Ethereum DEX – Decentralized Trading on Ethereum

When navigating Ethereum DEX, a decentralized exchange built on the Ethereum blockchain that lets users trade tokens directly from their wallets. Also known as Ethereum‑based DEX, it provides trust‑less swaps, liquidity provision, and instant access to DeFi protocols, you’re stepping into a space where peer‑to‑peer trades replace traditional order books. Ethereum DEX isn’t just a buzzword; it’s a concrete tool that lets anyone become a market maker or taker without handing over custody to a central hub. This core idea—removing the middleman—creates a direct link between traders, developers, and the broader Ethereum ecosystem.

Key Components of an Ethereum DEX

The backbone of any Liquidity Pool, a collection of token reserves that powers automated market making on decentralized platforms is the pool’s tokenomics. In simple terms, the pool holds two (or more) assets—say ETH and USDC—and uses a constant product formula to price swaps. The pool’s depth dictates slippage, while the fee structure incentivizes contributors. When you provide liquidity, you earn a slice of the transaction fees, turning passive holding into an active income stream. At the same time, the pool’s design influences impermanent loss, a risk every liquidity provider needs to weigh.

Another game‑changer is the Cross‑Chain Bridge, a protocol that connects Ethereum with other blockchains, allowing assets to move across ecosystems. Bridges extend an Ethereum DEX’s reach, letting users swap assets that originate on Solana, Binance Smart Chain, or even Bitcoin without leaving the DEX interface. This interoperability fuels deeper liquidity, more trading pairs, and the ability to tap into emerging markets. However, bridges also bring security considerations, as the trust‑less guarantees of Ethereum can be tested by the bridge’s validator set.

Beyond pools and bridges, Tokenomics, the economic model that defines a token’s supply, distribution, and utility shapes user behavior on an Ethereum DEX. Tokens with deflationary mechanisms, staking rewards, or governance rights attract different kinds of participants. For example, a DEX that issues its own governance token can align incentives, letting token holders vote on fee structures or new pool launches. This creates a feedback loop: better tokenomics draw more users, which deepens liquidity, which in turn improves price discovery for all traded assets.

Security isn’t an afterthought either. A thorough Smart Contract Audit, a systematic review of a contract’s code to find vulnerabilities before deployment can mean the difference between a flawless launch and a costly exploit. Audits check for re‑entrancy bugs, integer overflows, and other pitfalls that have plagued past DEX projects. Pairing an audit with ongoing monitoring tools helps maintain trust, especially as the DEX scales and attracts larger capital flows.

All these pieces—liquidity pools, cross‑chain bridges, tokenomics, and audits—interlock to make an Ethereum DEX functional and resilient. In practice, a trader might hop onto a DEX to swap ETH for a stablecoin, a liquidity provider could lock up assets to earn fees, and a developer might use the DEX’s SDK to build a novel DeFi app. The ecosystem is a living network where each role feeds the other, creating a self‑sustaining market that lives entirely on-chain.

Below you’ll find a hand‑picked selection of articles that dive deeper into each of these topics. From stablecoin dynamics and cross‑chain bridge mechanics to tokenomics breakdowns and audit best practices, the collection gives you the practical insight you need to navigate the world of Ethereum DEXs with confidence.

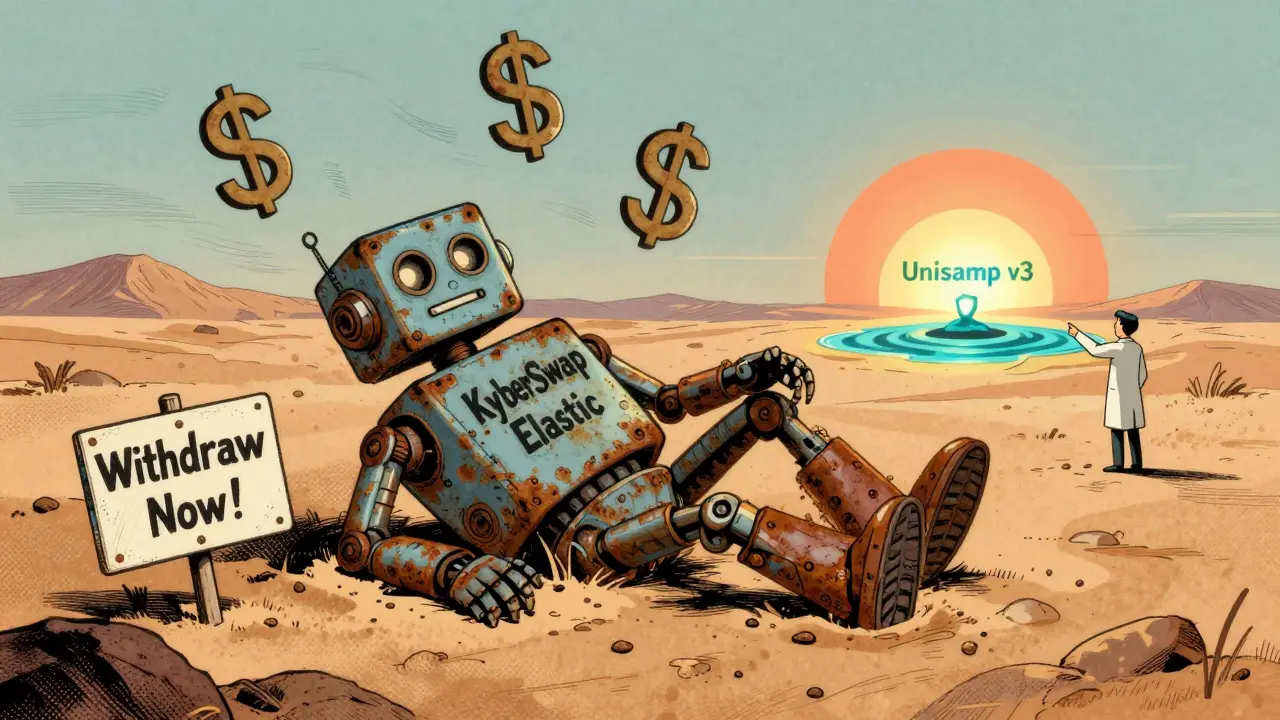

KyberSwap Elastic (Ethereum) Crypto Exchange Review: Is It Safe to Use in 2026?

by Johnathan DeCovic Jan 15 2026 18 CryptocurrencyKyberSwap Elastic on Ethereum was designed for advanced traders with auto-compounding liquidity, but a critical security breach has rendered it inactive as of 2026. No trades, no volume, and users are advised to withdraw funds immediately.

READ MORESushiSwap (Ethereum) Review - Fees, Features & How to Trade

by Johnathan DeCovic May 6 2025 21 CryptocurrencyA detailed review of SushiSwap on Ethereum covering fees, liquidity, security, token economics and step‑by‑step guide to start trading and earning.

READ MORE