Crypto Exchange Crackdown

When dealing with crypto exchange crackdown, a wave of regulatory enforcement targeting digital trading platforms worldwide. Also known as exchange enforcement, it forces exchanges to tighten rules around user verification, transaction monitoring, and reporting. The crackdown isn’t just a headline; it reshapes how traders access markets, how platforms price services, and how security teams defend assets.

The central player in this story is the crypto exchange, an online venue where users buy, sell, or swap digital tokens. Exchanges sit at the intersection of finance, technology, and law, meaning any regulatory shift reverberates across all three. When a regulatory crackdown a coordinated effort by governments to enforce compliance hits the market, exchanges must adapt quickly—updating KYC procedures, enhancing AML monitoring, and often revising fee models to cover compliance costs.

Security becomes a non‑negotiable pillar under the crackdown. Exchange security, the set of technical and procedural measures protecting user funds and data now faces stricter audits and mandatory reporting of breaches. This push drives platforms to adopt hardware security modules, multi‑signature wallets, and real‑time threat detection. For traders, stronger security means less chance of losing assets, but it can also introduce extra steps like hardware token verification.

What the Crackdown Means for Traders

Fees are the visible cost most users feel immediately. Under the crackdown, exchange fees, charges applied to trades, withdrawals, and other services often rise as platforms offset compliance expenses—think higher maker/taker spreads, withdrawal surcharges, or tiered pricing for verified versus unverified users. These changes force traders to recalculate profit margins and consider alternative venues with lower costs.

Compliance isn’t optional. Platforms now need robust licensing, regular audits, and clear communication with regulators. This reality creates a ripple effect: traders must keep their identity documents up to date, provide source‑of‑funds information, and stay aware of jurisdiction‑specific rules. While the paperwork can feel tedious, it also builds trust—exchanges that meet regulatory standards tend to attract more institutional liquidity, which can improve market depth and reduce slippage.

From a broader perspective, the crackdown reshapes the competitive landscape. Smaller or offshore exchanges that can’t meet the new standards may shut down or merge with larger, compliant players. Conversely, well‑capitalized platforms invest in compliance teams, legal counsel, and technology upgrades, turning regulation into a market advantage. This dynamic encourages innovation in compliance‑as‑a‑service tools, automated KYC solutions, and transparent fee structures.

For anyone active in the crypto space, understanding the interplay between regulation, security, and fees is crucial. The posts below dive into specific exchange reviews—Hibt, OKX, KoinBX, and more—showing how each platform navigates the crackdown. You’ll also find deep dives on consensus mechanisms, cross‑chain bridges, and risk management, all of which tie back to how regulators view the ecosystem.

Ready to see how these forces play out in real‑world platforms? Keep scrolling to explore detailed reviews, security analyses, and practical tips that help you stay compliant, keep costs in check, and protect your assets amid the ongoing crypto exchange crackdown.

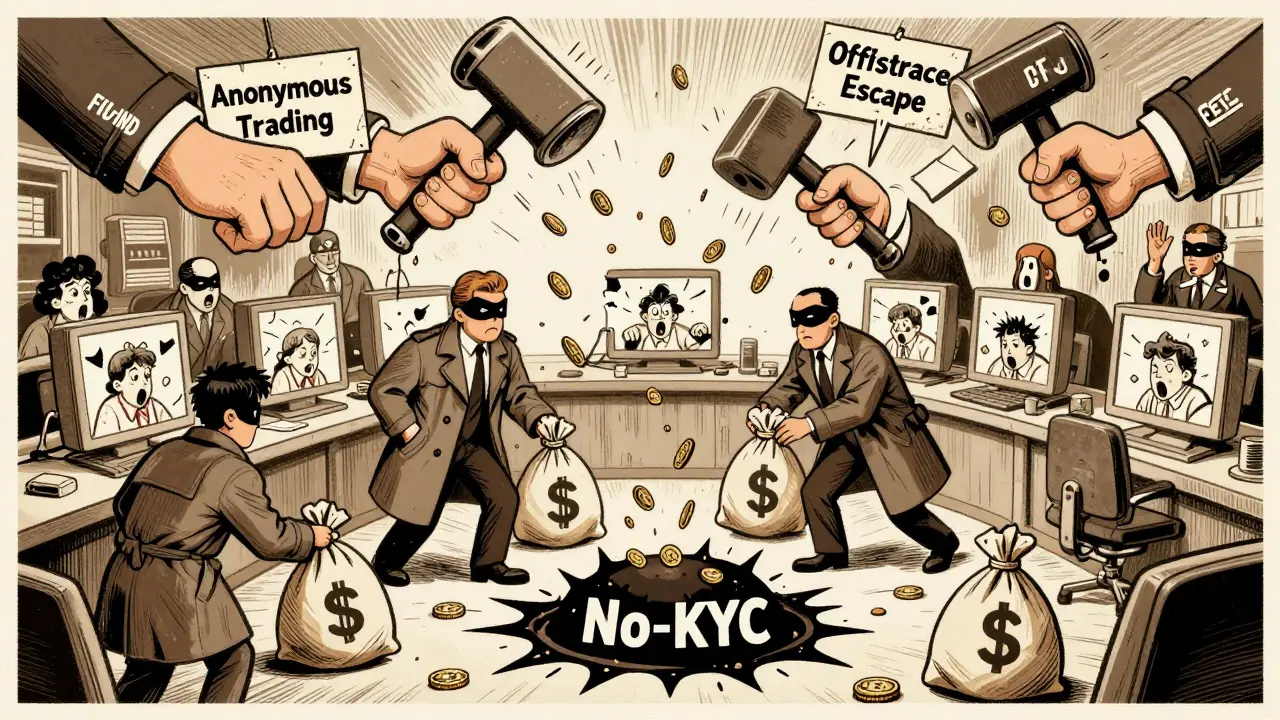

No-KYC Crypto Exchange Shutdowns by Authorities: What Happened and Why It Matters

by Johnathan DeCovic Dec 6 2025 25 CryptocurrencyNo-KYC crypto exchanges faced global shutdowns in 2024-2025 as regulators cracked down on money laundering and sanctions evasion. Platforms like KuCoin and BitMex were forced to relocate or face criminal charges. Compliance is now mandatory for survival.

READ MOREChina Cryptocurrency Ban: History, Policies & Global Impact

by Johnathan DeCovic Oct 16 2025 16 CryptocurrencyExplore China's comprehensive cryptocurrency ban, its timeline, enforcement, market impact, and future outlook, plus practical compliance tips.

READ MORE