Bitcoin Ban Afghanistan: What It Means for Users and Markets

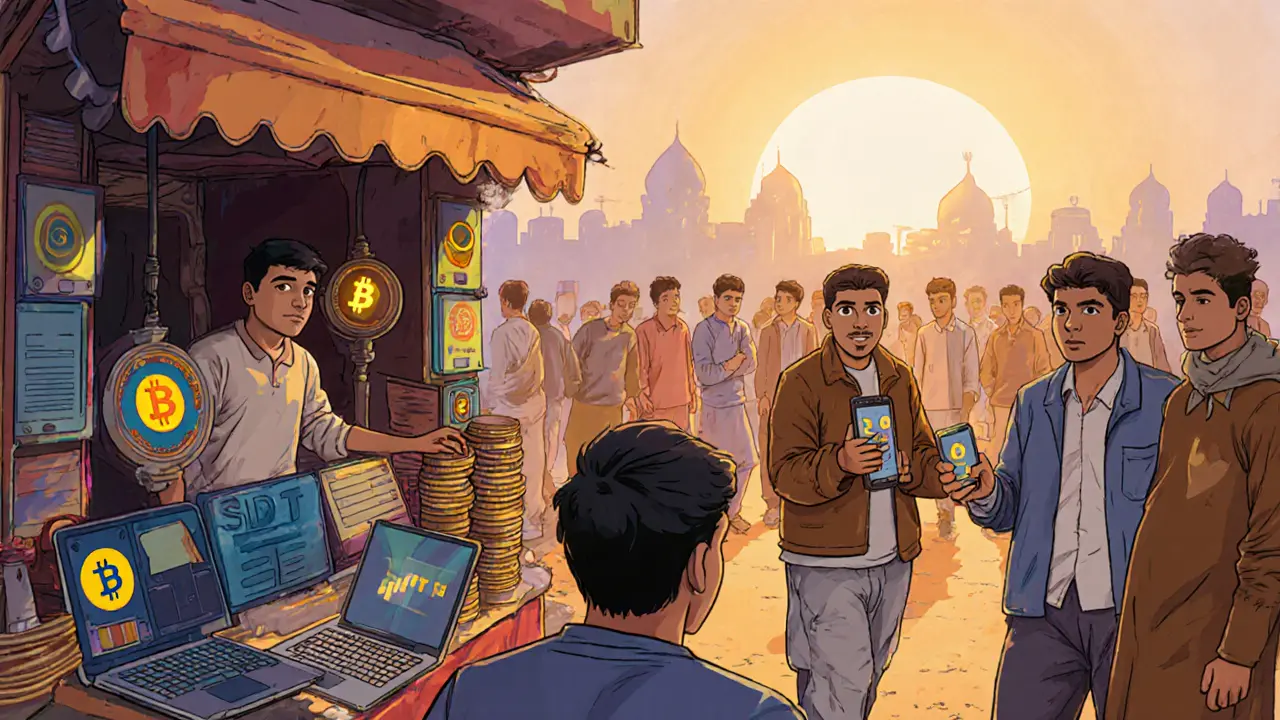

When talking about Bitcoin ban Afghanistan, a government‑imposed restriction that prohibits the use, trading, and mining of Bitcoin within Afghanistan's borders. Also known as Afghanistan Bitcoin prohibition, it reflects a growing trend of national authorities tightening control over digital currencies.

Understanding this ban requires looking at related concepts. Crypto regulation, the set of laws and policies that govern how digital assets are created, exchanged, and reported forms the backbone of any ban. Bitcoin, the first and most widely recognized cryptocurrency, built on a decentralized ledger called a blockchain is the specific asset targeted. Finally, Digital assets, all tokenized forms of value on a blockchain, from stablecoins to NFTs represent the broader ecosystem that feels the ripple effects of any single‑currency restriction.

Why the Ban Matters

The Afghan ban is not an isolated event. It mirrors moves in Tunisia, Kuwait, and other jurisdictions where governments have drawn hard lines around crypto activity. These policies share three core traits: they define illegal behavior, outline enforcement mechanisms, and signal to the market that risk levels have shifted. In Afghanistan, the ban prohibits anyone from holding, buying, selling, or mining Bitcoin. Violations can lead to fines, asset seizure, or even criminal charges, depending on how aggressively authorities choose to act.

From a user standpoint, the ban creates immediate practical hurdles. Wallet providers that operate locally must block Bitcoin‑related services, and exchanges with a presence in the country are forced to delist the asset. Even if you keep your Bitcoin on an overseas platform, you risk running afoul of capital‑flight controls if you try to move funds in or out of Afghanistan. This reality forces users to rethink their strategy: either comply, relocate their crypto activities, or accept the legal risk.

Investors also feel the impact through market signals. When a country announces a ban, price volatility often spikes as traders scramble to adjust positions. The broader crypto market watches these moves because they hint at how other regulators might act. For example, the Tunisia crypto ban earlier this year led to a 12% dip in Bitcoin’s price within 48 hours, illustrating the interconnected nature of global sentiment.

Beyond Bitcoin, other digital assets feel the pressure. Stablecoins—cryptocurrencies pegged to fiat like USDC—rely on regulatory clarity to function as reliable payment rails. When a major economy restricts Bitcoin, stablecoin issuers may face heightened scrutiny, especially if they’re used to route funds around the ban. Likewise, cross‑chain bridges that enable swapping Bitcoin for tokens on other blockchains might see reduced usage, as users avoid pathways that could expose them to legal trouble.

Learning from similar cases can help you navigate the Afghan landscape. The Kuwait Central Bank’s ban, for instance, targeted both crypto trading and mining, but it left room for licensed institutions to offer custodial services under strict oversight. If Afghanistan were to adopt a moderated approach later, having a licensed intermediary could become the safest way to stay in the game.

On the technical side, the ban does not shut down the Bitcoin network itself—it remains fully operational worldwide. What changes is your ability to interact with it from within Afghanistan’s jurisdiction. That distinction matters for developers building decentralized apps (dApps) that depend on Bitcoin’s blockchain. They must now consider compliance layers, such as geofencing, to avoid exposing users to legal risk.

For anyone new to crypto, the takeaway is simple: regulatory environments dictate how and where you can use digital assets. A ban on Bitcoin in Afghanistan means you’ll need to either shift to compliant assets, use offshore services with caution, or wait for potential policy revisions. Keeping an eye on how other countries handle similar bans—like Tunisia’s evolving sandbox or the EU’s MiCA framework—will give you a better sense of where the market is heading.

Below you’ll find a curated selection of articles that break down related topics in plain language. From stablecoin mechanics to cross‑chain bridge basics, each piece offers practical insight you can apply whether you’re navigating the Afghan ban or any other crypto regulation. Dive in to sharpen your understanding and stay ahead of the curve.

Afghanistan Crypto Ban: How the Taliban’s 2022 Prohibition Shaped the Underground Market

by Johnathan DeCovic Nov 17 2024 20 CryptocurrencyExplore how the Taliban's 2022 crypto ban reshaped Afghanistan's digital asset landscape, its underground market, and the impact on women and remittances.

READ MORE