Crypto Foreign Exchange Violations – What You Need to Know

When dealing with Crypto Foreign Exchange Violations, illegal or non‑compliant swaps between fiat money and digital assets that break local or international law, you’re stepping into a space where finance, tech, and law collide. These breaches often happen because traders ignore cryptocurrency regulations, rules that define how digital currencies can be bought, sold, and moved across borders. Think of it like driving a car without a license – the road is there, but you’re not allowed to use it the way you think. Understanding the core definition helps you spot red flags before you get caught in a costly investigation.

How Exchange Compliance and AML Shape the Landscape

Every legit exchange must meet exchange compliance, the set of internal policies and external legal standards that ensure trades are transparent and lawful. When an exchange skips KYC checks or hides transaction data, it creates a breeding ground for anti‑money laundering (AML) procedures designed to stop criminals from turning dirty money into clean crypto. In practice, a weak AML program means a trader can move large sums of fiat into crypto without proper reporting, triggering violations that can lead to hefty fines or even prison time. The relationship is simple: strong compliance reduces the chance of foreign exchange violations, while lax oversight invites regulators to step in.

Beyond the exchange itself, enforcement agencies like the SEC, FINCEN, and their overseas counterparts keep tabs on cross‑border transactions. They look for patterns such as repeated high‑volume swaps, use of privacy‑focused tokens, or routing funds through offshore mixers. When they spot a breach, they can freeze assets, levy penalties, and publish enforcement actions that serve as warnings to the whole industry. For regular traders, this means staying updated on the latest guidance, using platforms that publish their licensing status, and keeping records of every fiat‑to‑crypto move. Below you’ll find a curated list of articles that break down real‑world cases, practical compliance checklists, and the newest regulatory trends so you can avoid the pitfalls of crypto foreign exchange violations.

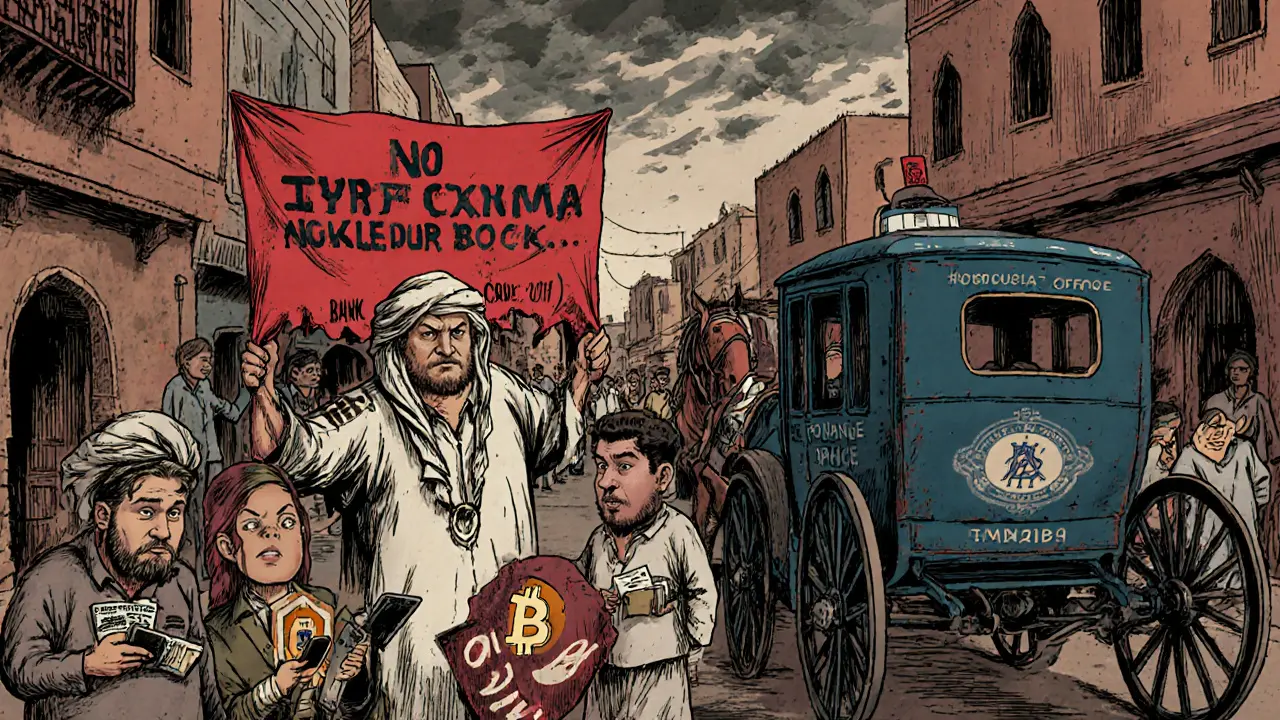

Understanding Morocco's Crypto Foreign Exchange Violations and New Regulations

by Johnathan DeCovic Oct 31 2024 14 CryptocurrencyLearn how Morocco's new crypto regulations tackle foreign‑exchange violations, licensing rules, penalties, taxes, and the future of e‑Dirham in a clear, practical guide.

READ MORE