Order Book Data: Your Guide to Market Depth and Smart Trading

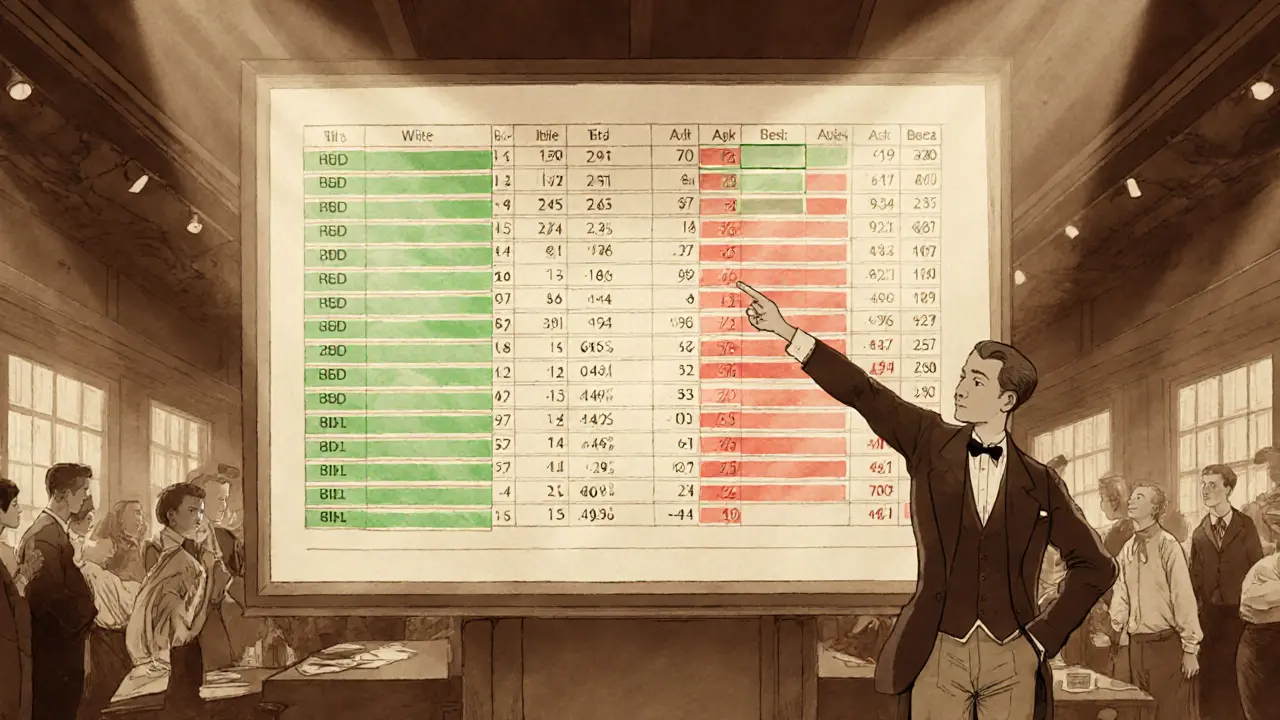

When working with order book data, the real‑time list of buy and sell orders for a given asset. Also known as order flow, it shows the quantity and price of each pending trade. Market depth, the cumulative volume of orders at each price level is a direct output of the order book and tells you how much liquidity sits on either side of the current price. Another key piece is liquidity pools, collections of funds that enable trades without a traditional order book—they complement order book data by smoothing out price impact for large orders. Understanding these pieces together lets you gauge price discovery, the process by which a market finds the true value of an asset and avoid costly slippage. In short, order book data is the backbone of modern trading analytics, feeding everything from algorithmic strategies to manual day‑trading decisions.

Why Order Book Data Matters for Every Trader

Order book data encompasses market depth, which requires you to read bid and ask stacks to see where support and resistance lie. It also influences price discovery by showing how many orders are waiting at each price point, helping you predict short‑term moves. For crypto fans, the data is especially valuable because markets run 24/7 and order flow can shift in seconds. Tools like depth charts turn raw numbers into visual heat maps, highlighting where large trading pairs, two assets exchanged against each other like BTC/USDT have most of their liquidity. When a big sell wall appears, you can expect the price to wobble down unless new buy orders fill the gap. Conversely, a thick buy wall often signals a solid floor. By combining order book snapshots with on‑chain data from liquidity pools, you get a fuller picture of market health and can spot arbitrage opportunities before they disappear.

Below you’ll find a curated set of articles that break down these concepts in plain language. We cover how stablecoins use order book data to stay pegged, the role of cross‑chain bridges in moving liquidity, and real‑world smart‑contract applications that read order books automatically. There are also deep dives into risk management, tokenomics, and regulatory changes that affect how order flow is reported on exchanges. Whether you’re hunting for the next airdrop, comparing exchange fees, or building a DeFi bot, the posts here give you the practical context you need to turn raw order book data into actionable trading insights.

Understanding Order Book Data for Effective Trading Analysis

by Johnathan DeCovic Feb 5 2025 17 TechnologyLearn how order book data works, why it matters for trading, and practical steps to use market depth, bid‑ask spread, and order flow for better strategies.

READ MORE