Crypto Exchange 2025: What’s Changing, Who’s Still Standing, and Where to Trade

When you think about a crypto exchange 2025, a platform where you buy, sell, or trade digital assets under today’s strict global rules. Also known as a digital asset trading platform, it’s no longer just about low fees or fast trades—it’s about surviving government crackdowns, proving you’re not a money-laundering hub, and staying open for business. In 2025, the crypto exchanges that still exist are the ones that played by the new rules. The rest? Shut down, relocated, or vanished into scam territory.

Take MiCA, the European Union’s sweeping crypto regulation that turned every exchange into a regulated financial business. Also known as Markets in Crypto-Assets Regulation, it forced platforms to prove they had real offices, real audits, and real compliance teams—or get banned. You can’t just set up a website and call it a crypto exchange anymore. The same goes for crypto compliance, the daily grind of KYC checks, transaction monitoring, and reporting that every legal exchange must follow. Without it, you’re not a business—you’re a target. And that’s why platforms like KuCoin had to change their whole structure, while others like Spin and Unielon disappeared overnight. These weren’t just bad platforms—they were illegal ones, and regulators made sure they couldn’t hide.

Meanwhile, scams are more creative than ever. Fake exchanges pop up with slick websites, fake reviews, and promises of free tokens. But if you see an exchange that doesn’t list its location, has no regulatory status, and pushes you to send crypto to a wallet you can’t control? It’s a trap. The crypto exchange scam, a fraudulent platform designed to steal funds under the guise of trading. Also known as fake crypto platform, it thrives when people ignore the basics: no license, no transparency, no future. You’ll find stories here about platforms that vanished after promising airdrops, or exchanges blocked in countries like Cambodia and Thailand because they refused to play by local rules.

What’s left? The exchanges that got licensed, built real infrastructure, and accepted that transparency isn’t optional—it’s the price of survival. Whether it’s meeting EU standards, handling Thai licensing fees, or avoiding OFAC sanctions, the winners in 2025 are the ones who stopped pretending crypto was lawless. The rest? They’re gone. Below, you’ll find real breakdowns of what’s working, what’s not, and which platforms you can actually trust—without the hype, without the fluff, just the facts.

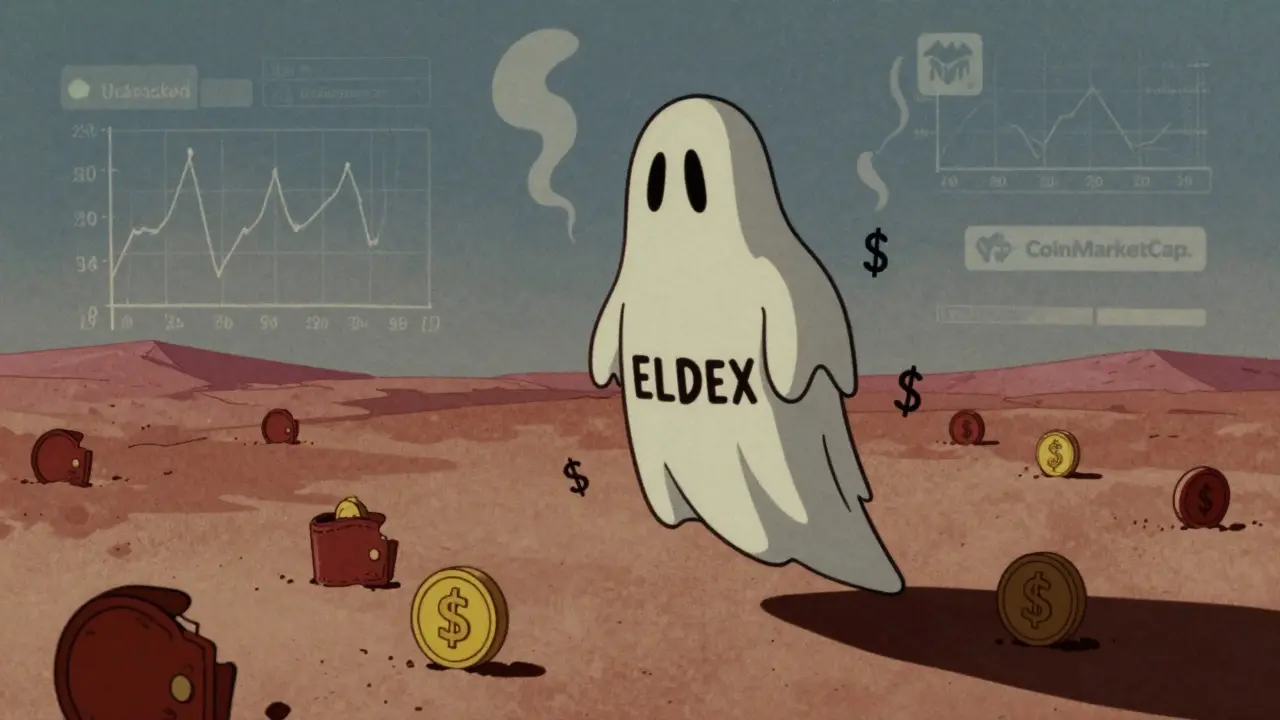

ELDEX Crypto Exchange Review: Is This Platform Legit or Just a Ghost?

by Johnathan DeCovic Dec 7 2025 25 CryptocurrencyELDEX crypto exchange shows no trading data, no user base, and no transparency. Listed as 'Untracked' on CoinMarketCap, it's not a legitimate platform. Avoid it and use verified DEXs like Uniswap or 1inch instead.

READ MORE