Digital Payments Overview

When you hear digital payments, the electronic transfer of money using internet‑based tools, apps, or platforms. Also known as e‑payments, it connects buyers and sellers instantly, often bypassing traditional banks. Digital payments encompass everything from mobile wallets to QR‑code checkout, and they rely heavily on underlying tech like APIs and encryption. In today’s market, the speed of a transaction can mean the difference between a sale and a missed opportunity, so understanding the ecosystem is key. Digital payments sit at the crossroads of finance and technology, pulling in concepts from crypto, blockchain, and stablecoins while also demanding secure payment gateways and regulatory compliance.

One of the biggest game‑changers is cryptocurrency, a digital asset secured by cryptography that can be transferred without intermediaries. When crypto is used for payments, it brings two major benefits: borderless transactions and programmability. Cryptocurrency also fuels new payment models like pay‑per‑use services and micro‑transactions that were impossible with fiat alone. The rise of blockchain, the distributed ledger that records every crypto move, adds trust and transparency, letting merchants prove that payments are immutable and auditable. Together, crypto and blockchain create a feedback loop – more blockchain projects launch payment features, and those features push blockchain adoption higher.

Stablecoins, Payment Gateways, and Real‑World Use

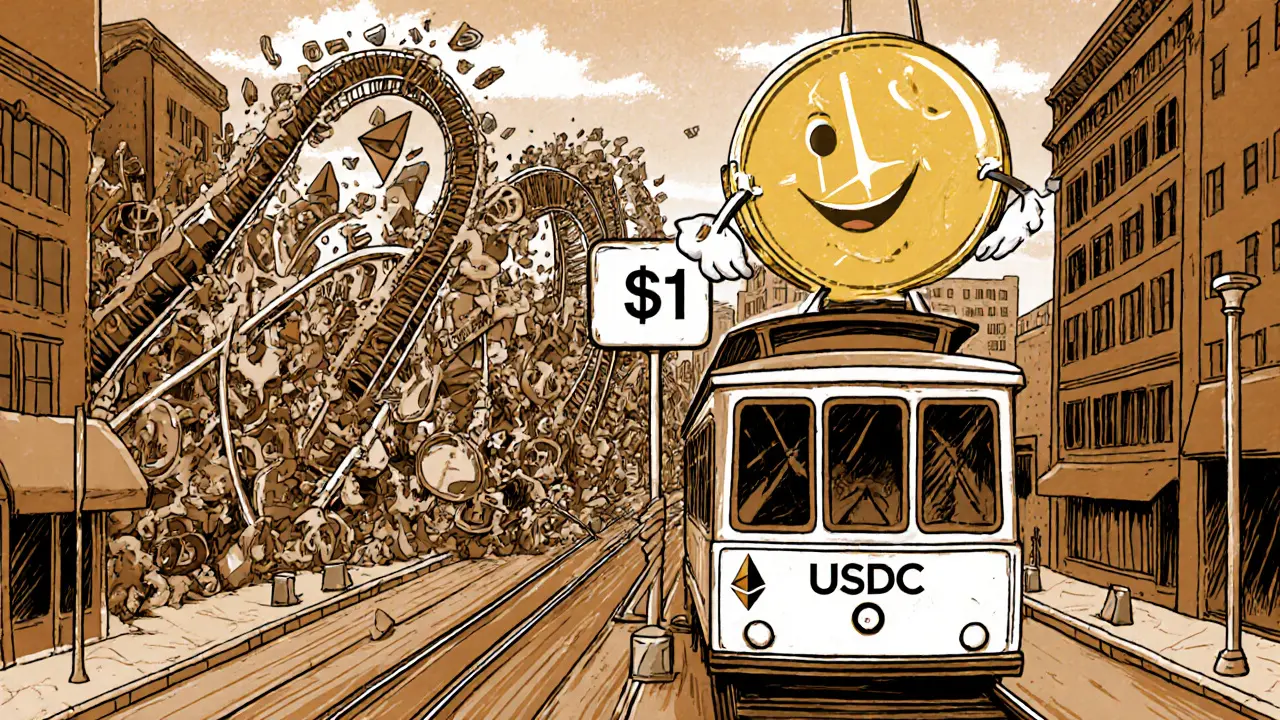

While volatile tokens attract traders, stablecoins, cryptocurrencies pegged to a stable asset like the US dollar, are the workhorse for everyday purchases. A stablecoin acts as a bridge between crypto excitement and fiat stability, letting users pay for coffee, rides, or subscription services without fearing sudden price swings. Because stablecoins are often built on existing blockchains, they inherit the same security guarantees while providing price predictability – a perfect fit for merchants who need consistent revenue.

Behind every smooth checkout experience sits a payment gateway, the service that connects merchants’ websites or apps to the payment network. Modern gateways support a mix of fiat cards, crypto wallets, and stablecoin APIs, allowing a single integration to handle dozens of payment methods. The gateway must also handle compliance checks, fraud detection, and settlement, turning raw digital assets into usable cash for the business. In short, digital payments requires reliable gateways, and stablecoins influence the pricing models that gateways help manage.

All these pieces – crypto, blockchain, stablecoins, and gateways – form a tightly knit ecosystem. Digital payments encompasses cross‑border remittances, in‑app purchases, and IoT‑driven micropayments, while also demanding robust security frameworks and clear regulatory pathways. Below you’ll find a hand‑picked collection of articles that dig deeper into each of these areas, from cross‑chain bridges that boost interoperability to tokenomics that shape the value of payment‑focused coins. Browse the list to see how the latest trends can power your next transaction strategy.

Stablecoins: Tackling Crypto Volatility in 2025

by Johnathan DeCovic Oct 12 2025 22 CryptocurrencyExplore how stablecoins tame crypto volatility, the mechanisms behind their peg, major players, benefits, risks, and 2025 market trends in clear, practical terms.

READ MORE