Bid Ask Spread: What It Means for Your Crypto Trades

When you hear the term bid ask spread, you’re looking at the price gap between the highest buyer (bid) and the lowest seller (ask) on an exchange. Bid Ask Spread, the difference between the best buying and selling prices at a given moment. Also known as price spread, it tells you how tight or wide the market is for a coin.

Understanding the Components of a Spread

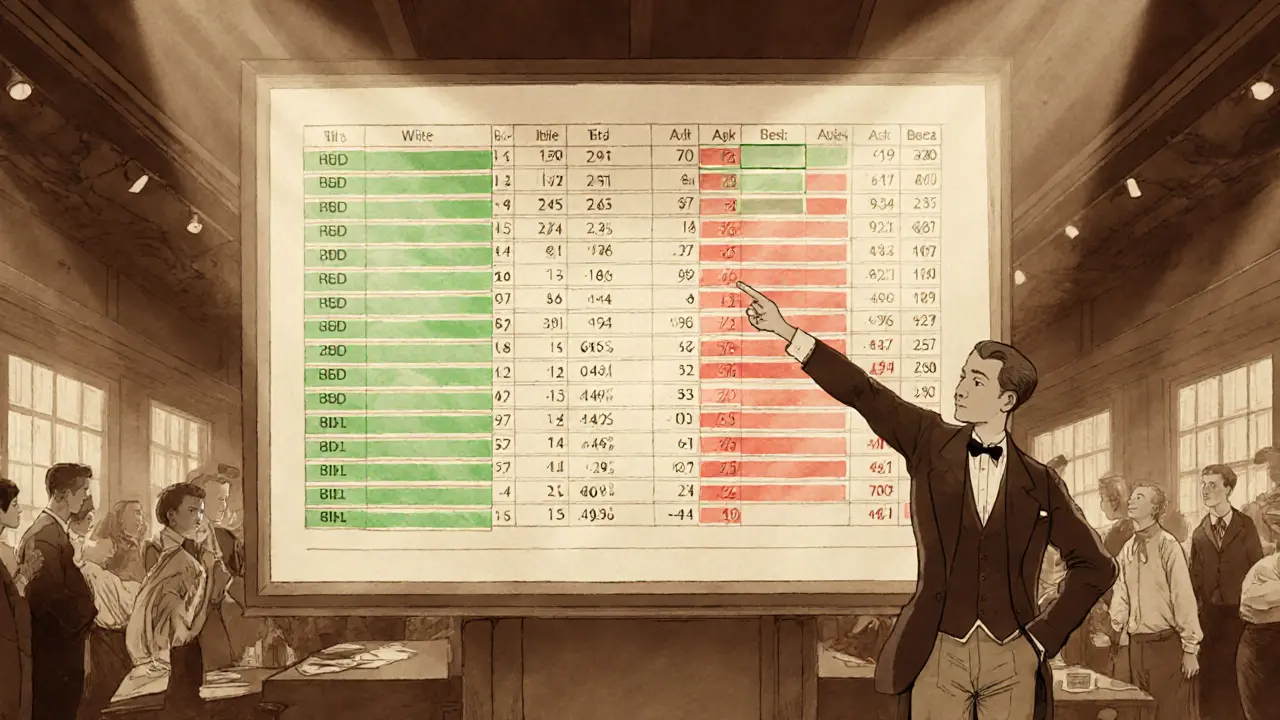

One of the biggest drivers behind the size of a spread is Liquidity, the ease with which an asset can be bought or sold without moving its price. When many traders are active, orders pile up on both sides of the book and the spread tightens. Less liquidity means fewer orders, so the gap widens. Order Book, a real‑time list of all buy and sell orders for a trading pair shows exactly how many bids and asks sit at each price level. The depth of that book—how many units sit at each level—directly influences the spread. In other words, Liquidity enables a dense Order Book, which in turn narrows the Bid Ask Spread.

Another piece of the puzzle is Market Depth, the cumulative volume of orders at successive price points away from the mid‑price. Deep markets can absorb large trades without shifting the price much, so the spread stays small even during heavy activity. Shallow market depth, on the other hand, makes the spread vulnerable to sudden jumps when a big order hits. This relationship can be summed up as: Market Depth supports a tight Bid Ask Spread by cushioning price impact.

Trading fees also play a hidden role. Exchanges usually charge a percentage on each side of the trade. If the spread is already tight, fees can become a noticeable portion of the total cost, effectively widening what you pay. Some platforms offer maker‑taker models where makers (those adding liquidity) pay less, encouraging tighter spreads. Understanding the fee structure lets you gauge the real cost of a trade beyond the quoted spread.

Volatility adds another layer. During fast‑moving market conditions, bids and asks can shift in seconds, causing the spread to balloon. In a calm market, the spread often reflects pure supply‑demand balance. So, high volatility inflates the Bid Ask Spread, whereas stable periods let it settle.

How can you use this knowledge? First, check the order book depth before placing a large order—if depth looks thin, consider breaking the order into smaller chunks. Second, compare spreads across exchanges; a lower spread often means better liquidity and lower hidden costs. Third, watch the fee schedule; choosing a maker‑friendly tier can shave off a few basis points from the effective spread. These practical steps help you keep trading costs low.

In the collection below you’ll find guides on stablecoins, cross‑chain bridges, tokenomics, and more—each touching on the same concepts of liquidity, market depth, and price efficiency. Together they paint a full picture of how the crypto market works, so you can make smarter decisions when the bid ask spread shows up in your trade screen.

Understanding Order Book Data for Effective Trading Analysis

by Johnathan DeCovic Feb 5 2025 17 TechnologyLearn how order book data works, why it matters for trading, and practical steps to use market depth, bid‑ask spread, and order flow for better strategies.

READ MORE