Stablecoins: A Practical Overview

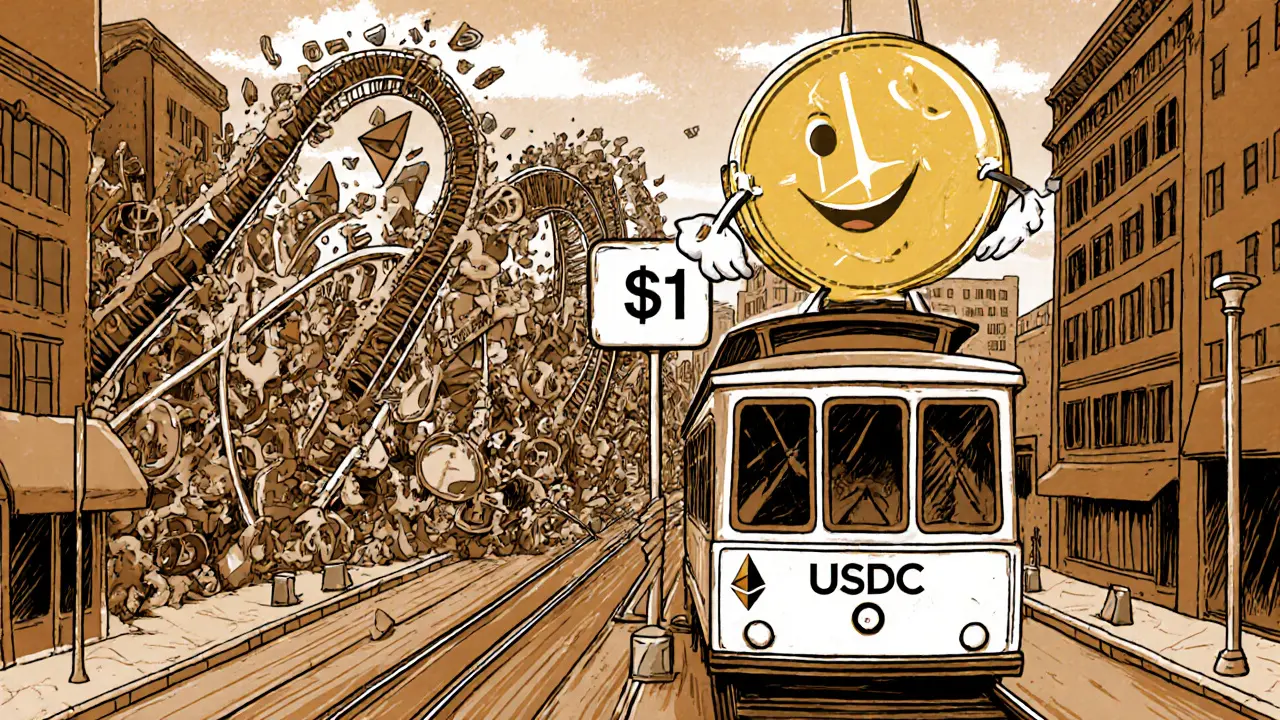

When talking about stablecoins, cryptocurrencies designed to hold a steady value by linking to a fiat currency, commodity, or algorithmic rule. Also known as stable coin, they aim to combine crypto’s speed with the predictability of traditional money. Stablecoins have become a backbone for DeFi trading, remittances, and everyday payments because they let users move value without the wild price swings typical of Bitcoin or altcoins.

One of the key forces keeping a stablecoin on track is its tokenomics, the economic design that defines supply, collateral, and incentive mechanisms. Good tokenomics ensures that every token is backed by real assets or a reliable algorithm, so the peg stays firm even when markets get volatile. For example, a fiat‑backed stablecoin might hold $1 in a bank for each token issued, while an algorithmic version uses smart contracts to expand or shrink supply automatically. Understanding tokenomics helps you assess risk, spot hidden fees, and decide if a stablecoin fits your portfolio.

Moving stablecoins across different blockchains is made possible by cross‑chain bridges, protocols that lock an asset on one chain and mint a wrapped version on another. These bridges let users enjoy low fees on platforms like Solana or Polygon while still holding a USD‑pegged asset. However, bridges also add a layer of trust risk; a vulnerability can expose wrapped stablecoins to hacks. When evaluating a bridge, look for audited code, decentralised validator sets, and clear rollback mechanisms.

Regulators worldwide are zeroing in on stablecoins because their widespread use can affect monetary policy and consumer protection. crypto regulation, laws and guidelines governing issuance, trading, and compliance of digital assets, shapes which stablecoins can operate in a given jurisdiction. The EU’s MiCA framework, the U.S. Treasury’s recent guidance, and Asian central bank pilots each impose different reporting, reserve, and licensing requirements. Staying aware of these rules helps you avoid frozen accounts, unexpected taxes, or legal hassles.

In the DeFi world, liquidity pools, smart contracts that pool assets to enable instant swapping and lending, often use stablecoins as the low‑volatility side of the pair. Providing stablecoins to a pool can earn you fees and rewards while minimizing impermanent loss. Yet, pool composition matters: a highly concentrated pool may face slippage, whereas a diversified pool with multiple stablecoins spreads risk. Tools that show pool token ratios and real‑time APY can guide you to the most efficient setups.

Beyond these core concepts, the stablecoin ecosystem interacts with a host of other topics covered on our site. You’ll find deep dives into crypto risk management, airdrop opportunities that sometimes involve stablecoins, and reviews of exchanges where you can trade them. Whether you’re a beginner wanting to understand how a dollar‑pegged token works, or a seasoned trader looking for the best bridge or liquidity pool, the articles below give you actionable insights backed by data.

Now that you’ve got the fundamentals, explore the collection of guides, reviews, and analyses that unpack stablecoins from every angle. From tokenomics breakdowns to bridge security checks and regulatory updates, the following posts will help you make smarter moves in the fast‑moving world of stablecoins.

Stablecoins: Tackling Crypto Volatility in 2025

by Johnathan DeCovic Oct 12 2025 22 CryptocurrencyExplore how stablecoins tame crypto volatility, the mechanisms behind their peg, major players, benefits, risks, and 2025 market trends in clear, practical terms.

READ MORE