Liquidity Pools – The Heart of DeFi Trading

When you hear Liquidity Pools, public pools of crypto assets that let users swap tokens instantly without a traditional order book. Also known as LP pools, they power most decentralized finance apps. Understanding liquidity pools is the first step to using DeFi safely and profitably.

Key Concepts Behind Liquidity Pools

At the core of every pool sits an Automated Market Maker, a smart‑contract algorithm that sets prices based on the ratio of assets in the pool. This AMM model means "Liquidity pools encompass automated market makers" and removes the need for a central counterparty. The pool issues LP tokens, receipts that represent your share of the pool’s assets. Holding these tokens lets you earn a slice of the trading fees, which is why "Liquidity pools require LP token ratios" to calculate your exact earnings.

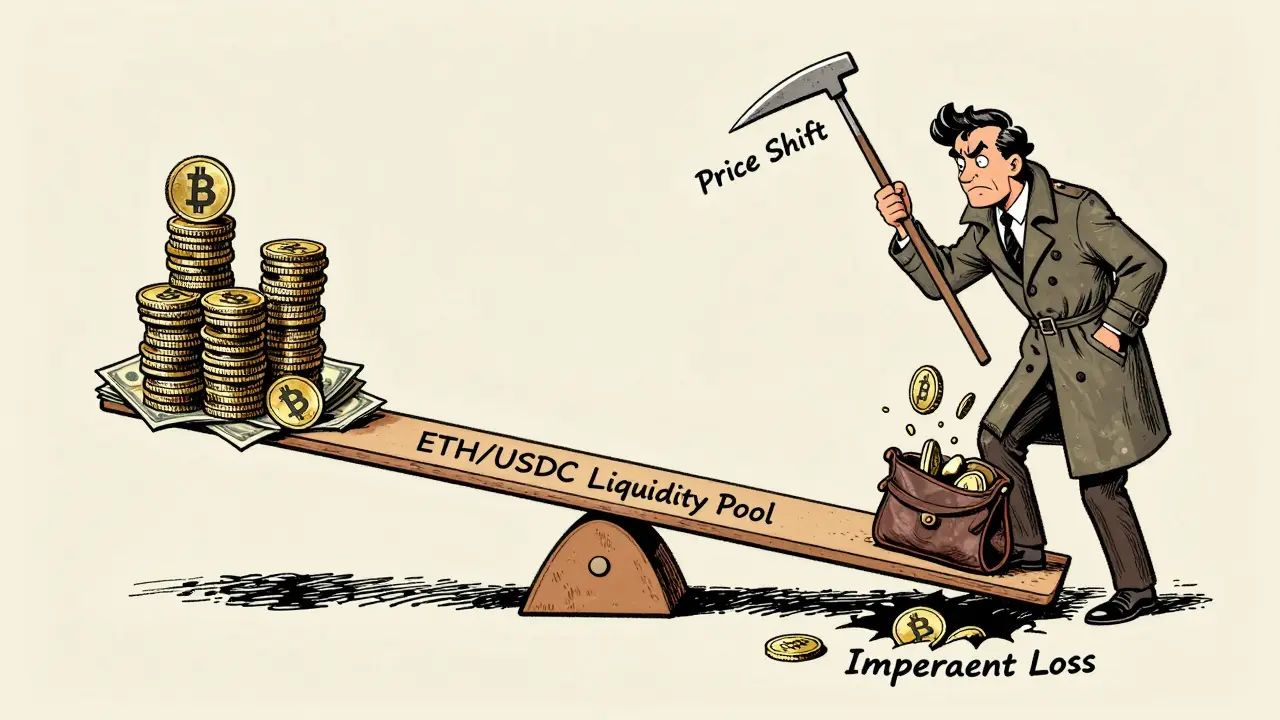

But there’s a catch called impermanent loss, the temporary value dip you experience when the price of pooled assets diverges. Knowing how impermanent loss works helps you size your positions and avoid nasty surprises. On the upside, many users combine pools with yield farming, strategies that move LP tokens across pools to chase higher rewards. That’s why "Yield farming influences liquidity pool returns" and can boost overall profits when managed right.

Below you’ll find a curated set of articles that break down each of these ideas in plain language—stablecoin peg mechanics, tokenomics, bridge tech, risk management, and more. Dive in to see how the pieces fit together and start navigating DeFi with confidence.

How to Minimize Impermanent Loss in DeFi Liquidity Pools

by Johnathan DeCovic Jan 2 2026 22 CryptocurrencyLearn how to minimize impermanent loss in DeFi by choosing stablecoin pools, using concentrated liquidity wisely, and ensuring your fees beat your losses. Real strategies for 2026.

READ MORETop Advantages of Decentralized Exchanges for Crypto Traders

by Johnathan DeCovic Jun 10 2025 21 CryptocurrencyDiscover why decentralized exchanges give crypto traders better security, lower fees, privacy, and access to a wider range of tokens-all without a middleman.

READ MORE