Crypto Regulation Afghanistan: What You Need to Know

When talking about crypto regulation Afghanistan, the set of laws, guidelines and enforcement actions that govern digital currencies and related services within the Afghan territory. Also known as Afghan crypto law, it shapes how investors, exchanges and developers can operate. The landscape is still forming, but existing financial statutes, anti‑money‑laundering (AML) rules, and central bank advisories already influence what projects can launch. In practice, crypto regulation Afghanistan encompasses licensing requirements, tax treatment, and cross‑border transaction monitoring. This means anyone dealing with Bitcoin, stablecoins or NFTs must keep an eye on both local decrees and international sanctions.

Key Players Shaping the Rules

The primary authority issuing monetary policy is Da Afghanistan Bank, the country’s central bank that oversees banking licenses, foreign exchange and now digital asset guidelines. Da Afghanistan Bank has begun issuing statements that digital tokens are not legal tender but can be used for payment under strict compliance. This institution requires crypto service providers to register, implement robust KYC procedures, and report suspicious activity. Alongside the central bank, the Afghanistan Financial Intelligence Unit, the national body tasked with monitoring money‑laundering risks and enforcing AML standards, plays a crucial role. The unit enforces the AML/KYC regulations that many jurisdictions consider the backbone of any crypto framework. Together, these bodies create a regulatory triangle where the central bank sets monetary policy, the intelligence unit enforces compliance, and lawmakers draft supporting legislation. This triangle influences how crypto exchanges, wallet providers and DeFi platforms can operate in the country.

From a practical standpoint, the existing AML/KYC regime demands that every user’s identity be verified before any transaction above a certain threshold. Exchanges looking to serve Afghan users must integrate real‑name verification, transaction monitoring tools, and reporting mechanisms that align with the Financial Action Task Force (FATF) recommendations. At the same time, developers building on blockchain need to consider that smart contracts may be subject to audit requirements if they facilitate large‑scale token sales. The current legal vacuum also opens space for pilot projects, such as government‑backed stablecoin trials, which could redefine how digital money is used for remittances and trade. As the regulatory environment matures, expect clearer licensing categories, tax guidance, and possibly a dedicated “digital assets” law. For now, staying compliant means treating Afghan crypto activity as a high‑risk operation that must meet both central bank advisories and the Financial Intelligence Unit’s AML expectations. Below, you’ll find a curated set of articles that break down each aspect, from cross‑border bridge risks to stablecoin mechanics, helping you navigate Afghanistan’s evolving crypto landscape.

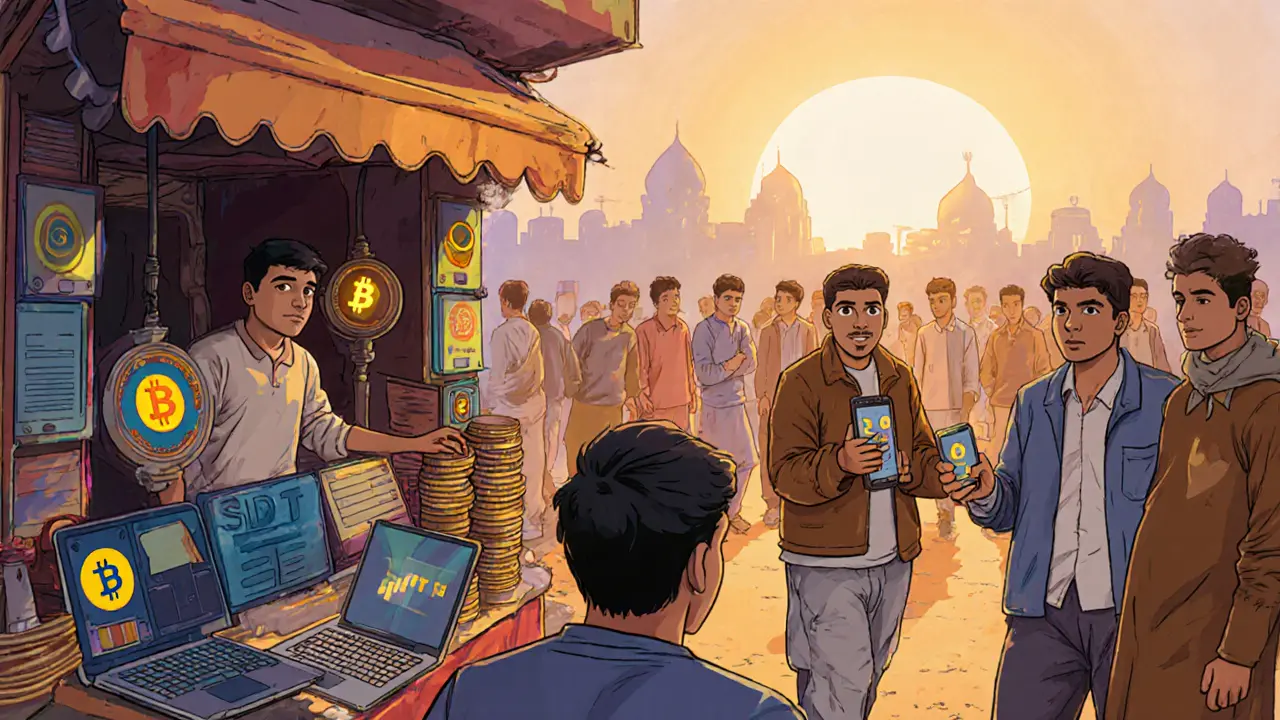

Afghanistan Crypto Ban: How the Taliban’s 2022 Prohibition Shaped the Underground Market

by Johnathan DeCovic Nov 17 2024 20 CryptocurrencyExplore how the Taliban's 2022 crypto ban reshaped Afghanistan's digital asset landscape, its underground market, and the impact on women and remittances.

READ MORE