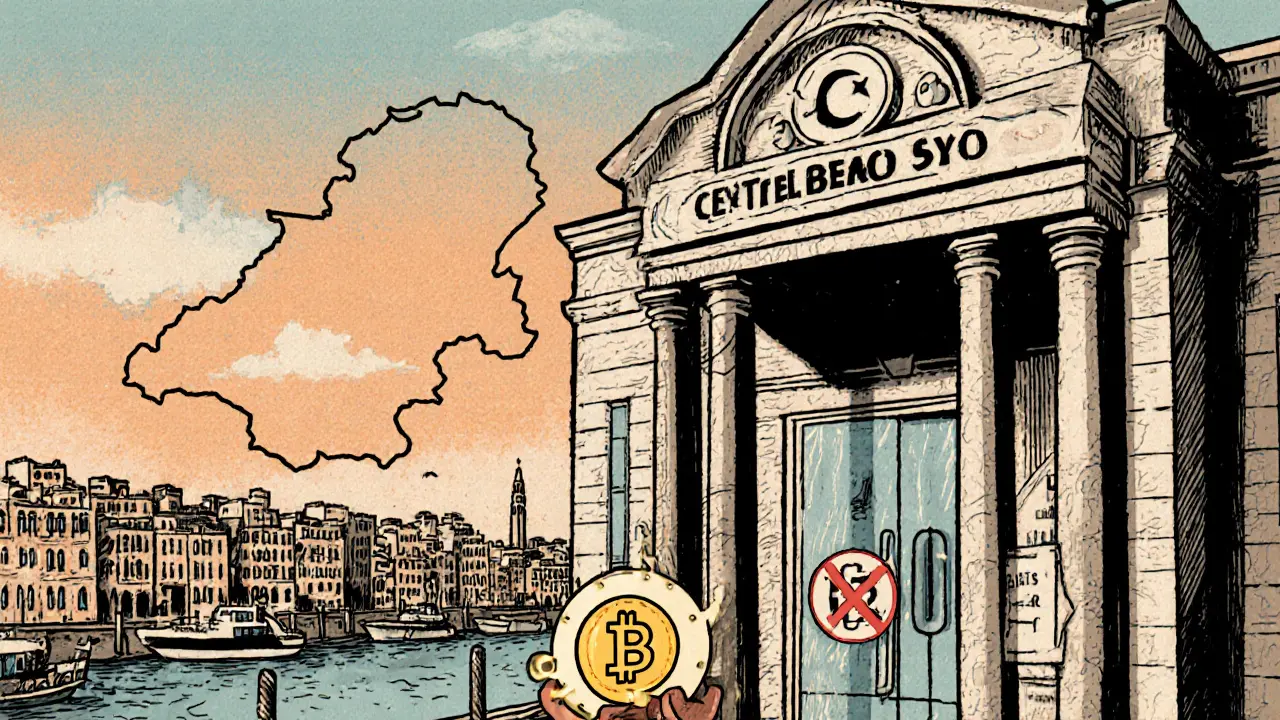

Digital Currency Ban Tunisia: What It Means for Crypto Users

When working with digital currency ban Tunisia, the Tunisian government's prohibition on buying, selling, or using cryptocurrencies within its borders. Also known as Tunisia crypto ban, it directly shapes the country's cryptocurrency regulation, the set of legal rules governing digital assets, exchanges, and related services. This ban isn’t just a headline; it reshapes how local businesses, investors, and developers can interact with blockchain tech. Think of it as a rulebook that forces every crypto‑related player to rethink compliance, risk, and even basic transaction flows. Below we break down the core pieces of the puzzle and why they matter to anyone watching the North African crypto scene.

Why the Ban Matters for the Central Bank and Financial System

The central bank, specifically the Central Bank of Tunisia, is the authority that enforces the ban. Its mandate includes maintaining monetary stability and protecting the national currency from speculative pressures. By outlawing digital currency activities, the bank aims to prevent capital flight and curb potential money‑laundering channels. This relationship creates a direct semantic link: the digital currency ban requires strict compliance from every financial intermediary, from traditional banks to fintech startups. In practice, the central bank monitors transactions, imposes hefty fines for non‑compliance, and works with law‑enforcement agencies to shut down illegal platforms. The result is a tighter grip on capital movement, which can slow down innovation but also shields the economy from volatile crypto swings.

Beyond the banking sector, the ban has a ripple effect on stablecoins, digital assets pegged to fiat currencies that aim to reduce price volatility. Stablecoins have become a popular bridge for cross‑border payments and DeFi participation, yet they sit in a gray zone between regulated money and unregulated tokens. Tunisia’s prohibition forces stablecoin issuers to either obtain special licensing or cease operations in the country. This, in turn, impacts digital payments, the use of electronic methods to transfer value, often leveraging blockchain technology that rely on stablecoins for price stability. The ban therefore curtails a key tool that could have expanded financial inclusion, especially for the unbanked population seeking low‑cost, instant transfers.

Finally, the crackdown hits crypto exchanges, platforms that allow users to trade cryptocurrencies for fiat or other digital assets hard. Both local and international exchanges that previously offered services to Tunisian residents must now block accounts, freeze assets, and adjust KYC procedures. This creates a compliance burden that many smaller platforms cannot bear, leading to market exits and reduced liquidity. For investors, the ban raises the stakes: navigating a legal landscape that suddenly deems certain assets illegal adds a layer of risk that must be factored into any strategy. Whether you’re an individual trader, a DeFi developer, or a business considering crypto payments, you’ll find the upcoming articles dive deep into each of these angles, offering practical tips, regulatory updates, and real‑world case studies.

Ready to see how these pieces fit together? Below you’ll discover a curated collection of guides, analyses, and reviews that unpack the ban’s nuances, from its impact on stablecoins to strategies for staying compliant. Dive in to get the full picture and make informed decisions in this evolving regulatory environment.

Tunisia's Crypto Ban: How It Works, Who Enforces It, and What Might Change

by Johnathan DeCovic May 13 2025 13 CryptocurrencyA clear, up‑to‑date guide on Tunisia's total crypto ban, covering the law, enforcement, real‑world impact, sandbox pilots, and potential future reforms.

READ MORE