Crypto Risks: What You Need to Know

When working with Crypto Risks, the potential downsides and threats that affect digital assets like Bitcoin, Ethereum, and altcoins. Also known as digital asset risk, it shapes how investors, developers, and regulators approach the crypto market. Understanding these threats is the first step to protecting your portfolio.

crypto risks

Key Areas of Crypto Risk

One of the biggest sources of trouble is market volatility. Prices can swing 20% in a single day, wiping out gains overnight. Stablecoins, tokens pegged to fiat or other assets that aim to keep their value steady were created to tame that swing. By holding a stablecoin instead of a pure crypto, traders can move funds quickly without exposing themselves to wild price moves. At the same time, Risk Management, the systematic process of identifying, measuring, and mitigating exposure becomes essential – you need tools like position sizing and stop‑loss orders to stay in control.

Regulatory risk adds another layer of uncertainty. Governments can change rules overnight, turning a thriving market into a legal gray area. Recent examples include Tunisia’s total crypto ban and Kuwait’s central bank crackdown. These moves affect not only traders but also developers building DeFi products, because compliance costs can rise sharply. Understanding the local legal landscape helps you avoid fines, frozen accounts, or even criminal charges.

Smart contract vulnerabilities are a hidden danger that often goes unnoticed until a hack happens. Bugs in code can let attackers drain funds, as seen in several high‑profile DeFi exploits. While you can’t inspect every line of code, a thorough Smart Contract Audit, an independent security review that looks for flaws before deployment dramatically lowers the chance of loss. Audits also provide a checklist for developers, covering issues like re‑entrancy, integer overflow, and improper access controls.

Beyond the big categories, more niche risks pop up as the ecosystem matures. Cross‑chain bridges, which let you move tokens between Bitcoin, Ethereum, Solana and other chains, can be a single point of failure. If a bridge is compromised, funds on multiple networks can be stolen in one go. Similarly, liquidity pool token ratios can shift, leading to impermanent loss for providers who aren’t aware of the math behind AMMs. Knowing these subtleties lets you decide whether the potential rewards outweigh the hidden costs.

All of these risk types connect back to a core principle: you need a clear plan before you click “trade.” Start with a risk tolerance assessment, choose the right mix of assets, set realistic stop‑loss levels, and keep an eye on regulatory news. Diversification across stablecoins, major coins, and DeFi protocols can smooth out bumps, while regular audits and compliance checks keep you on the right side of the law.

The articles below dive deeper into each of these topics. You’ll find a rundown of how stablecoins try to solve volatility, step‑by‑step guides on crypto risk management, analysis of recent regulatory bans, and practical advice on smart contract audits. Whether you’re a beginner trying to avoid common pitfalls or an experienced trader looking for advanced safety nets, this collection gives you the tools to manage crypto risks with confidence.

Ready to explore the details? Scroll down to see the full list of guides and insights tailored for anyone who wants to stay safe in the fast‑moving world of digital assets.

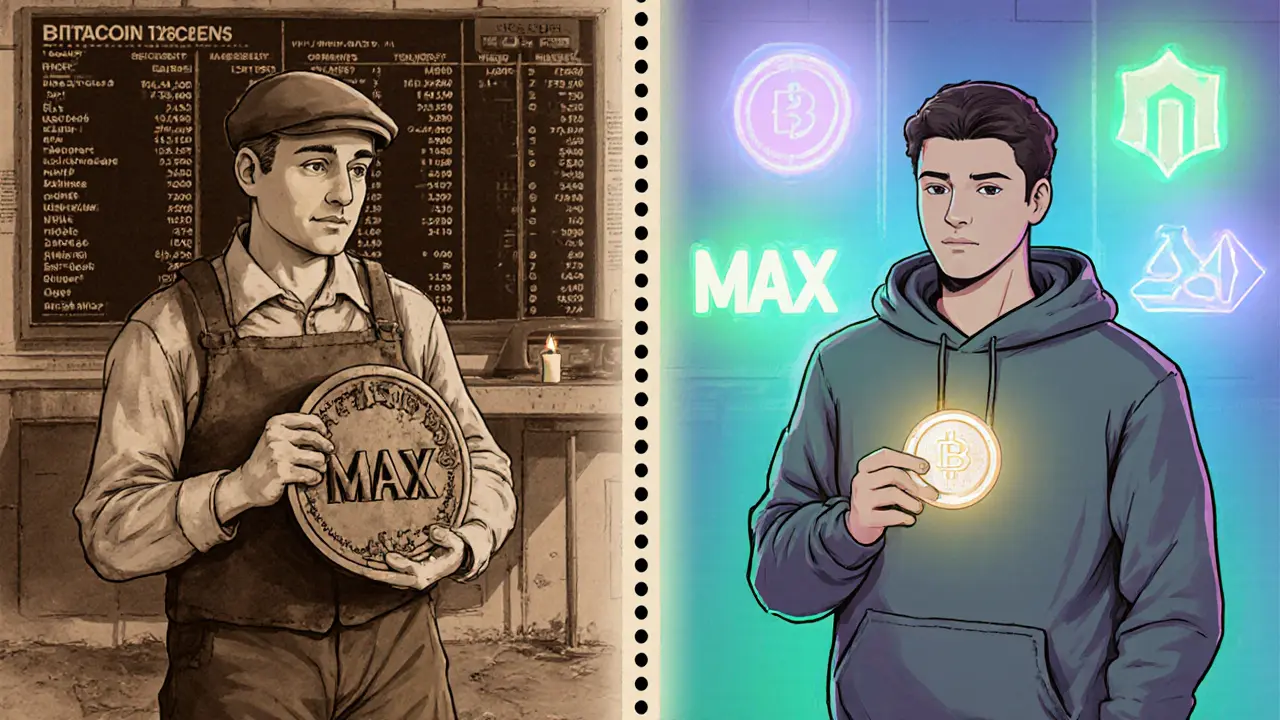

Understanding MAX (MAX) Crypto Coin: Maxcoin vs. MAX Token Explained

by Johnathan DeCovic Jan 23 2025 20 CryptocurrencyA clear guide that separates the two MAX crypto coins-Maxcoin and the newer MAX Token-covering their specs, markets, risks, and how to acquire them.

READ MORE