SushiSwap Fee Calculator

Token Pair

Trading Parameters

Estimated Earnings Breakdown

Total Daily Swaps: 0

Total Daily Fees: $0.00

Fee Distribution:

- to Liquidity Providers

- to SUSHI Treasury

Potential Annual Earnings: $0.00

Potential SUSHI Rewards: 0 SUSHI

Important Notes

- This calculator estimates potential earnings based on current SushiSwap fee structure (0.30% per swap)

- Actual earnings depend on token pair volatility, pool size, and impermanent loss

- SUSHI rewards are variable and depend on farming incentives

- Results are for educational purposes only

Quick Take

- Built on Ethereum is a public blockchain that enables smart contracts and decentralized apps.

- Offers lower fees than Uniswap but higher rewards for liquidity providers.

- Native governance token: SUSHI token is a ERC‑20 token used for voting, staking and fee sharing.

- TVL sits around $400million (Oct2025), placing it in the top‑75 crypto assets.

- Good for beginners thanks to restaurant‑themed UI, but beware of impermanent loss and governance centralization.

SushiSwap review dives into the core of this DeFi platform, explains how it works on Ethereum, and gives you a step‑by‑step guide to start trading safely.

What is SushiSwap?

SushiSwap is a decentralized exchange (DEX) and automated market maker (AMM) that runs primarily on the Ethereum blockchain. Launched in August2020 as a fork of Uniswap, it quickly added its own token, cross‑chain bridges, and a suite of DeFi tools such as lending, borrowing and yield farms. The platform’s UI follows a Japanese restaurant theme - think “BentoBox” for modular apps and “Kashi” for reward tokens - which aims to make complex finance feel more familiar.

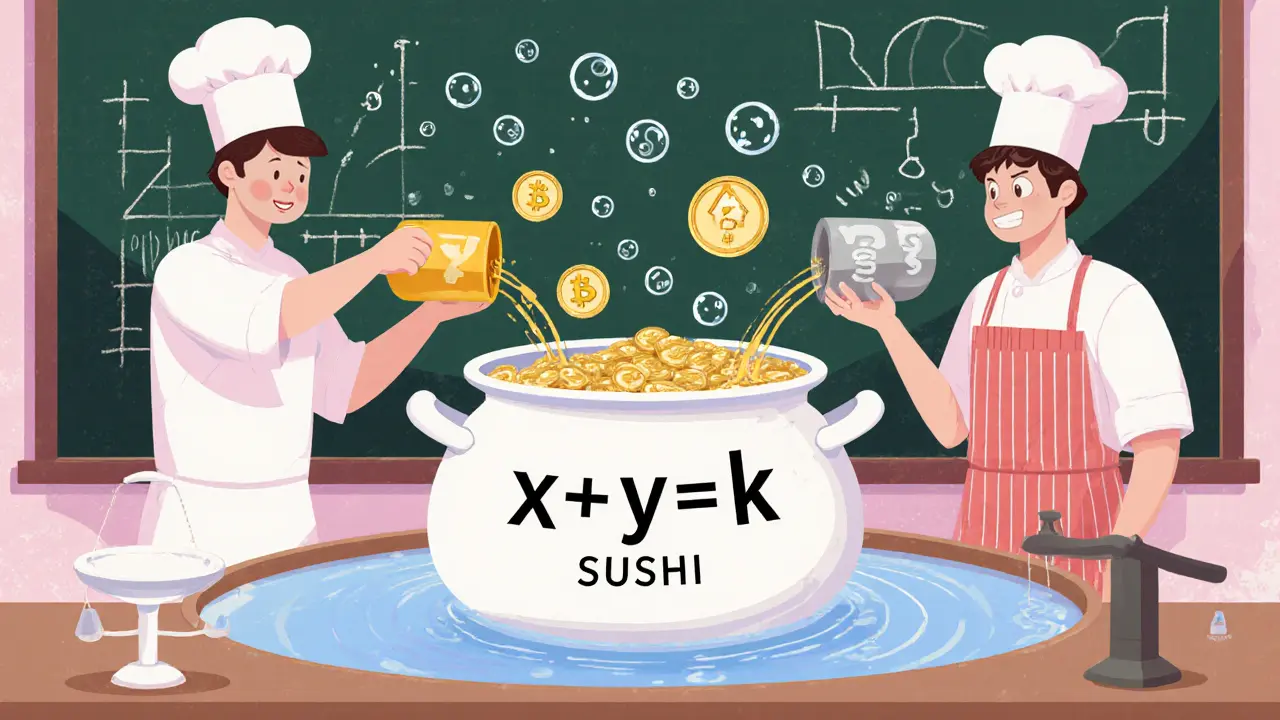

How the Automated Market Maker Model Works

The AMM model replaces traditional order books with liquidity pools. Users (called Liquidity Providers are crypto holders who lock pairs of tokens into smart contracts to enable instant swaps. In return they earn a share of the trading fees and, on SushiSwap, extra SUSHI rewards.

Every swap triggers a formula (x·y=k) that keeps the product of the two token reserves constant. This guarantees that a trade can always be executed, but it also creates the risk of impermanent loss - the difference between holding assets in a pool versus keeping them in a personal wallet.

Key Technical Elements

- Smart Contract is a self‑executing code on the blockchain that enforces the rules of each liquidity pool.

- Total Value Locked (TVL) measures the total USD worth of assets deposited in SushiSwap’s pools - roughly $400million as of October2025.

- Fees: 0.30% per swap, of which 0.25% goes to LPs and 0.05% to the SUSHI treasury.

- Governance: Token‑based voting on proposals, currently overseen by a nine‑person multi‑sig.

Ethereum vs. Multi‑Chain Experience

Because SushiSwap originated on Ethereum, it supports any ERC‑20 token. However, Ethereum’s gas fees can spike above $20 during network congestion, making small swaps pricey. To mitigate this, SushiSwap expanded to Arbitrum, Binance Smart Chain, Polygon, and other chains where transaction costs are a fraction of Ethereum’s.

On Ethereum, you’ll notice slower confirmation times (≈15seconds) and higher fees, whereas on Arbitrum or BNB Smart Chain trades settle in a few seconds for under $0.10. The platform automatically routes you to the cheapest chain if you select the “cross‑chain swap” option.

Pros and Cons - A Balanced View

| Aspect | SushiSwap | Uniswap |

|---|---|---|

| Swap fee | 0.30% (0.25% to LPs) | 0.30% (0.25% to LPs) |

| Liquidity incentives | SUSHI rewards + farming | No native token rewards |

| TVL (Oct2025) | ≈ $400M | ≈ $850M |

| Governance | 9‑person multi‑sig + token voting | Community‑wide token voting |

| User experience | Themed UI, beginner‑friendly docs | Minimalist, more technical |

What’s better on SushiSwap? Higher APY for LPs thanks to SUSHI farming and a more approachable UI. What’s worse? Slightly lower TVL and a governance model that leans on a small core team.

How to Get Started on Ethereum

- Install a Web3 wallet (MetaMask, Trust Wallet, etc.) and fund it with ETH for gas.

- Navigate to app.sushi.com and click “Connect Wallet”.

- Select the “Swap” tab, choose the ERC‑20 pair you want to trade, and review the price impact.

- Confirm the transaction in your wallet; Ethereum will ask you to pay a gas fee.

- To become a liquidity provider, go to the “Pool” tab, add equal USD value of both tokens, and click “Supply”.

- Stake your LP tokens in the “Kashi” or “Onsen” farms to earn extra SUSHI.

Remember: always double‑check contract addresses, especially when dealing with lesser‑known tokens. SushiSwap flags verified contracts, but phishing sites still exist.

Security, Audits, and Risks

SushiSwap’s core contracts have undergone multiple audits by firms like PeckShield and Quantstamp. No major breach has been reported since the 2021 migration to a more robust contract suite. However, the platform’s history includes a “rug pull” incident when the original creator, Chef Nomi, withdrew 14M SUSHI in 2020. The community responded by moving governance to a multi‑sig, which restored trust for most users.

Key risks to keep in mind:

- Impermanent loss - especially in volatile pairs.

- Gas fee spikes on Ethereum can turn small arbitrage opportunities unprofitable.

- Governance centralization - nine individuals control contract upgrades.

Mitigation tip: start with stable‑coin pairs (e.g., USDC/DAI) to learn the mechanics before moving into more volatile assets.

Token Economics and Price Outlook

The SUSHI token has a capped supply of 250million. Holders receive 0.05% of every swap fee and can stake SUSHI for xSUSHI, which represents a share of the protocol’s revenue. Analysts in 2025 predict a price range of $0.49‑$0.60, reflecting broader market pressure and the dilution effect from farming incentives.

Even if the token stays flat, the platform’s value proposition lies in the fee‑sharing model for LPs and the cross‑chain trading experience. For traders, the key metric is the effective cost per swap, not the SUSHI price itself.

Community and Support

SushiSwap maintains an active Discord, Telegram, and forum where developers share roadmap updates. Educational resources include a “Sushi Academy” with video tutorials, a glossary that explains terms like “impermanent loss” in plain language, and a weekly AMA with core developers.

Feedback highlights the UI’s friendliness but also calls for more transparency in governance voting records. The platform has responded by publishing weekly snapshots of multi‑sig activity.

Is SushiSwap Right for You?

If you’re a beginner who wants a gentler entry into DeFi, SushiSwap’s themed interface and abundant docs make it a solid choice. If you prioritize the deepest liquidity and the lowest slippage, Uniswap still leads on Ethereum.

For users who enjoy earning extra yields, the SUSHI farming programs can boost returns dramatically-sometimes exceeding 100% APR on high‑risk pairs. Just remember that high yields come with high risk.

Frequently Asked Questions

How do I connect my wallet to SushiSwap?

Open the SushiSwap app, click “Connect Wallet”, choose your Web3 provider (e.g., MetaMask), and approve the connection request in the wallet pop‑up.

What are the gas costs on Ethereum for a typical swap?

Gas fees vary with network congestion. In mid‑2025 the average cost for a 0.3% fee swap ranged from $5 to $20, but using Arbitrum or BNB Smart Chain can drop it below $0.10.

Can I withdraw my liquidity at any time?

Yes. LP tokens are fully withdrawable. Removing liquidity will trigger a transaction that returns your share of the pool plus any earned fees, minus any impermanent loss.

Is SushiSwap safe from hacks?

The core contracts have passed multiple third‑party audits, but no platform is 100% risk‑free. Use hardware wallets for large balances and avoid unverified third‑party integrations.

What is the difference between SUSHI and xSUSHI?

Staking SUSHI locks it in the SushiBar, returning xSUSHI tokens that accrue a share of the protocol’s revenue. xSUSHI can be redeemed for the underlying SUSHI plus earned fees.

mark gray

May 6, 2025 AT 02:49SushiSwap on Ethereum offers a decent entry point for newbies, the UI is clean and the fee split is easy to understand.

Alie Thompson

May 9, 2025 AT 19:37SushiSwap presents itself as a democratizing force in decentralized finance, yet the very architecture that promises openness also hides layers of complexity that most casual users simply cannot fathom. The platform’s reliance on liquidity providers creates a subtle form of rent extraction, where those who supply capital are compensated only after they bear the brunt of impermanent loss. By coupling fee sharing with the proprietary SUSHI token, the protocol incentivizes short‑term speculation over sustainable, community‑driven growth. Moreover, the governance model, while advertised as token‑based, remains in the hands of a tightly‑knit core team, which raises legitimate concerns about centralization. The historical rug‑pull by the original creator, Chef Nomi, serves as a cautionary tale that even in ostensibly open‑source ecosystems, power can be consolidated. Users are further exposed to volatile gas fees on Ethereum, which can erode any modest returns from farming activities. While the cross‑chain expansion mitigates some of these costs, it also introduces additional attack vectors and bridge vulnerabilities. The native token’s economics, with a capped supply but continual emission through farming incentives, dilute its value over time, making it a risky store of wealth. In essence, SushiSwap is a sophisticated financial instrument that demands a high degree of diligence, not a casual playground for the uninformed. Its promise of higher APY must be weighed against the hidden risks of governance capture, protocol upgrades without broad consensus, and the ever‑present threat of smart‑contract bugs. Consequently, treating SushiSwap as a silver bullet for DeFi exposure is a misguided simplification that overlooks the nuanced trade‑offs inherent in its design. Investors should approach it with the same critical scrutiny they would apply to any leveraged financial product, recognizing that the allure of rewards can quickly be eclipsed by hidden costs and systemic risks.

Samuel Wilson

May 13, 2025 AT 12:25SushiSwap’s AMM model is articulated with commendable clarity, and the fee distribution mechanism aligns incentives for liquidity providers. By allocating 0.25 % of each swap to LPs and retaining 0.05 % for the treasury, the protocol balances sustainability with participant reward. The documentation provides step‑by‑step guidance, which is invaluable for users transitioning from centralized exchanges. Overall, the platform maintains a high standard of technical precision while remaining accessible.

Rae Harris

May 17, 2025 AT 05:13Honestly, the whole SushiSwap hype is just another layer of DeFi noise – the UI feels like a sushi menu, but the underlying slippage on volatile pairs can be brutal. You’re basically paying for the privilege of moving tokens through a self‑rebalancing pool that’s riddled with impermanent loss. If you’re not into hunting for high‑APR farms, you might as well stick to a plain Uniswap swap and avoid the extra token‑omics drama.

Danny Locher

May 20, 2025 AT 22:01SushiSwap’s interface is pretty straightforward, and the ability to switch between Ethereum and cheaper L2s makes it versatile. I started with a small USDC/DAI pool to get a feel for the fee earnings. It’s a good way to dip a toe into liquidity provision without too much risk.

Emily Pelton

May 24, 2025 AT 14:49Look, SushiSwap is *not* just another cute app, it’s a serious financial tool, and if you can’t handle the heat, stay out of the kitchen! The fee structure is transparent, the rewards are tangible, and the governance model-while not perfect-offers real voting power; don’t let the critics distract you from the actual yields! Dive in, stake your tokens, and watch the compounding work for you, but keep an eye on gas costs, because those can eat your profits faster than a shark in shallow water.

sandi khardani

May 28, 2025 AT 07:37SushiSwap claims to be a community‑driven platform, yet its history is littered with incidents that suggest otherwise. The infamous Chef Nomi episode is a stark reminder that early developers can wield disproportionate power, extracting value from unsuspecting users. Even after the migration to a multi‑sig, the core team still retains significant upgrade authority, which could be abused under the guise of protocol improvements. Furthermore, the ever‑changing fee‑sharing formulas can be tweaked without broad consensus, subtly shifting rewards away from LPs. The reliance on the SUSHI token for governance also creates a feedback loop where token holders influence policy that benefits the token itself, potentially leading to circular incentives that are not in the best interest of the broader ecosystem. In addition, cross‑chain bridges, while expanding utility, have historically been vulnerable to exploits, adding another layer of risk. All these factors combine to paint a picture of a platform that, while innovative, is far from the decentralized utopia it professes to be. Users should therefore approach SushiSwap with a healthy dose of skepticism and conduct thorough due diligence before allocating capital.

Donald Barrett

June 1, 2025 AT 00:25Stop trusting SushiSwap blindly; everything’s a scam.

Christina Norberto

June 4, 2025 AT 17:13The recent audits of SushiSwap’s core contracts appear thorough on the surface, yet one must consider the possibility of hidden backdoors embedded by insiders. Given the platform’s history of governance centralization, it is plausible that future upgrades could introduce subtle mechanisms to siphon fees. Moreover, the reliance on centralized oracle services for price feeds introduces a single point of failure that could be exploited by coordinated actors. While the official statements emphasize security, an informed observer should remain vigilant about the latent vulnerabilities inherent in any complex smart‑contract system.

Fiona Chow

June 8, 2025 AT 10:01Oh great, another DeFi playground where you think you’re a pro because you can swap a token for a token. Spoiler: the gas fees will eat your lunch, and the “rewards” are just a clever marketing trick to keep you hooked. If you wanted a gamble, you could've bought a lottery ticket.

Rebecca Stowe

June 12, 2025 AT 02:49Sounds good, give it a try!

Kailey Shelton

June 15, 2025 AT 19:37SushiSwap’s fee calculator is a handy tool, but remember it’s based on assumptions that may not hold in volatile markets. Always double‑check the numbers against current gas prices and pool depth before committing large amounts.

Angela Yeager

June 19, 2025 AT 12:25Here are a few quick tips to maximize your experience with SushiSwap:

• Use stable‑coin pairs for your first liquidity provision to reduce impermanent loss.

• Consider L2 networks like Arbitrum or Polygon for lower transaction costs.

• Regularly monitor the pool’s TVL and your share of fees.

• Stake earned SUSHI in the SushiBar to collect additional protocol revenue.

By following these steps, you can better manage risk while taking advantage of the platform’s yield opportunities.

vipin kumar

June 23, 2025 AT 05:13The whole DeFi narrative is a façade engineered by elite technocrats to control our financial behavior. Platforms like SushiSwap are merely tools in a larger agenda to shift power away from sovereign institutions and into shadowy smart contracts that no regulator can oversee. Stay skeptical.

Vaishnavi Singh

June 26, 2025 AT 22:01When contemplating the philosophical implications of decentralized exchanges, one must reflect on the duality of trust and autonomy. SushiSwap embodies a paradox: it grants users agency while simultaneously binding them to immutable code. This tension invites a deeper inquiry into the nature of financial freedom in the digital age. Ultimately, the platform serves as a mirror reflecting both our aspirations and our vulnerabilities.

Kevin Fellows

June 30, 2025 AT 14:49Yo, SushiSwap is pretty cool for grabbing some quick swaps without the hassle. I’ve been using it on Polygon and the fees are barely anything. Definitely worth a shot if you’re into low‑cost trading.

victor white

July 4, 2025 AT 07:37One cannot dismiss the aesthetic considerations that SushiSwap brings to the decentralized finance tableau; its culinary metaphor, while whimsical, belies a sophisticated orchestration of liquidity mechanics. The platform’s architecture, when examined through a lens of systemic design, reveals an intricate lattice of incentives that reward strategic positioning with a finesse comparable to haute cuisine. Yet, beneath the veneer of elegance, one discerns the subtle undercurrents of centralization that persist in governance deliberations. To the discerning connoisseur, SushiSwap represents both a feast and a cautionary tale, urging vigilance alongside participation.

Lara Cocchetti

July 8, 2025 AT 00:25It’s evident that the architects of SushiSwap have woven a narrative that masks the underlying power structures; the token distribution model, in particular, concentrates influence among a select cadre. While the community is encouraged to vote, the reality is that a handful of addresses can sway outcomes, perpetuating a pseudo‑decentralized framework. This discrepancy between rhetoric and practice warrants scrutiny.

Mark Briggs

July 11, 2025 AT 17:13Sure, SushiSwap is the best thing ever.

Millsaps Delaine

July 15, 2025 AT 10:01SushiSwap, with its culinary branding, attempts to demystify the complexities of automated market making, yet the very nomenclature serves as a double‑edged sword, simultaneously inviting newcomers while obscuring the inherent risks. The platform’s fee structure, a modest 0.30 % per swap, may appear attractive, but when juxtaposed against the volatile gas costs on Ethereum, the net effective rate can swell dramatically, eroding marginal gains. Moreover, the promise of SUSHI token rewards introduces an additional layer of opportunity cost; the token’s own price dynamics, influenced by yield farming incentives, can lead to dilution of returns, particularly for LPs who remain exposed to impermanent loss. From a governance perspective, the nine‑person multi‑sig, though a step toward decentralization, concentrates decision‑making authority, raising concerns about the resilience of protocol upgrades in adversarial scenarios. Cross‑chain expansions to Arbitrum and Polygon mitigate some gas concerns, yet they also broaden the attack surface, as bridge contracts have historically been vulnerable to exploits. Users must therefore conduct a holistic assessment, weighing not only the superficial APR figures but also the underlying operational costs, tokenomics, and governance architecture. In essence, while SushiSwap presents an alluring gateway into DeFi, it is imperative to navigate it with a calibrated understanding of both its benefits and its systemic vulnerabilities.

Anthony R

July 19, 2025 AT 02:49SushiSwap, as a decentralized exchange, provides a user‑friendly interface, utilizes an automated market maker model, offers fee sharing for liquidity providers, supports multiple blockchains, and includes a native governance token, SUSHI, which grants voting rights, while also featuring yield farming opportunities, and despite higher gas fees on Ethereum, it remains a viable option for many traders, especially when considering cross‑chain swaps, and users should remain mindful of impermanent loss, gas costs, and protocol governance when participating.