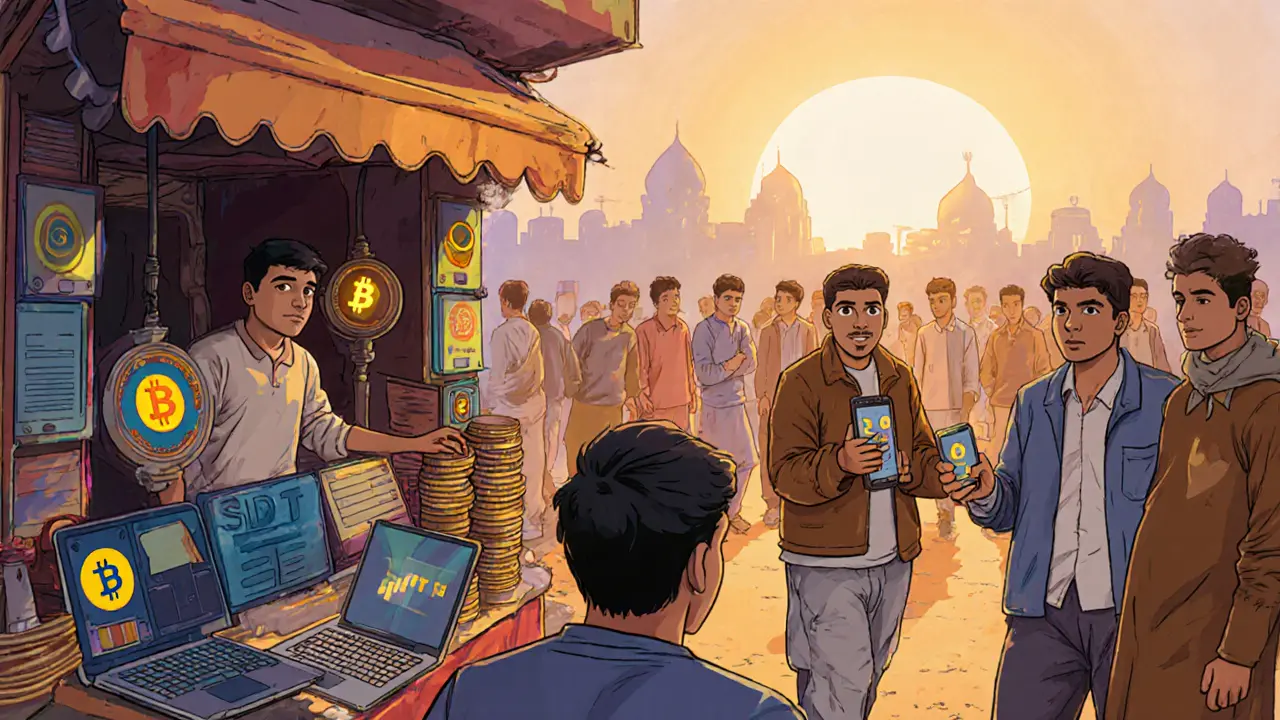

Underground Crypto Afghanistan: Risks, Trends and Realities

When talking about underground crypto Afghanistan, the informal market where crypto is traded, mined, or used outside official oversight in Afghanistan, you’re really looking at a mix of technology, law, and local economics. It’s also called the shadow crypto market and it often overlaps with crypto regulation, the set of rules, bans, and enforcement actions that governments apply to digital assets. In practice, people dodge bans by using airdrop, free token distribution campaigns that can be claimed with minimal KYC, making it a favorite tool for quick, low‑risk entry. At the same time, stablecoins, digital tokens pegged to a fiat currency to reduce volatility serve as a bridge between volatile local tokens and more stable global assets. Finally, cross‑chain bridges, protocols that let assets move between different blockchains enable traders to hop between networks, sidestepping local restrictions while chasing better liquidity.

Key Factors Shaping the Underground Scene

The first major driver is the regulatory environment. Afghanistan’s central bank has issued vague warnings, but there’s no clear legal framework, so many operators treat the space as a gray zone. That uncertainty pushes users toward anonymous wallets, peer‑to‑peer platforms, and off‑shore exchanges that claim privacy. Second, the lure of airdrops is huge; projects targeting “early adopters” often promise high‑value tokens with almost no cost, drawing in locals who lack capital for big purchases. Third, stablecoins like USDC and USDT become the preferred store of value because they protect against the Afghan afghani’s inflation while still being easy to move across borders. Finally, cross‑chain bridges such as Wormhole or Binance Bridge let users swap between Binance Smart Chain, Solana, and Ethereum without touching local banks, which are often under scrutiny. Each of these pieces feeds the next: lax regulation fuels airdrop interest, which in turn relies on stablecoins for liquidity, all made possible by bridges that cut across networks.

What you’ll see in the articles below is a practical look at how these elements play out. One piece breaks down how stablecoins are being used to hedge local price swings in 2025, another warns about high‑risk tokens like Hertz Network that pop up in underground markets, and a guide walks you through spotting legit airdrops versus scams. There’s also a deep dive into cross‑chain bridges and how they can be both a shortcut and a security risk for Afghan traders. By the time you finish reading, you’ll have a clearer picture of the hidden crypto economy, the tools people use to stay under the radar, and the real dangers that come with operating in a space where law and technology intersect in unpredictable ways. Ready to explore the full range of insights? Dive into the curated posts below.

Afghanistan Crypto Ban: How the Taliban’s 2022 Prohibition Shaped the Underground Market

by Johnathan DeCovic Nov 17 2024 20 CryptocurrencyExplore how the Taliban's 2022 crypto ban reshaped Afghanistan's digital asset landscape, its underground market, and the impact on women and remittances.

READ MORE