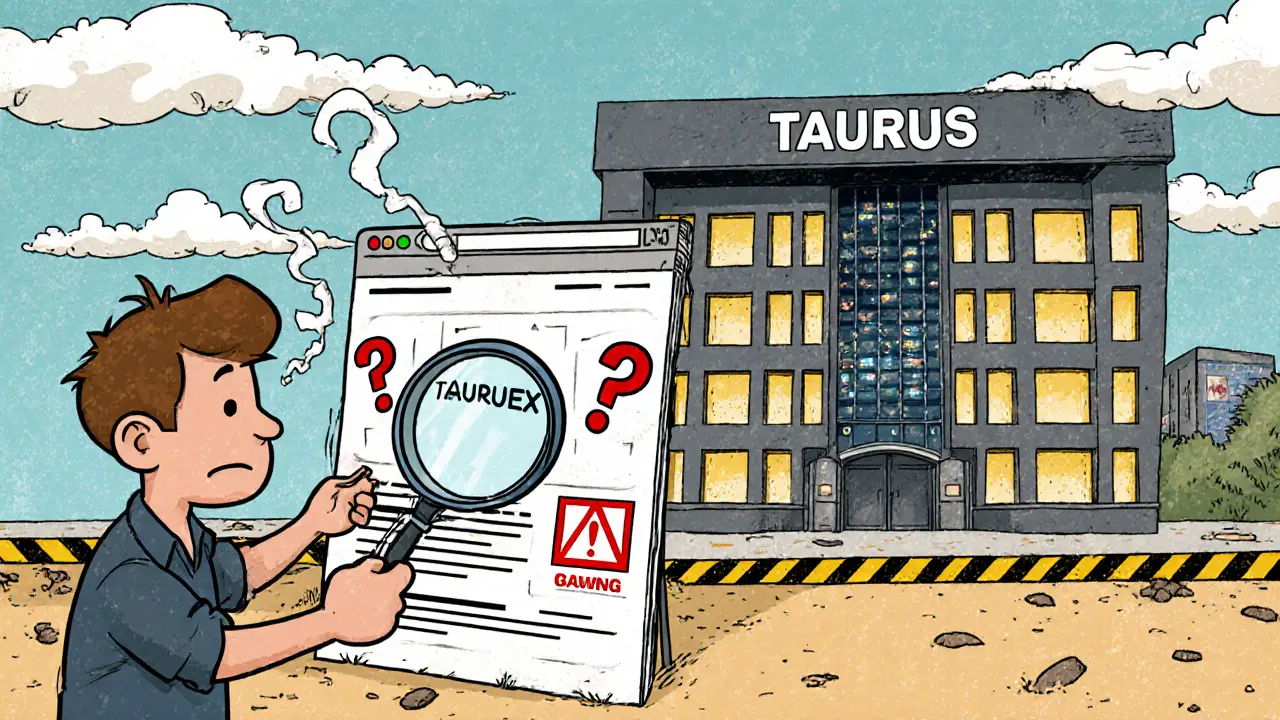

TaurusEX Safety: Is This Crypto Exchange Legit or a Risk?

When you hear TaurusEX, a crypto exchange platform that’s gained attention for its low fees and fast trades. Also known as Taurus Exchange, it claims to offer a smooth experience for trading Bitcoin, Ethereum, and altcoins. But with no public team, no regulatory license, and zero independent audits, the real question isn’t what it promises—it’s whether it’s safe to trust.

Exchange safety isn’t just about UI design or marketing slogans. It’s about cold storage, how a platform keeps user funds offline to prevent hacks, KYC compliance, the process of verifying user identity to meet legal standards, and whether the platform has ever been hacked or flagged by regulators. Look at platforms like Bitstamp or Kraken—they publish security reports, list their insurance partners, and are registered with financial authorities. TaurusEX does none of that. And when you compare it to Coinquista or BITCOINBING—both reviewed here for lacking transparency—it’s clear that silence isn’t neutral. It’s a red flag.

What’s worse? There’s no user review trail worth following. No Reddit threads with real experiences. No Trustpilot ratings. No independent security audits published on GitHub or their website. That’s not uncommon in the crypto space, but it’s exactly what makes TaurusEX dangerous. If you’re putting money into an exchange, you need to know who’s holding it, how it’s protected, and what happens if things go wrong. Without those answers, you’re not trading—you’re gambling. The posts below dive into real cases: exchanges that vanished overnight, platforms that lost millions to exploits, and the warning signs you can spot before you deposit a single dollar. You’ll see patterns. You’ll learn what to ask. And you’ll walk away knowing exactly why safety should come before speed or savings.

TaurusEX Crypto Exchange Review: What You Need to Know Before Trading

by Johnathan DeCovic Oct 31 2025 19 CryptocurrencyTaurusEX is not a real crypto exchange. This review clarifies the confusion between TaurusEX and the legitimate Swiss fintech company Taurus, explaining what's real, what's fake, and where to trade safely in 2025.

READ MORE