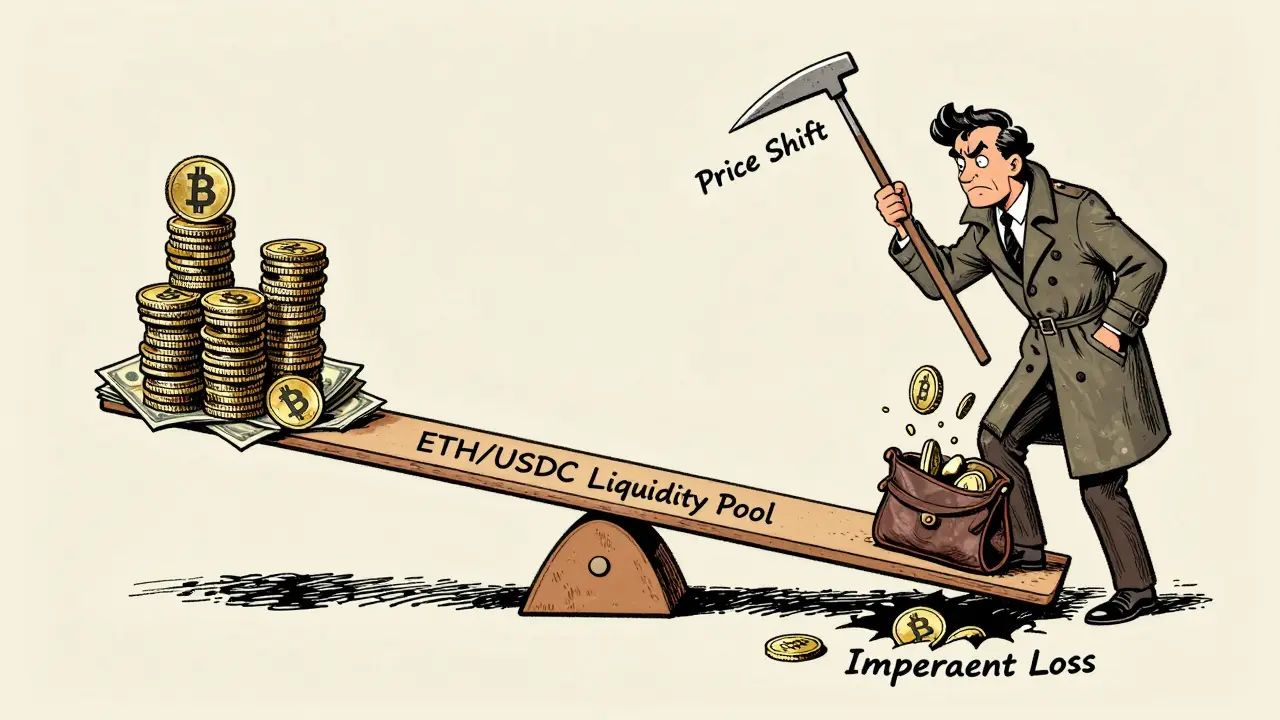

Impermanent Loss

When you hear impermanent loss, you probably wonder why your earnings from a liquidity pool can shrink even though the market looks bullish. Impermanent loss is the temporary loss of value that occurs when providing liquidity to a decentralized exchange pool compared to simply holding the assets. Also known as IL, it happens whenever the price ratio of the pooled tokens shifts. This phenomenon encompasses price divergence, meaning the larger the relative swing between the two tokens, the deeper the loss. It requires careful token selection and timing because not all assets react the same way to market moves. Below you’ll see how this ties into the broader DeFi ecosystem.

One of the biggest drivers of impermanent loss is the Automated market maker (AMM), the algorithm that powers most decentralized exchanges. An AMM uses a constant‑product formula to keep the pool balanced, which automatically re‑prices assets as traders swap them. Because the AMM influences token prices inside the pool, any external price change forces the pool to rebalance, creating the loss we observe. Understanding how the AMM works lets you predict when loss might spike and plan your deposits accordingly.

The third piece of the puzzle is the Liquidity pool itself. A pool pools together two (or more) assets so traders can swap without a traditional order book. While pools generate fees that can offset impermanent loss, the fee rate, pool size, and token volatility all affect the net outcome. In practice, a well‑chosen pool with high fee volume can turn a negative IL into a profitable position over time.

Managing Risk and Tokenomics

Beyond the technical side, DeFi risk management plays a crucial role. Simple tools like stop‑loss alerts, diversification across multiple pools, and monitoring tokenomics help keep IL in check. Tokenomics, the economic design of a cryptocurrency, determines supply curves, inflation rates, and incentive structures—factors that directly impact price stability. A token with a well‑balanced tokenomics model tends to move less wildly, reducing the chance of big IL events.

Putting these ideas together gives you a clear roadmap: understand the AMM formula, pick pools with favorable fee structures, and evaluate tokenomics before you commit capital. The articles below dive deeper into each of these areas, from stablecoin strategies that can curb volatility to detailed risk‑management guides for DeFi traders. Armed with this context, you’ll be better equipped to navigate impermanent loss and turn liquidity provision into a steady revenue stream.

How to Minimize Impermanent Loss in DeFi Liquidity Pools

by Johnathan DeCovic Jan 2 2026 22 CryptocurrencyLearn how to minimize impermanent loss in DeFi by choosing stablecoin pools, using concentrated liquidity wisely, and ensuring your fees beat your losses. Real strategies for 2026.

READ MORELiquidity Pool Token Ratios Explained: A DeFi Guide

by Johnathan DeCovic Apr 17 2025 23 CryptocurrencyLearn how liquidity pool token ratios work, from constant product math to weighted, stable‑swap and concentrated liquidity pools, and manage risk like a pro.

READ MORE