MAX Cryptocurrency: Guides, Tokens, and Trends

When you hear MAX cryptocurrency, a blockchain‑based token designed to reward liquidity providers and enable low‑fee DeFi transactions. Also known as MAX token, it sits at the intersection of finance and tech, letting users earn while they hold. The MAX cryptocurrency has sparked interest because it blends high‑yield staking with expanding use cases across multiple ecosystems. Investors often ask how it differs from other liquidity tokens, and the answer lies in its unique fee‑rebate model, on‑chain governance, and a growing suite of partner protocols that lock value into its pool.

Key Concepts Around MAX Cryptocurrency

Understanding stablecoins, digital assets pegged to fiat or commodities that aim to minimize price swings is crucial, as they often serve as the entry point for investors moving into MAX cryptocurrency. Stablecoins provide a low‑volatility bridge, allowing users to swap into MAX without exposing themselves to Bitcoin‑style price storms. In this way, MAX cryptocurrency requires a solid grasp of stablecoin mechanics to manage risk effectively.

Similarly, cross‑chain bridges, protocols that let tokens travel between different blockchains enable MAX to operate across Ethereum, Binance Smart Chain, and emerging layer‑2 networks. Cross‑chain bridges empower MAX cryptocurrency interoperability, letting liquidity flow wherever the highest yields appear. This connectivity is a core driver of the token’s adoption, because users can shift assets without bottleneck‑inducing withdrawals.

Finally, the tokenomics, the economic design governing supply, distribution, and incentives of MAX determines how rewards are calculated, how many tokens circulate, and what drives long‑term value. MAX cryptocurrency encompasses tokenomics that favor active participants; a portion of transaction fees is redistributed to stakers, while a controlled inflation schedule caps supply growth. This balance of incentives and scarcity helps maintain price stability even during market dips.

Beyond these pillars, MAX frequently launches crypto airdrops to attract new users and reward early adopters. Airdrop campaigns often tie into partner projects, giving participants a taste of cross‑protocol utility while expanding the token’s community. At the same time, risk management practices—like setting stop‑loss levels, diversifying across stablecoin pairs, and monitoring bridge security—are essential for protecting gains. Regulatory developments in major jurisdictions also shape how MAX can be offered on exchanges, so staying updated on compliance trends is part of a smart investor’s routine.

All this context sets the stage for the curated collection below. You'll find deep dives into stablecoin mechanisms, bridge security audits, tokenomics breakdowns, and step‑by‑step airdrop guides—all aimed at helping you navigate the MAX cryptocurrency landscape with confidence.

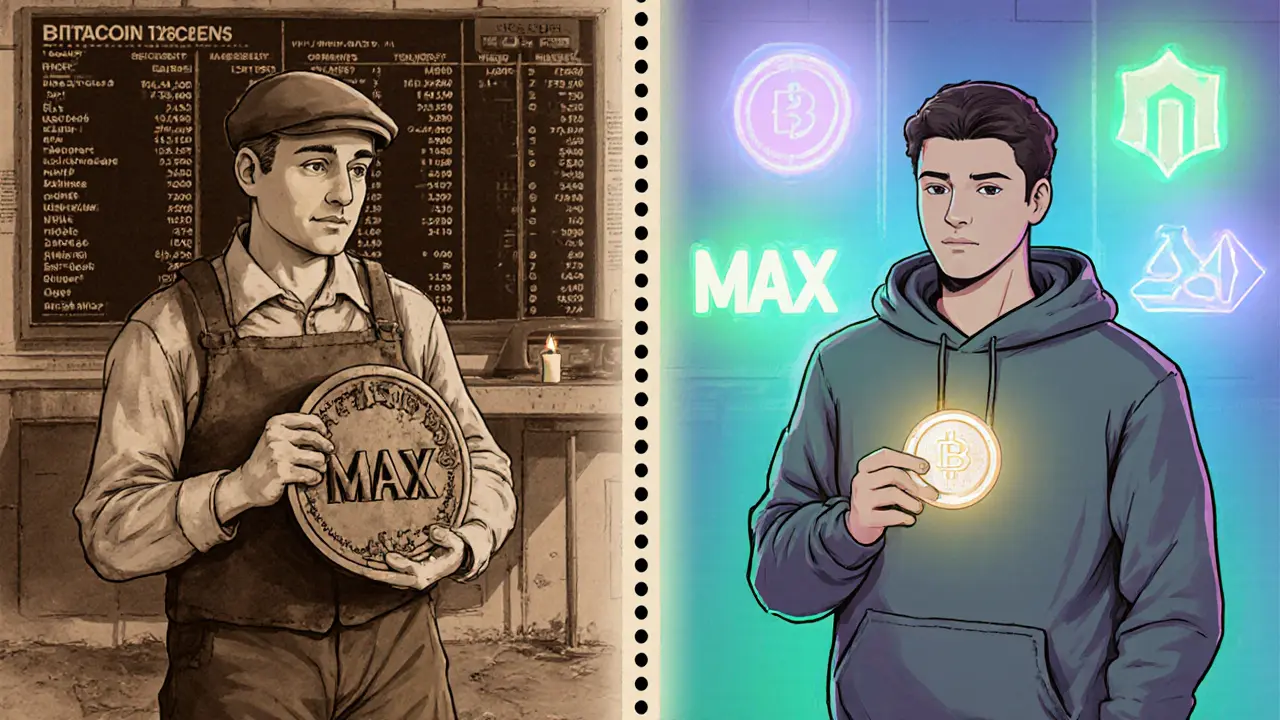

Understanding MAX (MAX) Crypto Coin: Maxcoin vs. MAX Token Explained

by Johnathan DeCovic Jan 23 2025 20 CryptocurrencyA clear guide that separates the two MAX crypto coins-Maxcoin and the newer MAX Token-covering their specs, markets, risks, and how to acquire them.

READ MORE