Cryptocurrency Regulations in Tunisia – What You Need to Know

When working with cryptocurrency regulations Tunisia, the set of rules governing digital assets, trading platforms, and token issuances in the North African country. Also known as Tunisia crypto law, it shapes how investors, startups, and banks can interact with blockchain technology. The government rolled out its first formal stance in 2022, aiming to protect consumers while still attracting tech talent. Since then, policymakers have tweaked the draft to balance innovation with security, and the public debate now focuses on how strict the licensing process should be. Understanding this legal backdrop is the first step before you buy, sell, or launch a project in Tunisia.

Key Pillars Shaping the Tunisian Crypto Landscape

cryptocurrency regulations Tunisia revolve around three core pillars: licensing, anti‑money‑laundering compliance, and asset classification. The Tunisian Financial Market Regulator (CMF), the authority that issues licences for crypto service providers defines who can operate as a crypto‑exchange, wallet service, or token issuer. To get a licence, a company must submit a business plan, show proof of capital, and pass a technical audit that verifies transaction security. Meanwhile, the Anti‑Money Laundering (AML) regulations, rules that require customer identification and transaction monitoring demand robust KYC procedures, regular reporting to the Financial Intelligence Unit, and strict record‑keeping for every on‑chain activity. Together they influence how crypto exchanges, platforms that match buyers and sellers of digital currencies can operate in Tunisia; an exchange without a CMF licence faces hefty fines, and non‑compliant platforms risk being shut down. The country also defines a digital asset classification, a taxonomy that separates payment tokens from utility and security tokens, which determines tax treatment, reporting obligations, and whether a token falls under securities law. For example, payment tokens are taxed as ordinary income, while security‑type tokens trigger capital‑gains rules and may need additional prospectus filings. These three entities create a framework where licensing, AML, and classification are interdependent: the CMF checks AML readiness before granting a licence, and the asset classification decides which AML rules apply.

Below you’ll find practical guides that walk through each step—from filing a licence application with the CMF, to setting up KYC workflows that satisfy Tunisian AML standards, and mapping your token to the right classification. We also cover recent proposals affecting DeFi platforms, NFT marketplaces, and cross‑border token sales, so you can see how the rules evolve in real time. Whether you’re a founder planning a token launch, an exchange looking to expand, or a trader wanting to stay compliant, the articles ahead give you actionable insights and clear roadmaps for navigating Tunisia’s crypto regulatory environment.

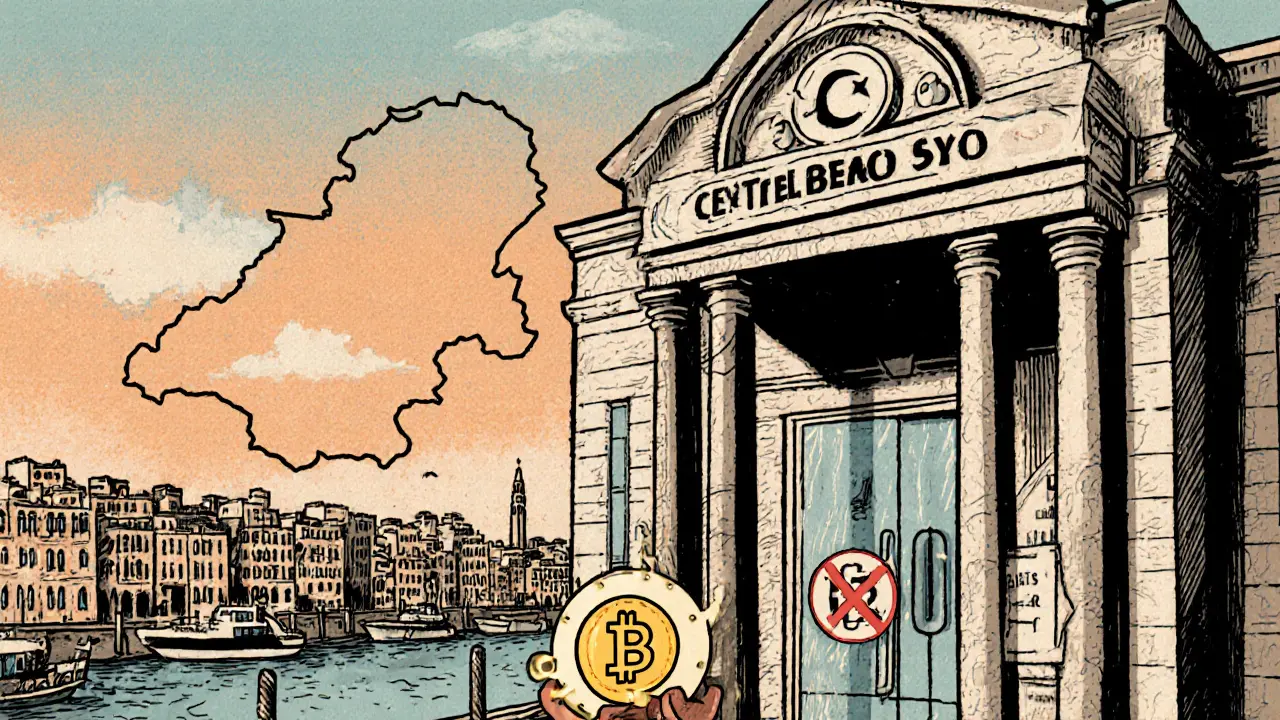

Tunisia's Crypto Ban: How It Works, Who Enforces It, and What Might Change

by Johnathan DeCovic May 13 2025 13 CryptocurrencyA clear, up‑to‑date guide on Tunisia's total crypto ban, covering the law, enforcement, real‑world impact, sandbox pilots, and potential future reforms.

READ MORE