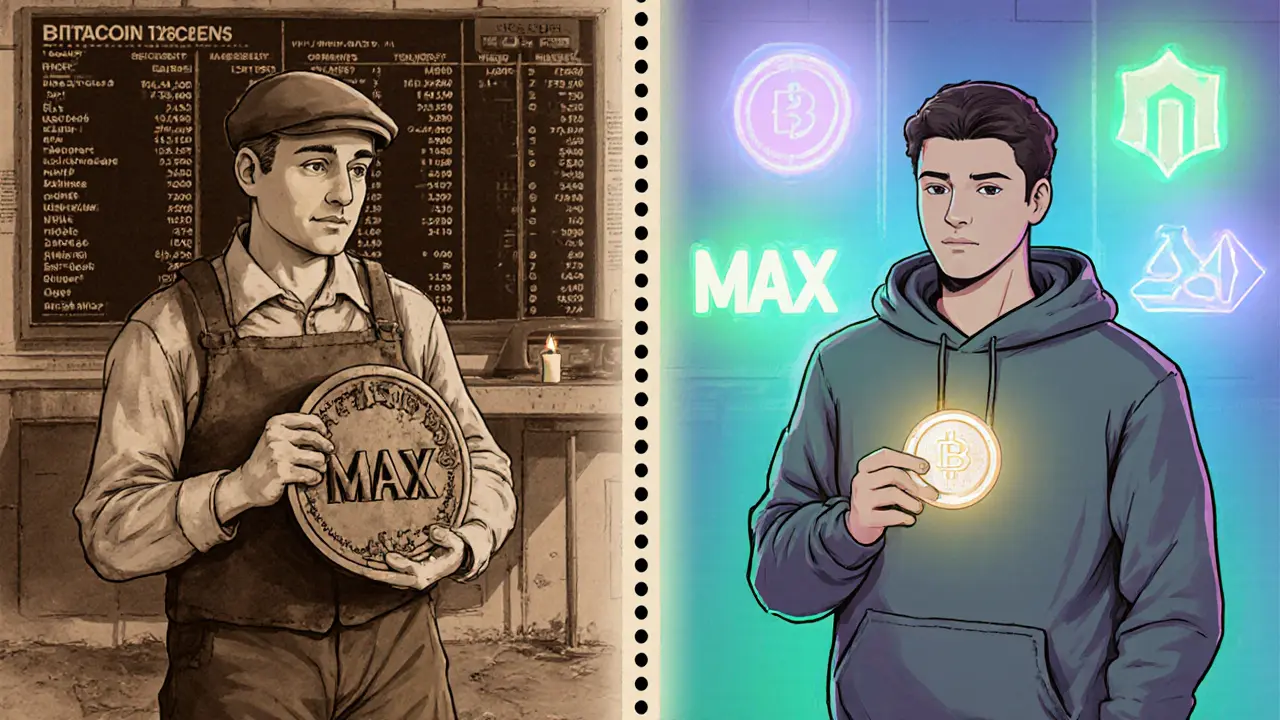

Maxcoin: What It Is and Why It Matters

When you hear about Maxcoin, a blockchain project that blends fast, cheap transactions with a flexible staking system. Also known as MXC, it aims to serve everyday users and developers alike.

Maxcoin sits at the intersection of several key crypto concepts. First, its tokenomics, the economic design that defines supply, distribution and incentive structure drives scarcity and rewards. Second, the staking, the process where holders lock up coins to secure the network and earn interest fuels network security and gives users passive income.

Core Components of Maxcoin

Maxcoin encompasses tokenomics that include a capped supply of 100 million coins, a gradual release schedule, and a built‑in burn mechanism that reduces circulation over time. This design mirrors what we see in stablecoins and other utility tokens, but Maxcoin adds a deflationary twist to keep long‑term holders motivated.

Staking requires a minimum of 5 % of the total supply to be delegated to validators. The reward rate currently sits at 12 % annually, paid out in MXC and a small portion of the network’s transaction fees. This dual‑reward model is similar to what you’d find on platforms like Ethereum’s PoS upgrade, offering both security and economic incentives.

DeFi integration is another pillar. Maxcoin can be supplied to liquidity pools on decentralized exchanges, earning fees and additional token rewards. These pools often use automated market maker (AMM) algorithms, letting users swap MXC for other assets without a central order book. The ability to earn from both staking and liquidity provision creates a layered income strategy.

Crypto regulations influence Maxcoin adoption heavily. In jurisdictions with clear crypto-friendly laws, exchanges list MXC quickly, boosting liquidity. Conversely, stricter regions may see delayed listings or require compliance steps like KYC/AML, which can affect user onboarding. Understanding the regulatory landscape helps investors anticipate where Maxcoin might gain traction next.

Airdrop programs have historically boosted community growth for new projects. Maxcoin ran a recent airdrop targeting early adopters who held at least 1 % of the circulating supply during a snapshot period. Participants received a one‑time bonus of 500 MXC, which sparked increased staking activity and broader awareness.

The relationship between these elements forms a web of incentives: Maxcoin’s tokenomics set the scarcity, staking turns that scarcity into network security, DeFi expands utility, regulation shapes market access, and airdrops kick‑start community participation. In short, each component reinforces the others, creating a self‑sustaining ecosystem.

If you’re curious about how Maxcoin stacks up against other coins, the articles below break down everything from risk management to exchange reviews, giving you a clear picture of where MXC fits in the broader crypto landscape.

Ready to explore the details? Below you’ll find practical guides, market analyses, and step‑by‑step tutorials that dive deeper into Maxcoin’s tokenomics, staking strategies, DeFi opportunities, and regulatory considerations.

Understanding MAX (MAX) Crypto Coin: Maxcoin vs. MAX Token Explained

by Johnathan DeCovic Jan 23 2025 20 CryptocurrencyA clear guide that separates the two MAX crypto coins-Maxcoin and the newer MAX Token-covering their specs, markets, risks, and how to acquire them.

READ MORE