Trading Strategies

When you start looking at trading strategies, a set of planned methods used to buy, sell, or hold crypto assets in order to meet specific profit or risk goals. Also known as crypto trading tactics, they help traders turn market signals into actionable moves while keeping emotions in check.

Key Concepts that Shape Every Strategy

Effective risk management, the practice of sizing positions, setting stop‑losses, and diversifying to protect capital is the backbone of any solid approach. Without it, even the best‑priced entry can turn into a loss. Tokenomics, the economic design behind a cryptocurrency, influences how a strategy should allocate assets because supply limits, inflation rates, and utility affect price behavior. When markets swing hard, stablecoins, digital tokens pegged to fiat currencies that aim to keep value steady give traders a safe harbor or a quick hedge. Finally, cross-chain bridges, tools that let you move assets between blockchains without selling expand the playbook, letting strategies tap into liquidity on multiple networks.

These entities form a web of influence: trading strategies encompass risk management, risk management shapes tokenomics choices, stablecoins support strategies by reducing volatility, and cross‑chain bridges enable broader asset access for those strategies. In practice, a day‑trader might use a stablecoin to park profits, rely on risk management rules to set stop‑losses, and jump through a bridge to exploit arbitrage on a different chain. Each component reinforces the others, creating a resilient approach that adapts to market shifts.

Our collection below reflects this mix. You’ll find guides on how stablecoins tame crypto volatility, deep dives into risk‑management principles, step‑by‑step bridge walkthroughs, and analyses of token economics that matter for long‑term trades. Whether you’re tweaking a scalping routine or building a diversified portfolio, the articles give you concrete tools and real‑world examples to sharpen your tactics.

Ready to see the full range of insights? Scroll down to explore each guide and start applying the concepts that turn theory into profit.

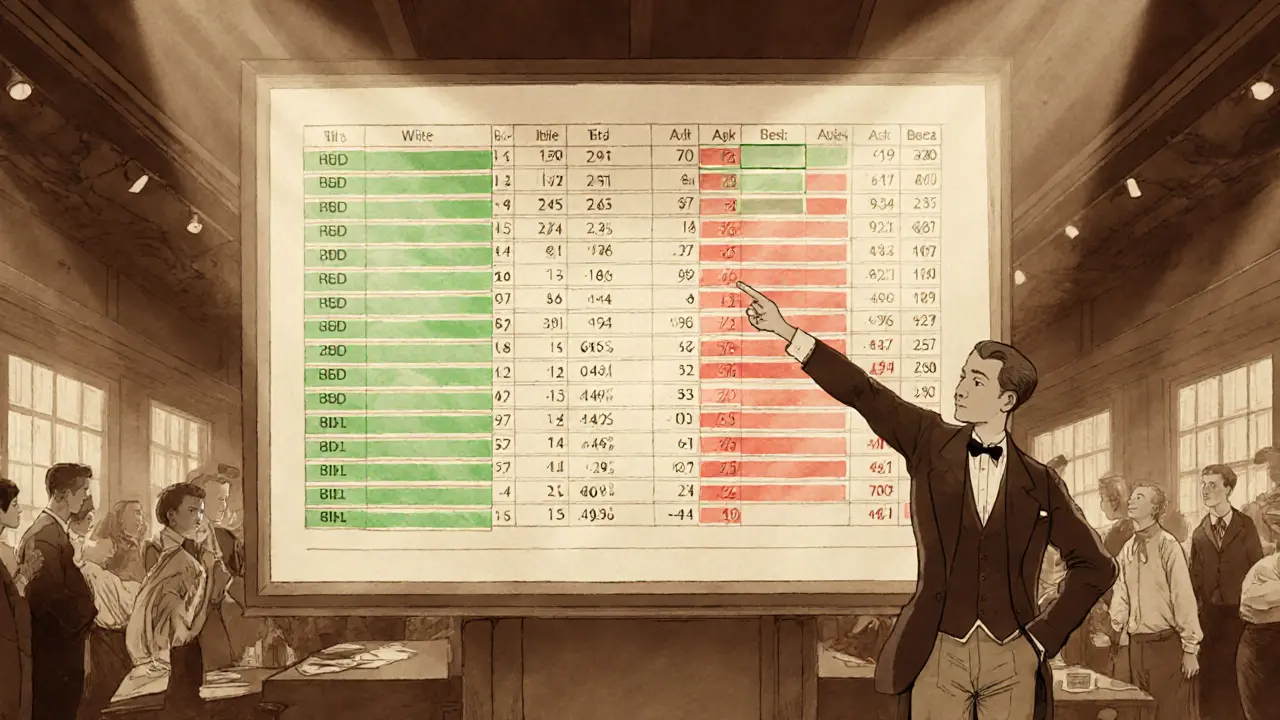

Understanding Order Book Data for Effective Trading Analysis

by Johnathan DeCovic Feb 5 2025 17 TechnologyLearn how order book data works, why it matters for trading, and practical steps to use market depth, bid‑ask spread, and order flow for better strategies.

READ MORE