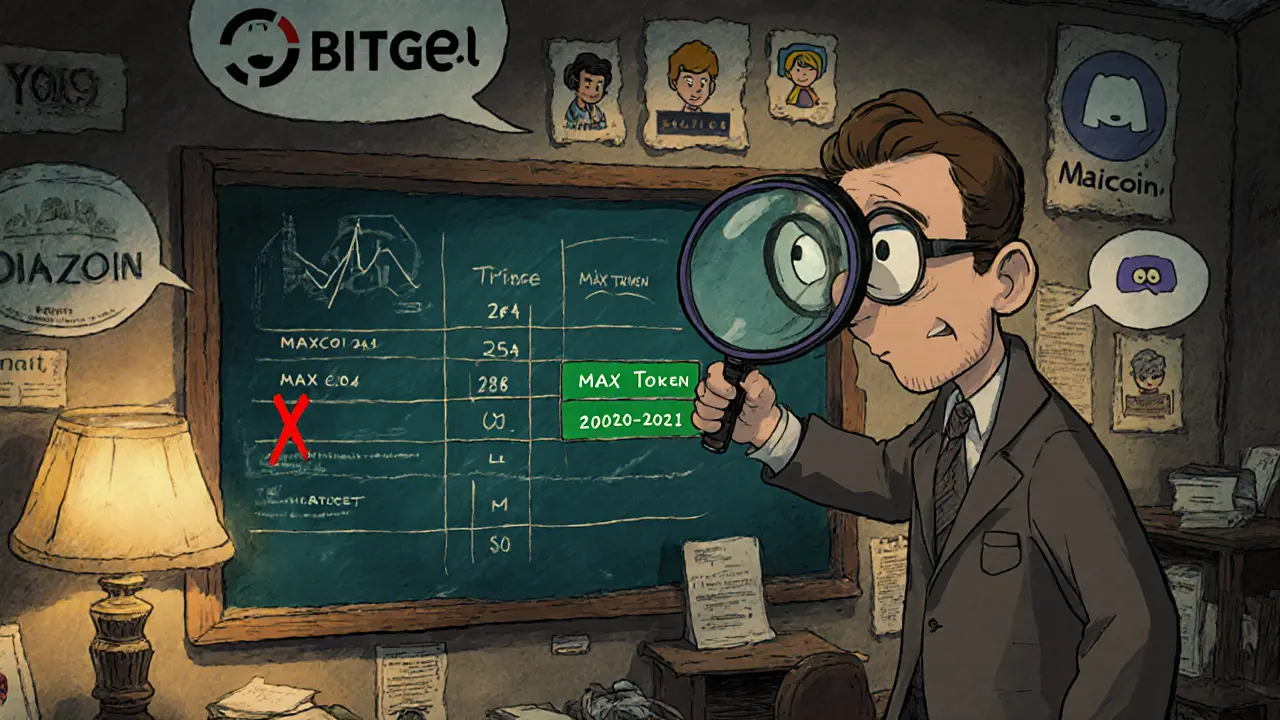

MAX Coin Comparison Tool

Original Maxcoin (MAX)

Launched: Feb 6, 2014

Supply: 100 million MAX

Price: $0.00

Volume: $0 (no exchanges)

Exchanges: None active

Market Cap: $0

Community: <10 active users

Newer MAX Token

Launched: 2020-2021

Supply: 500 million MAX

Price: $0.36

Volume: $1.2M (Bitget)

Exchanges: Bitget, Maicoin

Market Cap: ~$130M

Community: ~200 Discord members

Key Differences Summary

Maxcoin (Original)

- 2014 launch with 100M supply

- No active exchanges

- Zero market cap

- Dormant development

- Minimal community

MAX Token (Newer)

- 2020-2021 launch with 500M supply

- Trades on Bitget and Maicoin

- Active market with ~$130M cap

- Some development activity

- Small but growing community

Detailed Analysis

When you type "MAX" into a crypto tracker, you’ll see two completely different projects fighting for the same ticker. One is the original Maxcoin - an 2014‑era, proof‑of‑work coin that has basically vanished from exchanges. The other is a newer MAX Token built on a more conventional PoW model but with a larger supply and active markets on a handful of exchanges. This article untangles the confusion, compares the two, and tells you what (if anything) you should do with either of them.

Quick Takeaways

- There are two unrelated crypto assets that both use the MAX ticker.

- Maxcoin launched in 2014, runs on Proof of Work with the Keccak algorithm, and has no active exchanges.

- MAX Token appeared later, has a 500million supply, trades on Bitget and Maicoin, and shows modest daily volume.

- Both projects suffer from limited community activity and unclear roadmaps.

- Investors should treat MAX‑ticked assets as high‑risk, low‑liquidity bets.

Why Two MAX Coins Exist

The crypto world isn’t regulated like traditional finance, so duplicate tickers happen. The original Maxcoin (MAX) was created on February62014 with a purely community‑driven ethos - no pre‑mine, no ICO, and a fixed block reward of eight coins. Fast forward to 2020‑2022, a new project filed a token called MAX, chose a 500million supply, and listed on a few Asian‑focused exchanges. Because both projects claim the same three‑letter symbol, data aggregators often merge or mislabel the information, leading to the confusion you see on sites like CoinMarketCap and CoinGecko.

Maxcoin: The Original MAX

Maxcoin (ticker MAX) is an open‑source cryptocurrency that uses a Proof of Work consensus built on the Keccak algorithm - the same family behind SHA‑3. Its design goals were simple: fast, cheap (≈0% fees) transactions for everyday payments.

- Launch date: 6Feb2014

- Maximum supply: 100million MAX

- Block reward: 8MAX per block (fixed)

- Current circulating supply: ~61.4million (according to some feeds, but other sites list zero, indicating data gaps)

- All‑time high price: $0.28 (early 2018)

- Market status: No active exchange listings, $0market cap, essentially dormant

The lack of exchange listings makes buying Maxcoin practically impossible for new users. Its block explorer (explorer.maxcoinproject.net) still shows a live chain, but transaction volume is negligible. Community channels (Telegram, Discord) are dead or have fewer than a dozen members, and the GitHub repo shows the last commit in 2021.

MAX Token: The Newer Contender

The newer MAX Token launched sometime after 2020. It also runs a PoW model, but its code base is a fork of an older mining algorithm (still Keccak‑based). Key facts:

- Launch window: 2020‑2021 (exact date not publicly disclosed)

- Maximum supply: 500million MAX

- Current price (Oct2025): $0.36±0.004 across listed markets

- All‑time high: $0.70 on 20Mar2021

- 24‑hour volume: $1.2M (Bitget) to $375k (CoinGecko)

- Primary exchanges: Bitget (≈96% of volume) and Maicoin

- Market rank: #11,120 on CoinStats (low‑liquidity tier)

Unlike Maxcoin, the MAX Token has real order books, albeit thin. Bitget lists the pair MAX/USDT, and the price swings modestly (daily change under1%). The project’s website offers a brief whitepaper, but there’s no clear roadmap or milestone calendar. Social media chatter is limited to a few hundred tweets and a low‑activity Discord channel.

How to Acquire (or Not)

If you’re set on buying a MAX‑ticked asset, you’ll need to decide which one you actually want.

- Identify the token contract. On CoinMarketCap, Maxcoin uses the ticker “MAX” with a legacy blockchain explorer URL. The newer MAX Token is listed under a separate ID and often appears with a market‑cap column next to it.

- Choose an exchange. For Maxcoin, you’ll find no active markets - the only workaround is peer‑to‑peer swaps on obscure forums, which carries high fraud risk. For MAX Token, create an account on Bitget, pass KYC, and place a market order against USDT.

- Secure your holdings. Both assets use standard address formats. Use a hardware wallet (Ledger, Trezor) for Maxcoin because it’s a native chain. For the newer MAX Token, a software wallet that supports custom ERC‑like tokens (e.g., Trust Wallet) works, but always verify the contract address on the exchange’s info page.

Given the liquidity problems, many traders avoid MAX altogether and look for more robust alternatives (e.g., Litecoin, Dogecoin) that offer similar low‑fee transaction models with active markets.

Risks & Outlook

Both MAX projects share a handful of red flags:

- Liquidity risk: Maxcoin has zero volume; the newer token’s daily volume is under $2M, which can’t absorb sizable trades without slippage.

- Regulatory uncertainty: No clear compliance statements, no AML/KYC policies beyond exchange level, meaning potential legal exposure in jurisdictions with strict crypto rules.

- Development stagnation: Last code updates are years old; no public roadmap suggests the teams may have abandoned active development.

- Community engagement: Tiny Discords, few Twitter followers, and no mainstream coverage imply low user adoption.

From a price‑prediction standpoint, Maxcoin is likely to stay at $0 unless a rogue exchange lists it again. The newer MAX Token might hover around $0.30‑$0.40 for the next 12‑18 months, but any major partnership or network upgrade could spark a short‑term rally. Investors should treat exposure as speculative.

Side‑by‑Side Comparison

| Feature | Maxcoin (original) | MAX Token (new) |

|---|---|---|

| Launch date | 6Feb2014 | 2020‑2021 (approx.) |

| Consensus | Proof of Work (Keccak) | Proof of Work (Keccak‑based) |

| Maximum supply | 100M MAX | 500M MAX |

| Current price (Oct2025) | $0.00 (no market) | $0.36±0.004 |

| All‑time high | $0.28 (2018) | $0.70 (Mar2021) |

| 24‑h volume | $0 (no exchanges) | $1.2M (Bitget) / $375k (CoinGecko) |

| Active exchanges | None | Bitget, Maicoin |

| Community size (approx.) | <10 active users | ~200 Discord members |

| Current market cap | $0 (inactive) | ~$130M (derived) |

Frequently Asked Questions

What is the difference between Maxcoin and the newer MAX Token?

Maxcoin is a 2014‑origin PoW coin with a 100M supply that no longer trades on any exchange. The newer MAX Token launched around 2020, uses a larger 500M supply, and is listed on Bitget and Maicoin with modest daily volume.

Can I still buy Maxcoin?

Practically no. Since there are zero active markets, the only way would be a private, over‑the‑counter trade, which carries high risk of scams.

Is the MAX Token safe to trade on Bitget?

Bitget follows standard KYC and AML procedures, so the exchange itself is reputable. However, the token’s low liquidity and limited development activity make it a high‑risk speculative asset.

Where can I find reliable data on MAX‑ticked coins?

Cross‑check CoinMarketCap, CoinGecko, and the official project websites. Beware of mismatched data caused by the duplicate ticker.

What are the main risks of investing in any MAX coin?

Liquidity risk, unclear regulatory status, stalled development, and minimal community support. In short, you could lose the entire investment.

Bottom Line

If you stumble upon "MAX" while browsing crypto charts, pause and verify which asset you’re looking at. The legacy Maxcoin is essentially dead - treat it as a collector’s item rather than an investment. The newer MAX Token offers a tiny market, but the lack of clear use‑cases and a thin order book keep it in the speculative corner. For most traders, focusing on established low‑fee coins with active ecosystems will deliver better chances of success.

Michael Hagerman

October 3, 2025 AT 23:48Laura Herrelop

October 4, 2025 AT 01:00Nisha Sharmal

October 4, 2025 AT 09:52Karla Alcantara

October 4, 2025 AT 22:07Jessica Smith

October 5, 2025 AT 10:46Petrina Baldwin

October 6, 2025 AT 05:51Ralph Nicolay

October 6, 2025 AT 14:51Nick Carey

October 7, 2025 AT 11:56Sonu Singh

October 8, 2025 AT 06:33Peter Schwalm

October 8, 2025 AT 18:34Alex Horville

October 9, 2025 AT 17:01Marianne Sivertsen

October 10, 2025 AT 16:53Shruti rana Rana

October 11, 2025 AT 08:26Stephanie Alya

October 11, 2025 AT 19:33olufunmi ajibade

October 12, 2025 AT 14:58Manish Gupta

October 12, 2025 AT 21:08Gabrielle Loeser

October 13, 2025 AT 05:59Cyndy Mcquiston

October 13, 2025 AT 16:30Abby Gonzales Hoffman

October 13, 2025 AT 20:39Rampraveen Rani

October 14, 2025 AT 10:35