Taliban cryptocurrency prohibition

When discussing Taliban cryptocurrency prohibition, the set of rules and restrictions imposed by the Taliban on the use, trading, and mining of digital currencies in Afghanistan. Also known as Taliban crypto ban, it shapes how anyone in the country can interact with crypto markets.

The Taliban came to power in August 2021 and immediately began enforcing its interpretation of Islamic law across financial activities. One of the first moves was to declare cryptocurrency illegal, citing concerns over money‑laundering, fraud, and the lack of a central authority. This ban means that exchanges, wallets, and mining farms operating inside Afghanistan must shut down or face severe penalties. At the same time, the country's central bank, the Da Afghanistan Bank, has no official digital asset policy, leaving a regulatory vacuum that discourages any legitimate crypto business.

How the prohibition affects the broader market

From a market perspective, the ban creates a ripple effect. Investors outside Afghanistan who hold Afghan‑based crypto assets suddenly face liquidity risks, while miners lose a potential source of cheap electricity. Taliban cryptocurrency prohibition also fuels a black‑market ecosystem where illicit platforms try to bypass restrictions, raising the overall risk profile for traders worldwide. The restriction exemplifies a broader trend of sovereign crypto bans, similar to the policies seen in China and Tunisia, where governments use legal force to limit digital‑currency activity.

Regulators and compliance teams need to watch this development closely because it influences risk‑management strategies. When a country enforces a hard ban, exchange compliance departments must update AML/KYC procedures, block IP addresses from the region, and flag any transactions that appear to originate from Afghanistan. For institutional investors, the ban signals a cautionary tale: geopolitical shifts can instantly alter the legal status of an entire asset class.

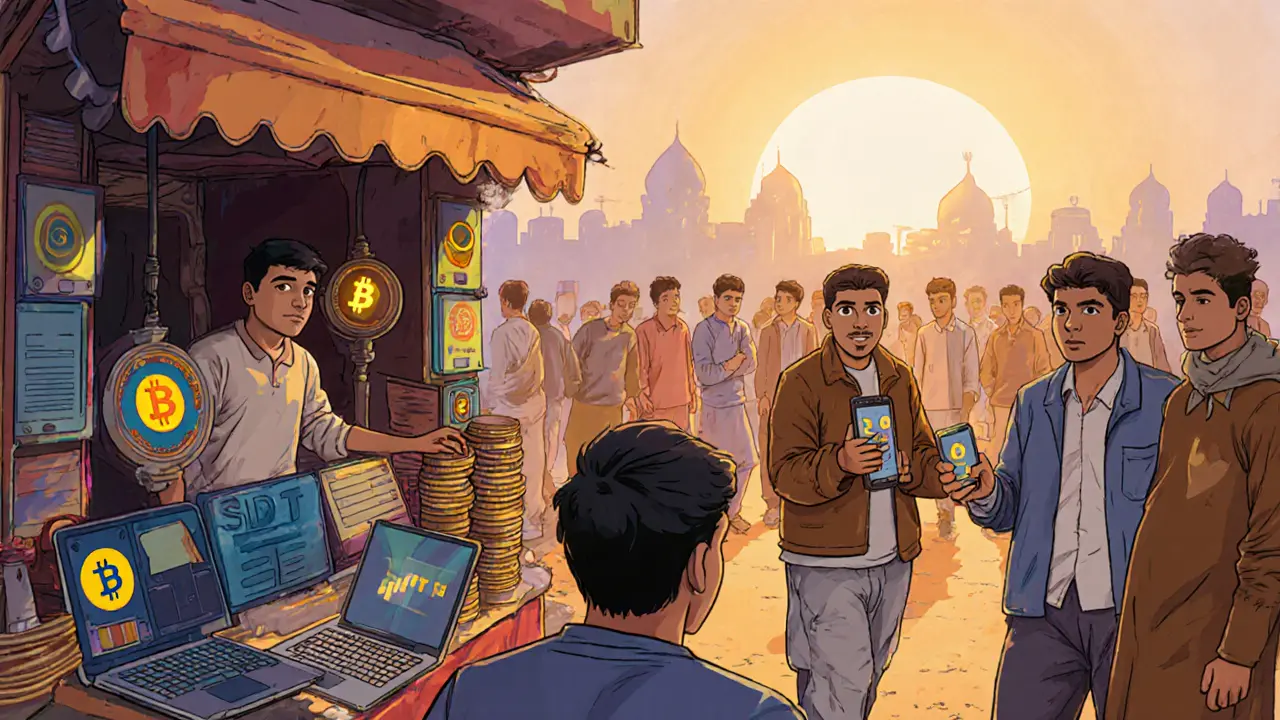

For everyday users, the ban means fewer options to buy, sell, or store crypto safely. Many Afghan citizens who once saw digital assets as a hedge against a volatile fiat environment now face limited access. Some turn to peer‑to‑peer networks, but those channels often lack the security and transparency of regulated exchanges. The prohibition also discourages foreign developers from launching blockchain projects aimed at the Afghan market, slowing innovation in sectors like remittances, supply‑chain tracking, and decentralized finance.

Despite the harsh stance, there are still pockets of activity. Underground mining groups continue to operate in remote areas where enforcement is weaker. Meanwhile, diaspora communities outside Afghanistan sometimes use crypto to send money back home, skirting the ban by routing funds through third‑party services. These workarounds keep the conversation about digital assets alive, even as the official policy remains unforgiving.

Below you’ll find a curated set of articles that dive deeper into related topics: from detailed reviews of crypto exchanges and security guides to analyses of other national bans like China’s and Tunisia’s. Each piece offers practical insight you can apply whether you’re navigating compliance, assessing risk, or simply staying informed about how political forces shape the crypto landscape.

Afghanistan Crypto Ban: How the Taliban’s 2022 Prohibition Shaped the Underground Market

by Johnathan DeCovic Nov 17 2024 20 CryptocurrencyExplore how the Taliban's 2022 crypto ban reshaped Afghanistan's digital asset landscape, its underground market, and the impact on women and remittances.

READ MORE