MAX Token – Everything You Need to Know

When you hear MAX Token, a utility token built on the Binance Smart Chain that powers governance, staking rewards and fee discounts within its ecosystem. Also known as MAX, it enables holders to vote on protocol upgrades, drives liquidity incentives, and supports a range of DeFi products. In plain terms, MAX Token is the magnetic core that pulls together tokenomics, airdrops and liquidity pool dynamics.

Semantic triple example: MAX Token encompasses tokenomics; tokenomics influences airdrop design; airdrop boosts liquidity pool participation. Understanding these links helps you see why the token matters beyond just a price ticker.

Key Aspects of MAX Token

The first thing to grasp is the token’s tokenomics, the set of rules that dictate supply, distribution, utility and inflation. MAX Token supplies 100 million units, with 40% allocated to community rewards, 30% to liquidity mining, 20% to development, and the remaining 10% held for future partnerships. This split ensures a steady flow of incentives for early adopters while preserving enough reserve for strategic growth. Because tokenomics defines how many tokens hit the market and where they go, it directly shapes the size and health of any airdrop campaign. A well‑balanced tokenomics model also reduces volatility, making the token more attractive for DeFi staking and yield farming.

Speaking of incentives, the airdrop, a free distribution of tokens to qualified wallets is a proven catalyst for community expansion. MAX’s airdrop strategy targets users who have previously interacted with Binance Smart Chain DeFi platforms, staked at least a minimum amount, or contributed to governance proposals. By rewarding active participants, the airdrop fuels organic growth, lifts transaction volume, and creates a larger pool of potential liquidity providers. The airdrop’s success hinges on clear eligibility criteria, secure claim processes, and transparent communication—lessons we’ve seen work across many projects in our article library.

Once tokens land in users’ wallets, they need a place to circulate, and that’s where the liquidity pool, a collection of paired assets that enable swapping, lending and yield farming on AMM platforms steps in. MAX Token pairs typically with BNB or USDT on leading DEXs, allowing holders to earn a share of swap fees while providing the depth needed for large trades. Liquidity pools also act as the backbone for staking contracts; the more tokens locked in a pool, the higher the reward rates for participants. This creates a virtuous cycle: solid tokenomics encourages airdrops, airdrops attract users, users add liquidity, and liquidity boosts the token’s utility and price stability.

All these pieces—tokenomics, airdrops, liquidity pools and the broader DeFi environment—interact like gears in a machine. When one component shifts, the others feel the impact. That’s why keeping an eye on governance votes, upcoming airdrop announcements, and pool performance metrics is crucial for anyone looking to maximize returns from MAX Token. Below you’ll find a curated selection of guides, reviews and deep dives that unpack each of these aspects in detail, from how to claim the next airdrop safely to advanced strategies for optimizing liquidity provision. Dive in, and turn the knowledge into actionable moves in the MAX Token ecosystem.

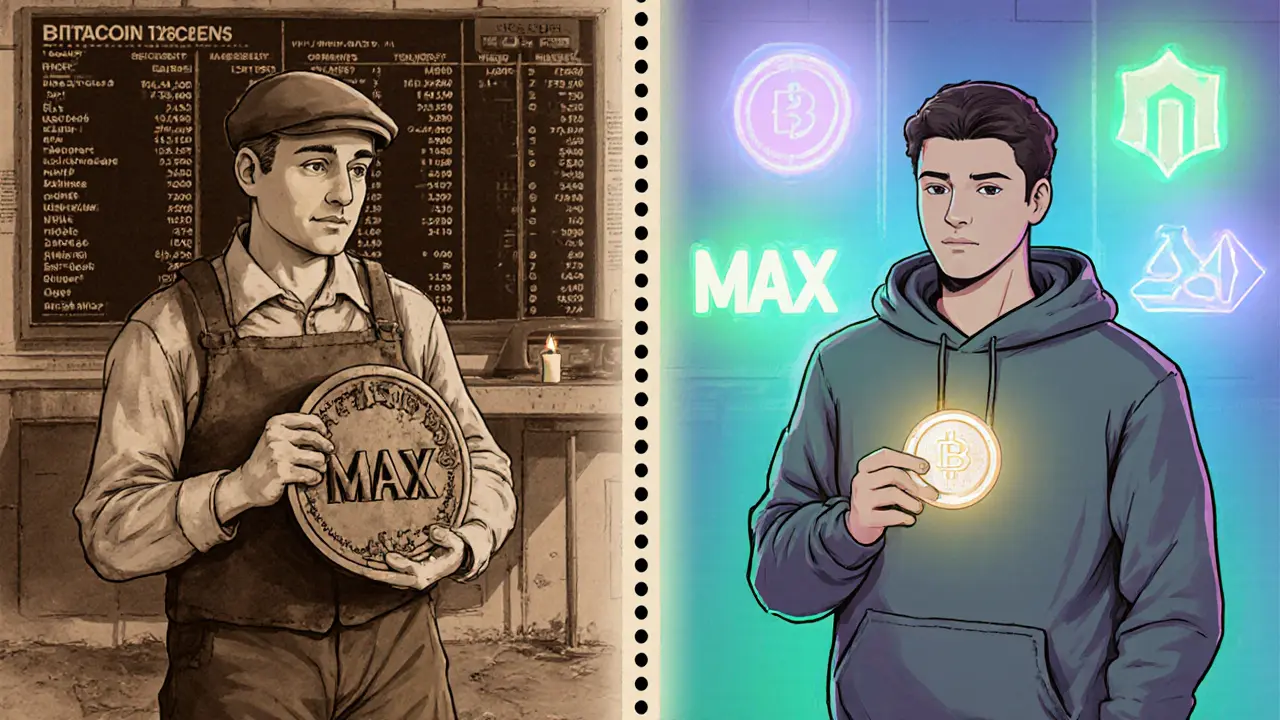

Understanding MAX (MAX) Crypto Coin: Maxcoin vs. MAX Token Explained

by Johnathan DeCovic Jan 23 2025 20 CryptocurrencyA clear guide that separates the two MAX crypto coins-Maxcoin and the newer MAX Token-covering their specs, markets, risks, and how to acquire them.

READ MORE