October 2024 Crypto Archive

When you look at October 2024 Crypto Archive, a collection of StakeLiquid’s posts from October 2024 covering crypto and staking topics, you instantly see a snapshot of what mattered in crypto that month. From the surge in Liquid Staking interest to the way DeFi protocols shifted their reward models, the archive is a quick‑stop shop for anyone who wants to stay updated without digging through weeks of noise. The goal here isn’t just to list articles; it’s to give you the context you need so you can decide which piece of content will actually help you move forward.

Key Themes You’ll Find

First up is Liquid Staking, a method that lets you earn staking rewards while keeping your tokens usable in other DeFi apps. This practice encompasses earning rewards while maintaining token liquidity, meaning you don’t have to lock assets away forever. In October we saw several new platforms launch bridges that let you move staked tokens across chains, a move that directly influences how investors allocate capital. If you’ve ever wondered whether you can earn yield and still trade, the posts in this archive break down the why, how, and what‑if of those options.

Next, DeFi Trends, the evolving patterns in decentralized finance, from protocol upgrades to shifting reward structures took center stage. DeFi trends influence staking strategies by reshaping risk‑reward calculations. For example, a major protocol’s switch to a lower inflation rate prompted a wave of users to explore alternative liquid staking solutions, a shift covered in depth in our October guides. Understanding these trends helps you anticipate where the next yield opportunities might pop up.

We also dove into Airdrop Opportunities, campaigns that distribute free tokens to eligible community members, often tied to network activity or governance participation. Airdrop opportunities drive community participation and can add a surprise boost to a portfolio. October’s coverage highlighted eligibility criteria, claim processes, and the best ways to position yourself for upcoming drops, turning what used to feel like a lottery into a strategic move.

Finally, Market Insights, analysis of price movements, trading volumes, and macro factors affecting crypto and traditional markets rounded out the month’s content. Market insights guide investment decisions by tying together on‑chain data, regulatory news, and macro‑economic shifts. Our October pieces linked Bitcoin’s price rally to institutional inflows, connected Ethereum’s upgrade timeline to gas fee expectations, and even compared crypto performance against select stock indices.

All these pieces fit together: liquid staking gives you flexible yield, DeFi trends shape where that yield makes sense, airdrop opportunities add extra upside, and market insights keep you grounded in the bigger picture. Below you’ll find the full list of October 2024 posts, each packed with practical tips you can start using right away.

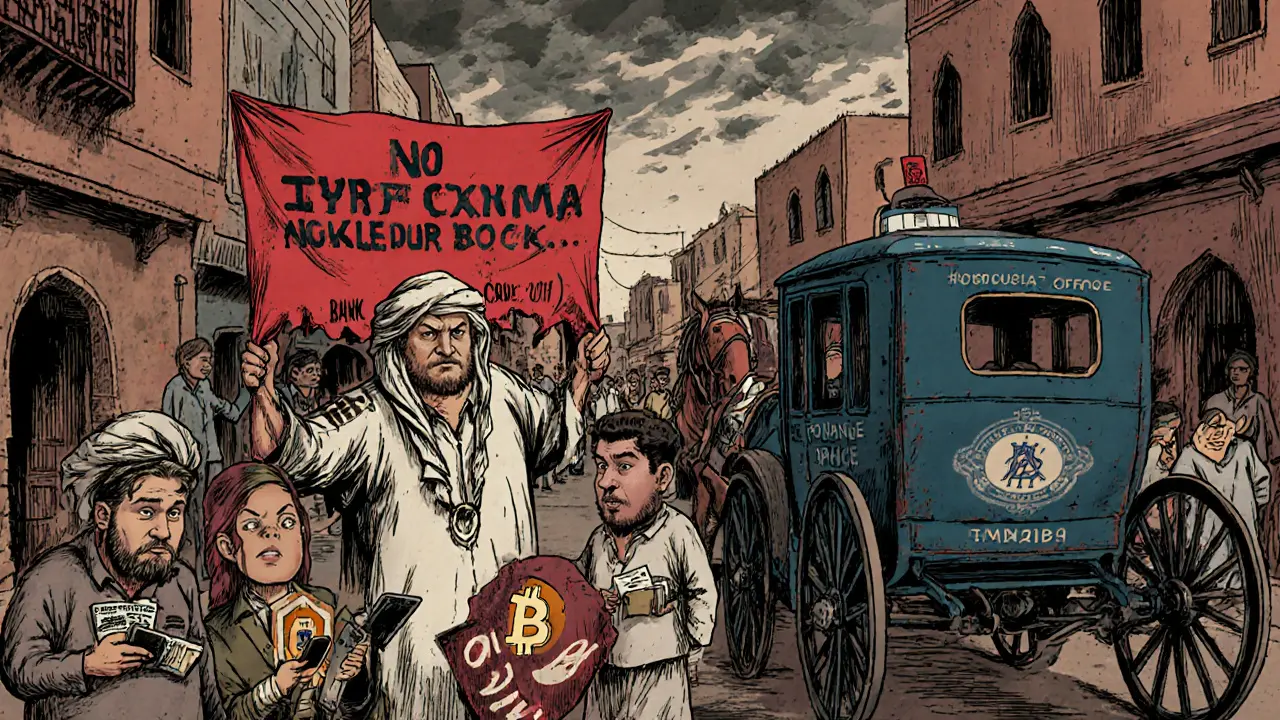

Understanding Morocco's Crypto Foreign Exchange Violations and New Regulations

by Johnathan DeCovic Oct 31 2024 14 CryptocurrencyLearn how Morocco's new crypto regulations tackle foreign‑exchange violations, licensing rules, penalties, taxes, and the future of e‑Dirham in a clear, practical guide.

READ MOREKuwait's Central Bank Crypto Ban: Full Details & Impact

by Johnathan DeCovic Oct 21 2024 20 CryptocurrencyAn in‑depth look at Kuwait’s Central Bank crypto ban, its legal scope, enforcement actions, economic impact and how it stacks up against other GCC regulators.

READ MORECakepie (CKP) Crypto Coin Explained - What It Is, How It Works, and Why It Matters

by Johnathan DeCovic Oct 19 2024 22 CryptocurrencyLearn what Cakepie (CKP) crypto coin is, its Solana roots, tokenomics, market data, and how to trade it in the DeFi space.

READ MORE