Tunisia Blockchain: Regulation, Projects and What’s Next

When looking at Tunisia blockchain, the network of distributed ledger technologies being built, used and regulated within Tunisia, it helps to first understand the core pieces that shape any national ecosystem. Blockchain regulation, the set of laws, licensing rules and compliance standards that govern crypto activity sets the legal playground, while Smart contract applications, code‑based agreements that run automatically on a blockchain turn ideas into real‑world solutions. Together they create a feedback loop: clear rules attract developers, and innovative contracts showcase what the rules can enable.

Key Pillars of the Tunisian Blockchain Landscape

The second pillar is Cross‑chain bridges, protocols that let assets move between different blockchains without losing security. In Tunisia, these bridges are crucial because many local startups build on Binance Smart Chain or Polygon to keep fees low, yet they need to interact with Ethereum‑based DeFi tools. The third pillar is DeFi and staking services, decentralized finance platforms that let users earn yields, borrow or lend without a traditional bank. DeFi projects often rely on both smart contracts and cross‑chain links, so the health of one affects the others.

Regulatory bodies such as the Tunisian Financial Market Authority have started issuing guidelines that mirror EU MiCA trends, focusing on anti‑money‑laundering (AML) checks and consumer protection. This means any new token launch must register as a virtual asset service provider (VASP) and implement “travel rule” data sharing. For developers, the takeaway is simple: embed AML checks directly into your smart contract logic or front‑end UI to stay compliant from day one.

Meanwhile, local universities are feeding talent into the ecosystem with blockchain curricula that cover tokenomics, security audits and bridge design. Graduates often join incubators that partner with international exchanges, giving Tunisian projects a fast lane to global liquidity. The combination of academic backing, regulatory clarity, and technical tools creates a fertile ground for real‑world use cases—think supply‑chain tracking for olive oil, tokenized real estate in Tunis, or voting systems for municipal elections.

All these pieces—regulation, smart contracts, bridges, DeFi and education—interlock to form a resilient network. As the rules evolve, they push developers toward more secure, interoperable solutions, which in turn raise the bar for what regulators need to oversee. This cycle fuels steady growth and attracts foreign investment, making Tunisia an emerging hub in North Africa.

Below you’ll find a curated set of articles that dig deeper into each of these areas. Whether you’re after the latest on stablecoins, a guide to cross‑chain bridges, or an audit checklist for smart contracts, the collection gives you actionable insights to navigate the Tunisian blockchain space with confidence.

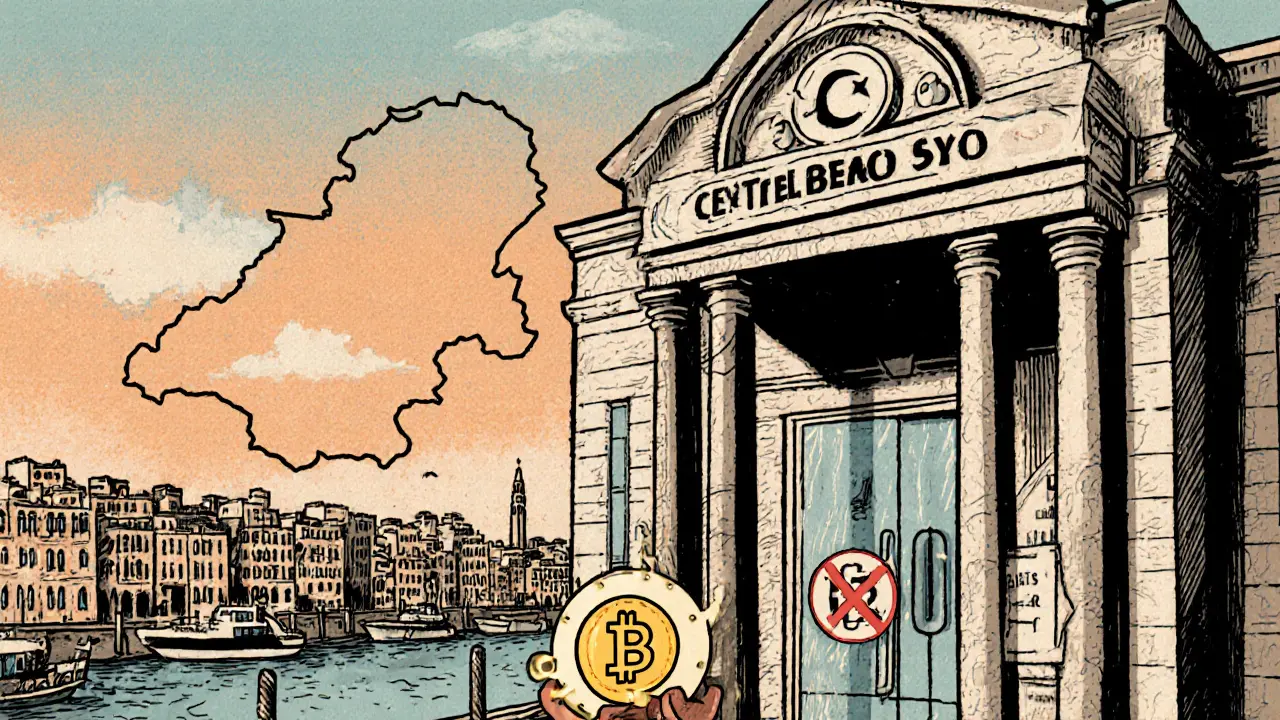

Tunisia's Crypto Ban: How It Works, Who Enforces It, and What Might Change

by Johnathan DeCovic May 13 2025 13 CryptocurrencyA clear, up‑to‑date guide on Tunisia's total crypto ban, covering the law, enforcement, real‑world impact, sandbox pilots, and potential future reforms.

READ MORE