their Identity Verification

When a KYC shutdown, the forced halt of identity verification systems on a crypto platform, often triggered by regulatory pressure or fraud exposure. Also known as identity verification collapse, it’s not just a technical glitch—it’s the moment trust evaporates. You log in one day and find your account locked. No email. No support. Just a message saying ‘compliance review in progress.’ That’s a KYC shutdown in action. It doesn’t mean the platform is down—it means they can’t prove who you are anymore, and without that, they can’t legally let you trade, withdraw, or even log in.

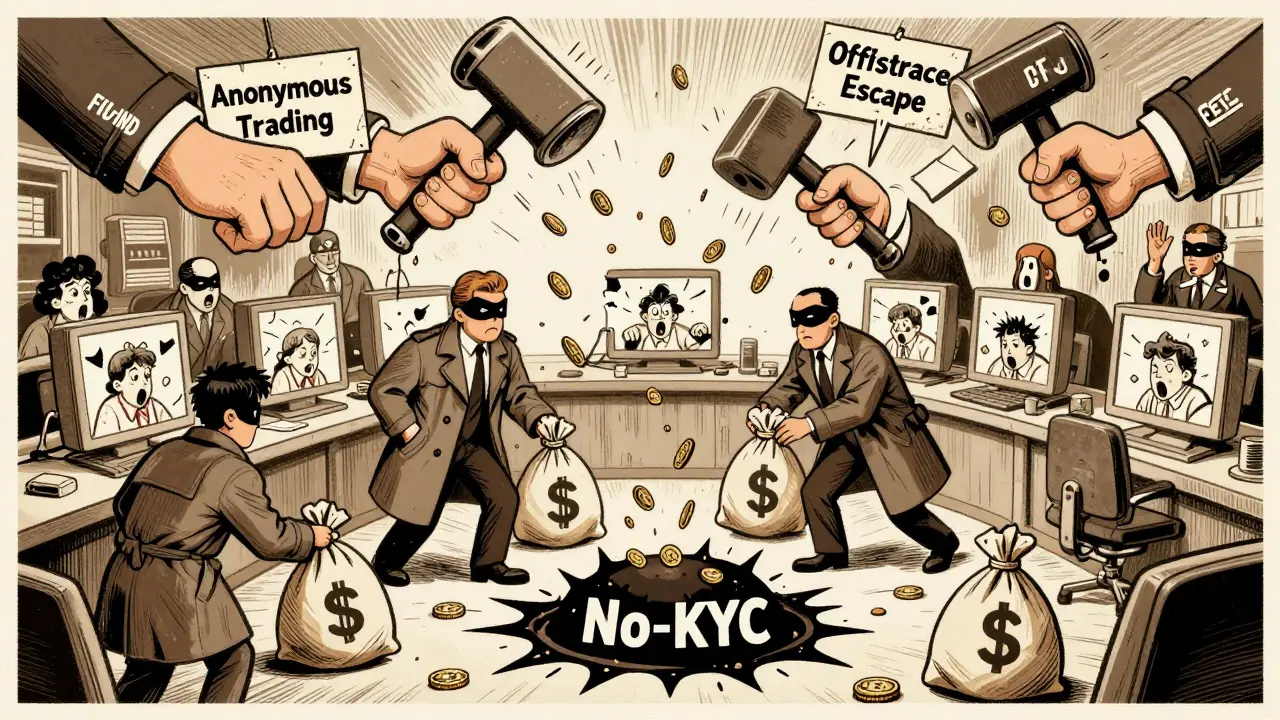

KYC shutdowns don’t happen in a vacuum. They’re usually the result of AML regulations, anti-money laundering rules that force crypto platforms to verify users’ identities and track transaction flows tightening globally. The EU’s MiCA rules, for example, demand full traceability of every transaction, no matter how small. When platforms can’t meet those standards—because they never had real KYC in the first place, or because they’re hiding something—they get shut down. And when that happens, the users who trusted them are left with nothing but a wallet full of tokens and no way out. Look at platforms like Spin Crypto Exchange or Unielon: they vanished overnight, not because of a hack, but because their entire business model relied on avoiding real identity checks. A KYC shutdown is the legal version of a rug pull.

It’s not just about big exchanges. Even niche DeFi platforms and cross-chain bridges like Elk Finance or iZiSwap can face KYC pressure if they attract regulators’ attention. The moment a platform starts handling large volumes or connects to regulated entities, compliance becomes unavoidable. If they’ve been flying under the radar, the crash is sudden. And when the lights go out, scams rush in. Fake customer support pages, fake airdrops claiming to ‘compensate’ you, and phishing sites that look just like the original platform—all of these thrive after a KYC shutdown. That’s why you need to watch for red flags: no clear team, no public audits, no physical address. If a platform doesn’t want you to know who they are, they’ll disappear when the regulators come knocking.

What’s left after a KYC shutdown? Usually, a trail of angry users, empty wallets, and a few lucky ones who withdrew early. But there’s a lesson here: if a platform doesn’t force you to verify your identity, it’s not because they’re user-friendly—it’s because they’re not playing by the rules. The safest crypto platforms don’t fear KYC. They build their systems around it. The ones that run from it? They’re already gone. Below, you’ll find real cases of platforms that collapsed, scams that followed, and the regulatory shifts that made it all inevitable. This isn’t theory. It’s what’s already happened—and what’s still coming.

No-KYC Crypto Exchange Shutdowns by Authorities: What Happened and Why It Matters

by Johnathan DeCovic Dec 6 2025 25 CryptocurrencyNo-KYC crypto exchanges faced global shutdowns in 2024-2025 as regulators cracked down on money laundering and sanctions evasion. Platforms like KuCoin and BitMex were forced to relocate or face criminal charges. Compliance is now mandatory for survival.

READ MORE