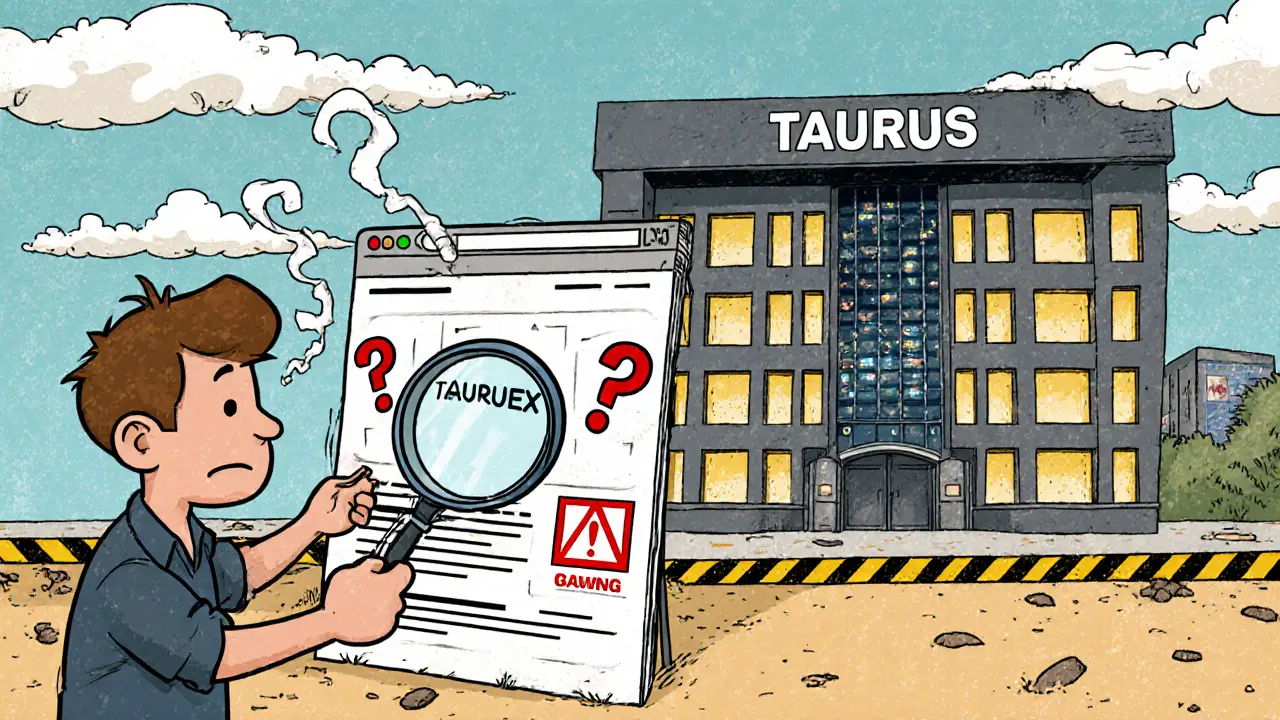

TaurusEX Crypto Exchange: Reviews, Risks, and Real User Experiences

When you hear about TaurusEX, a crypto exchange with minimal public footprint and no regulatory licensing. Also known as TaurusEX.io, it appears in forums as a low-fee platform—but without verified team details, audited security, or official customer support. That’s not just unusual—it’s a warning sign most experienced traders avoid.

Compare it to Bitstamp, a regulated exchange operating since 2011 with clear compliance and user protections, or even KoinBX, an Indian platform that publishes its fee structure and regulatory status openly. TaurusEX offers none of that. No contact email. No physical address. No public audit reports. And yet, it pops up in search results promising high yields and fast trades. That’s the classic setup of a platform designed to collect deposits, not deliver service.

Look at the pattern in the posts below. Users keep stumbling into exchanges like Coinquista, a platform with zero verified reviews and hidden fees, or BITCOINBING, a site exposed as a scam with fake trading volumes. TaurusEX fits right into that same mold. It doesn’t need a whitepaper or a team—it just needs new users to deposit crypto and never withdraw it. The real question isn’t whether TaurusEX is legit. It’s why anyone still considers using it in 2025.

Below, you’ll find real reviews of exchanges that either vanished, got exposed, or never had any credibility to begin with. These aren’t hypothetical warnings. These are cases where people lost money because they trusted platforms that looked real but weren’t. If you’re thinking about TaurusEX, read these first. You might save yourself a serious loss.

TaurusEX Crypto Exchange Review: What You Need to Know Before Trading

by Johnathan DeCovic Oct 31 2025 19 CryptocurrencyTaurusEX is not a real crypto exchange. This review clarifies the confusion between TaurusEX and the legitimate Swiss fintech company Taurus, explaining what's real, what's fake, and where to trade safely in 2025.

READ MORE